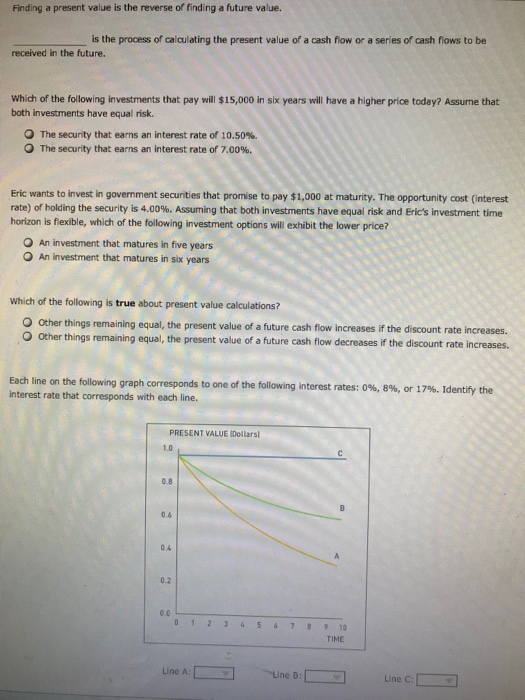

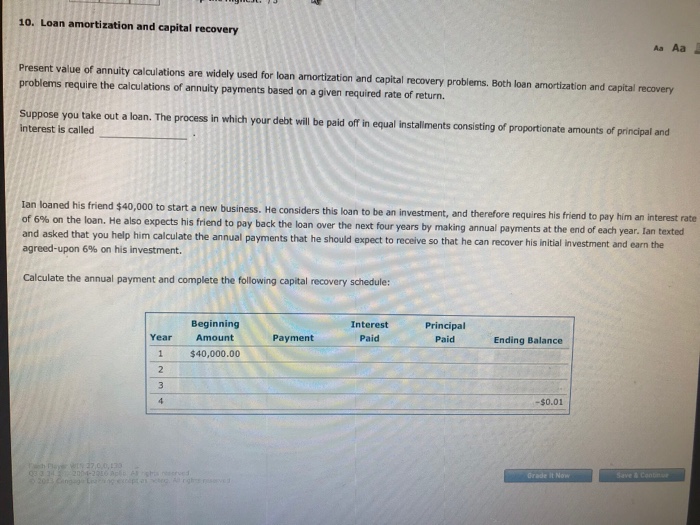

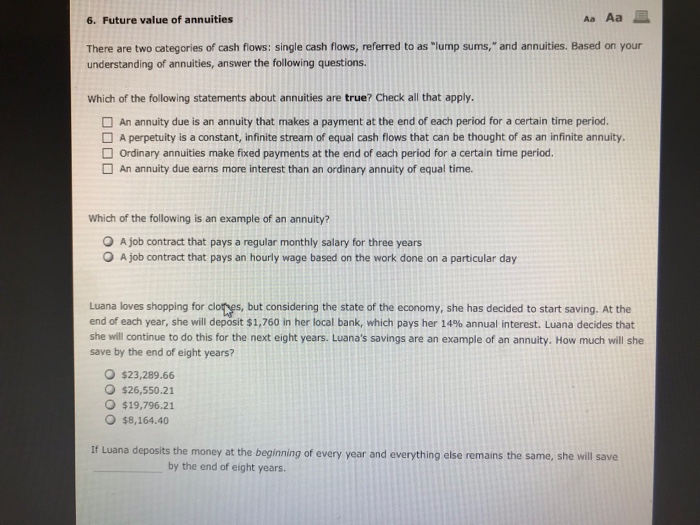

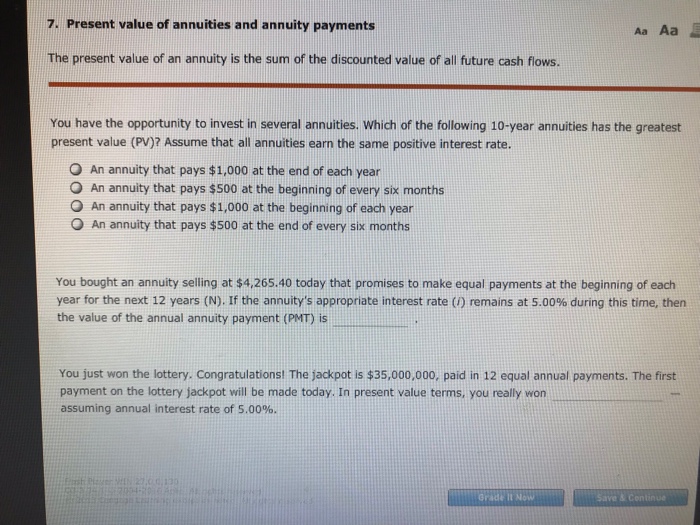

Question: 13) deferred annuities 4) present values 10) loan amortization and capital recovery 6) future value of annuities 7) present value of annuities and annuity payments

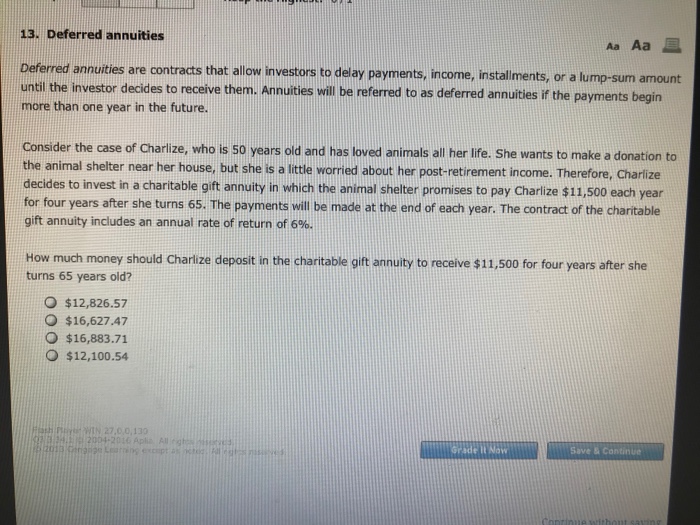

13. Deferred annuities Aa Aa Deferred annuities are contracts that allow investors to delay payments, income, install until the investor decides to receive them. Annuities will be referred to as deferred annuities if the payments begin more than one year in the future. ments, or a lump-sum amount Consider the case of Charlize, who is 50 years old and has loved animals all her lIfe. She wants to make a donation to the animal shelter near her house, but she is a itte worred about her post-retirement income. Therefore, Charlize decides to invest in a charitable gift annuity in which the animal shelter promises to pay Charlize $11,500 each year for four years after she turns 65. The payments will be made at the end of each year. The contract of the charitable gift annuity includes an annual rate of return of 6%. How much money should Charlize deposit in the charitable gift annuity to receive $11,500 for four years after she turns 65 years old? O $12,826.57 O $16,627.47 $16,883.71 O $12,100.54 Save & Continue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts