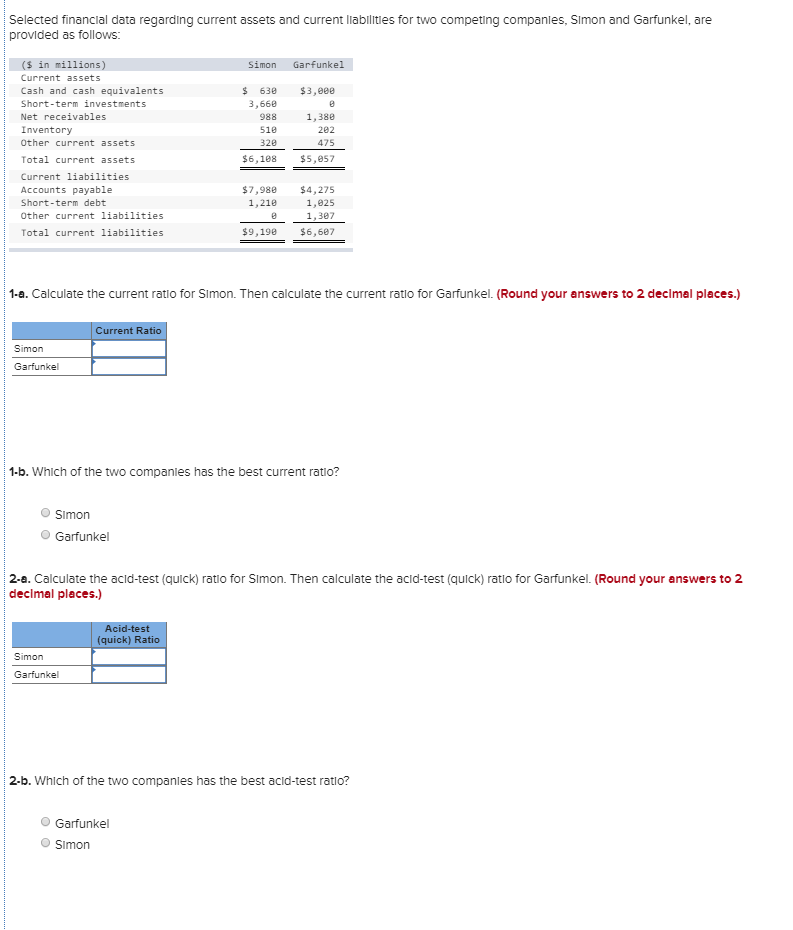

Question: 13. Selected financial data regarding current assets and current liabilities for two competing companies, Simon and Garfunkel, are provided as follows: Selected financial data regarding

13. Selected financial data regarding current assets and current liabilities for two competing companies, Simon and Garfunkel, are provided as follows:

Selected financial data regarding current assets and current liabillties for two competing companles, Simon and Garfunkel, are provided as follows: (s in millions) Current assets Cash and cash equivalents Short-term investments Net receivables Inventory Other current assets Simon Garfunkel $ 630 3,668 988 518 328 $3,8e8 1,380 282 475 $6,188 $5,857 Total current assets Current liabilities Accounts payable Short-term debt Other current liabilities Total current liabilities $7,988 $4,275 1,825 8 1,307 $9,198 $6,607 1,218 1-a. Calculate the current ratio for Slmon. Then calculate the current ratio for Garfunkel. (Round your answers to 2 decimel places.) Current Ratio Simon Garfunkel 1-b. Which of the two companles has the best current ratio? Simon O Garfunkel 2-a. Calculate the acld-test (quick) ratio for SImon. Then calculate the acid-test (quick) ratio for Garfunkel. (Round your answers to 2 declmal places.) (quick) Ratio Simon Garfunkel 2-b. Which of the two companles has the best acld-test ratio? O Garfunkel Simon

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts