Question: 13. (Lecture Note 10) Consider the following information. For S = 100, X = 95, r = 5%, = 40%, and T = 6 months:

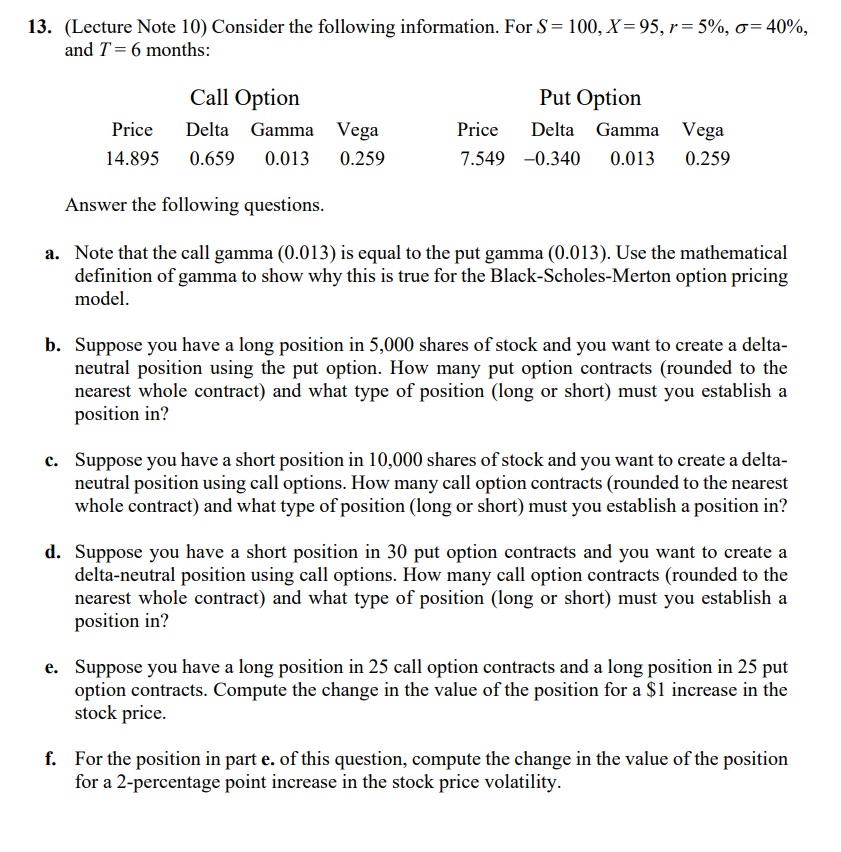

13. (Lecture Note 10) Consider the following information. For S = 100, X = 95, r = 5%, = 40%, and T = 6 months: Call Option Put Option Price Delta Gamma Vega Price Delta Gamma Vega 14.895 0.659 0.013 0.259 7.549 0.340 0.013 0.259 Answer the following questions. 8 a. Note that the call gamma (0.013) is equal to the put gamma (0.013). Use the mathematical definition of gamma to show why this is true for the Black-Scholes-Merton option pricing model. b. Suppose you have a long position in 5,000 shares of stock and you want to create a deltaneutral position using the put option. How many put option contracts (rounded to the nearest whole contract) and what type of position (long or short) must you establish a position in? c. Suppose you have a short position in 10,000 shares of stock and you want to create a deltaneutral position using call options. How many call option contracts (rounded to the nearest whole contract) and what type of position (long or short) must you establish a position in? d. Suppose you have a short position in 30 put option contracts and you want to create a delta-neutral position using call options. How many call option contracts (rounded to the nearest whole contract) and what type of position (long or short) must you establish a position in? e. Suppose you have a long position in 25 call option contracts and a long position in 25 put option contracts. Compute the change in the value of the position for a $1 increase in the stock price. f. For the position in part e. of this question, compute the change in the value of the position for a 2-percentage point increase in the stock price volatility.

13. (Lecture Note 10) Consider the following information. For S= 100, X=95, r= 5%, o=40%, and T = 6 months: Call Option Put Option Price Price Delta Gamma Vega 14.895 0.659 0.013 0.259 Delta Gamma Vega 7.549 -0.340 0.013 0.259 Answer the following questions. a. Note that the call gamma (0.013) is equal to the put gamma (0.013). Use the mathematical definition of gamma to show why this is true for the Black-Scholes-Merton option pricing model. b. Suppose you have a long position in 5,000 shares of stock and you want to create a delta- neutral position using the put option. How many put option contracts (rounded to the nearest whole contract) and what type of position (long or short) must you establish a position in? c. Suppose you have a short position in 10,000 shares of stock and you want to create a delta- neutral position using call options. How many call option contracts (rounded to the nearest whole contract) and what type of position (long or short) must you establish a position in? d. Suppose you have a short position in 30 put option contracts and you want to create a delta-neutral position using call options. How many call option contracts (rounded to the nearest whole contract) and what type of position (long or short) must you establish a position in? e. Suppose you have a long position in 25 call option contracts and a long position in 25 put option contracts. Compute the change in the value of the position for a $1 increase in the stock price. f. For the position in part e. of this question, compute the change in the value of the position for a 2-percentage point increase in the stock price volatility. 13. (Lecture Note 10) Consider the following information. For S= 100, X=95, r= 5%, o=40%, and T = 6 months: Call Option Put Option Price Price Delta Gamma Vega 14.895 0.659 0.013 0.259 Delta Gamma Vega 7.549 -0.340 0.013 0.259 Answer the following questions. a. Note that the call gamma (0.013) is equal to the put gamma (0.013). Use the mathematical definition of gamma to show why this is true for the Black-Scholes-Merton option pricing model. b. Suppose you have a long position in 5,000 shares of stock and you want to create a delta- neutral position using the put option. How many put option contracts (rounded to the nearest whole contract) and what type of position (long or short) must you establish a position in? c. Suppose you have a short position in 10,000 shares of stock and you want to create a delta- neutral position using call options. How many call option contracts (rounded to the nearest whole contract) and what type of position (long or short) must you establish a position in? d. Suppose you have a short position in 30 put option contracts and you want to create a delta-neutral position using call options. How many call option contracts (rounded to the nearest whole contract) and what type of position (long or short) must you establish a position in? e. Suppose you have a long position in 25 call option contracts and a long position in 25 put option contracts. Compute the change in the value of the position for a $1 increase in the stock price. f. For the position in part e. of this question, compute the change in the value of the position for a 2-percentage point increase in the stock price volatility

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts