Question: (13 marks) Use the information in the table below to answer the following questions. It is 31 December 2010 and all coupon payments are made

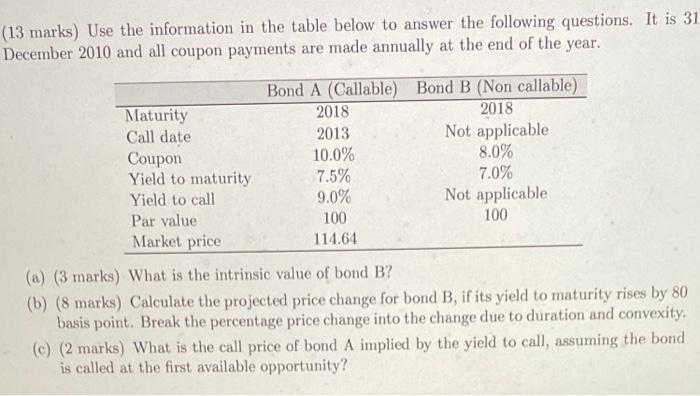

(13 marks) Use the information in the table below to answer the following questions. It is 31 December 2010 and all coupon payments are made annually at the end of the year. (a) ( 3 marks) What is the intrinsic value of bond B? (b) (8 marks) Calculate the projected price change for bond B, if its yield to maturity rises by 80 basis point. Break the percentage price change into the change due to duration and convexity. (c) ( 2 marks) What is the call price of bond A implied by the yield to call, assuming the bond is called at the first available opportunity? (13 marks) Use the information in the table below to answer the following questions. It is 31 December 2010 and all coupon payments are made annually at the end of the year. (a) ( 3 marks) What is the intrinsic value of bond B? (b) (8 marks) Calculate the projected price change for bond B, if its yield to maturity rises by 80 basis point. Break the percentage price change into the change due to duration and convexity. (c) ( 2 marks) What is the call price of bond A implied by the yield to call, assuming the bond is called at the first available opportunity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts