Question: Show in Excel please Question #2. Now suppose that our investor could alternatively obtain a $3,000,000 ARM mortgage loan for 25 years from a different

Show in Excel please

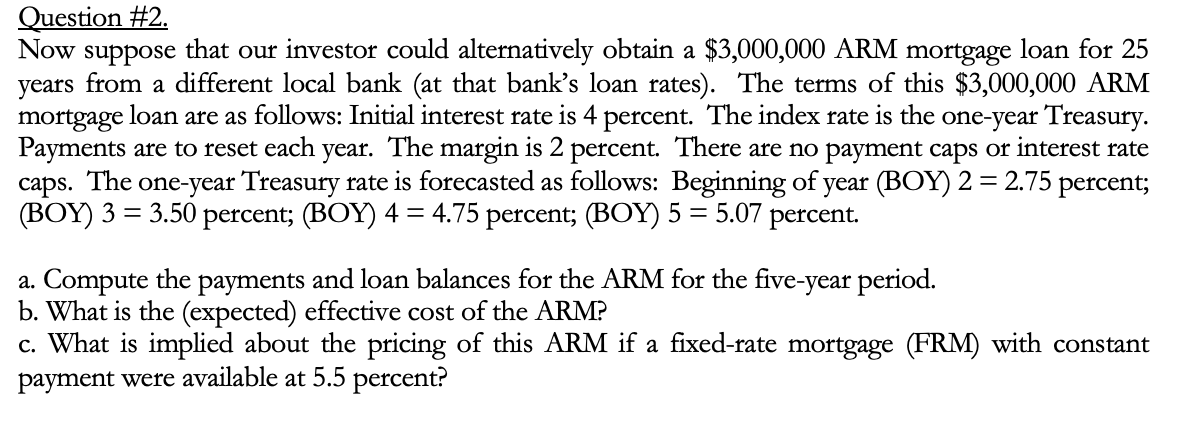

Question #2. Now suppose that our investor could alternatively obtain a $3,000,000 ARM mortgage loan for 25 years from a different local bank (at that bank's loan rates). The terms of this $3,000,000 ARM mortgage loan are as follows: Initial interest rate is 4 percent. The index rate is the one-year Treasury. Payments are to reset each year. The margin is 2 percent. There are no payment caps or interest rate caps. The one-year Treasury rate is forecasted as follows: Beginning of year (BOY)2 = 2.75 percent; (BOY) 3 = 3.50 percent; (BOY) 4 = 4.75 percent; (BOY) 5 = 5.07 percent. a. Compute the payments and loan balances for the ARM for the five-year period. b. What is the expected) effective cost of the ARM? c. What is implied about the pricing of this ARM if a fixed-rate mortgage (FRM) with constant payment were available at 5.5 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts