Question: 13 Everything else the same, which stock would you recommend that an investor sells? a. The stock with a relatively low P/E ratio. b. The

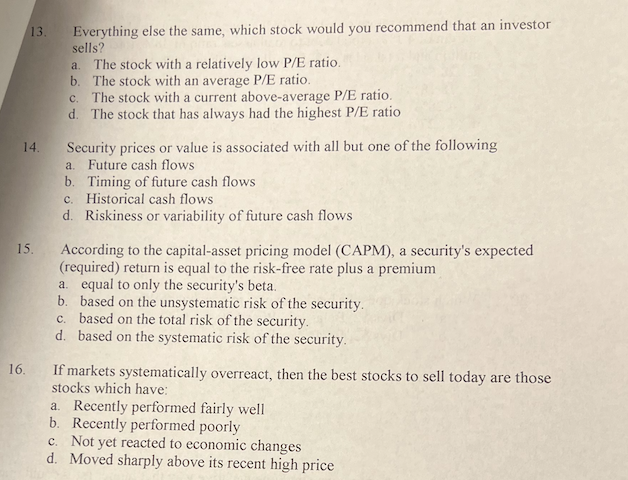

13 Everything else the same, which stock would you recommend that an investor sells? a. The stock with a relatively low P/E ratio. b. The stock with an average P/E ratio. c. The stock with a current above-average P/E ratio. d. The stock that has always had the highest P/E ratio 14. Security prices or value is associated with all but one of the following a. Future cash flows b. Timing of future cash flows c. Historical cash flows d. Riskiness or variability of future cash flows 15. According to the capital-asset pricing model (CAPM), a security's expected (required) return is equal to the risk-free rate plus a premium a. equal to only the security's beta. b. based on the unsystematic risk of the security. c. based on the total risk of the security. d. based on the systematic risk of the security 16. If markets systematically overreact, then the best stocks to sell today are those stocks which have: a. Recently performed fairly well b. Recently performed poorly c. Not yet reacted to economic changes d. Moved sharply above its recent high price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts