Question: 13. Projects A and B have identical expected lives and identical initial cash outflows (costs). However, most of one project's cash flows come in the

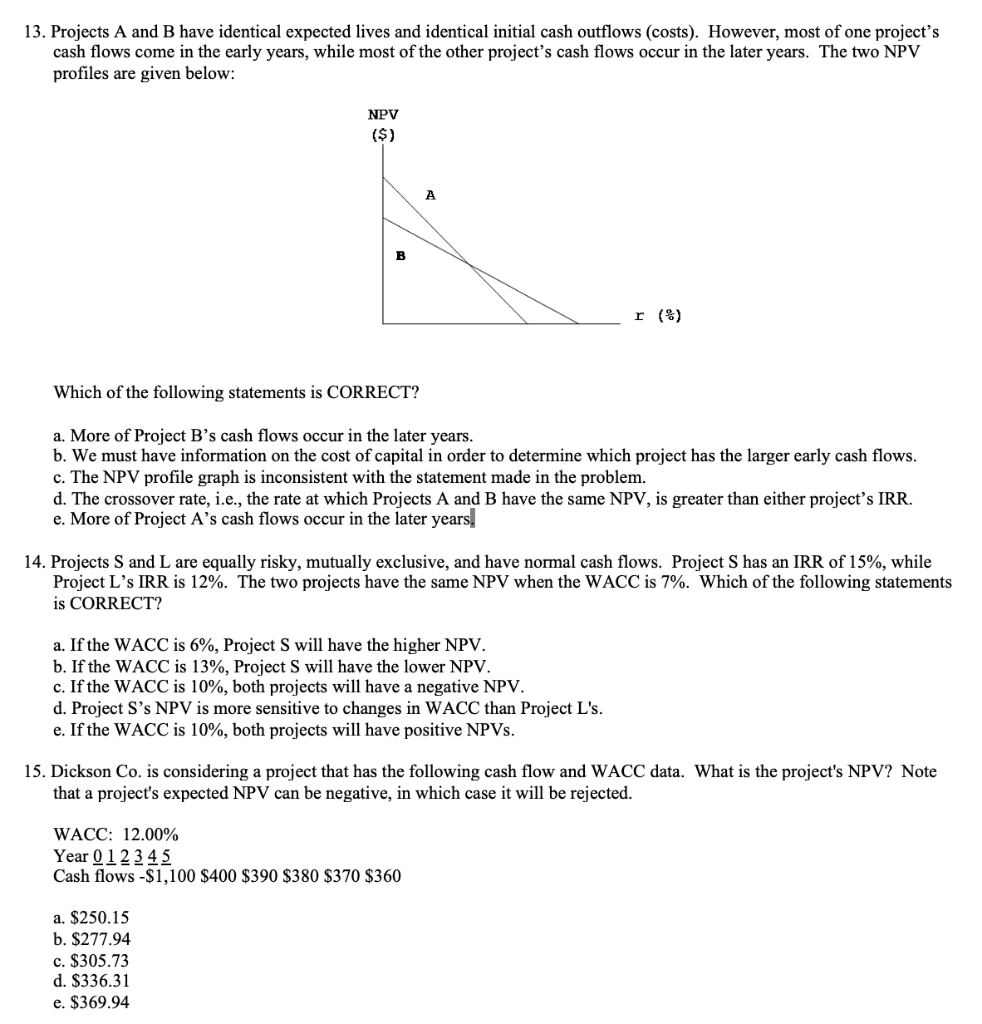

13. Projects A and B have identical expected lives and identical initial cash outflows (costs). However, most of one project's cash flows come in the early years, while most of the other project's cash flows occur in the later years. The two NPV profiles are given below: NPV ($) A B r (8) Which of the following statements is CORRECT? a. More of Project B's cash flows occur in the later years. b. We must have information on the cost of capital in order to determine which project has the larger early cash flows. c. The NPV profile graph is inconsistent with the statement made in the problem. d. The crossover rate, i.e., the rate at which Projects A and B have the same NPV, is greater than either project's IRR. e. More of Project A's cash flows occur in the later years. 14. Projects S and L are equally risky, mutually exclusive, and have normal cash flows. Project S has an IRR of 15%, while Project Ls IRR is 12%. The two projects have the same NPV when the WACC is 7%. Which of the following statements is CORRECT? a. If the WACC is 6%, Project S will have the higher NPV. b. If the WACC is 13%, Project S will have the lower NPV. c. If the WACC is 10%, both projects will have a negative NPV. d. Project S's NPV is more sensitive to changes in WACC than Project L's. e. If the WACC is 10%, both projects will have positive NPVs. 15. Dickson Co. is considering a project that has the following cash flow and WACC data. What is the project's NPV? Note that a project's expected NPV can be negative, in which case it will be rejected. WACC: 12.00% Year 0 1 2 3 4 5 Cash flows -$1,100 $400 $390 $380 $370 $360 a. $250.15 b. $277.94 c. $305.73 d. $336.31 e. $369.94

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts