Question: 13. Strategy 4 - Asset allocation Asset allocation is the proportion of your overall investment portfolio that you have invested in various categories of assets.

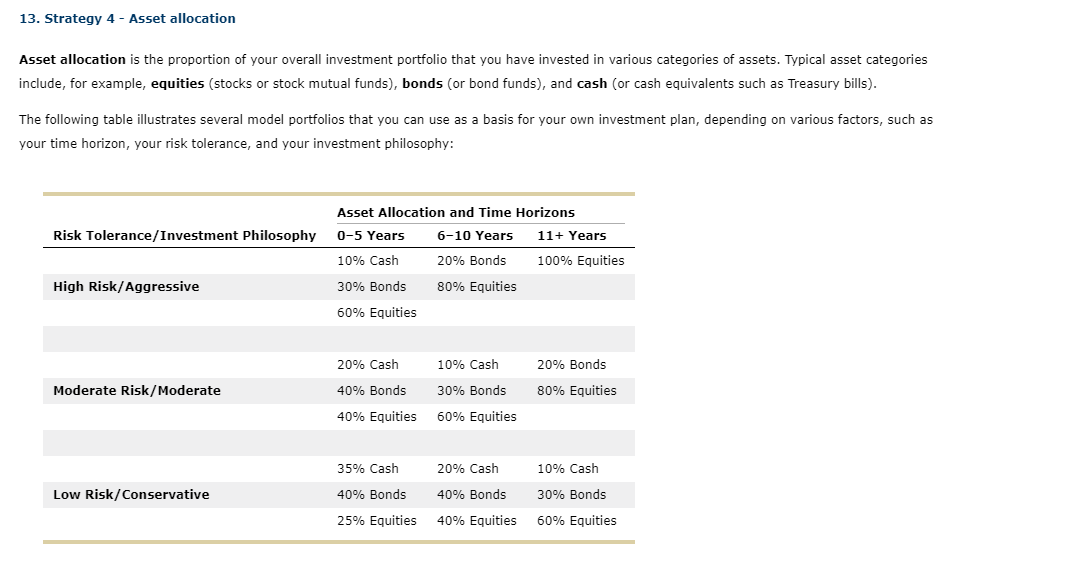

13. Strategy 4 - Asset allocation Asset allocation is the proportion of your overall investment portfolio that you have invested in various categories of assets. Typical asset categories include, for example, equities (stocks or stock mutual funds), bonds (or bond funds), and cash (or cash equivalents such as Treasury bills). The following table illustrates several model portfolios that you can use as a basis for your own investment plan, depending on various factors, such as your time horizon, your risk tolerance, and your investment philosophy: Risk Tolerance/Investment Philosophy Asset Allocation and Time Horizons 0-5 Years 6-10 Years 11+ Years 10% Cash 20% Bonds 100% Equities 30% Bonds 80% Equities 60% Equities High Risk/ Aggressive 20% Cash 10% Cash 20% Bonds Moderate Risk/Moderate 30% Bonds 80% Equities 40% Bonds 40% Equities 60% Equities 35% Cash 20% Cash 10% Cash Low Risk/Conservative 40% Bonds 40% Bonds 30% Bonds 25% Equities 40% Equities 60% Equities Hints: To calculate the average share price, simply divide the share price total by the number of investment periods (5). To calculate the average share cost, simply divide the total amount invested by the total number of shares purchased. Round your answers to nearest dollar. Enter all values as positive. In the fluctuating market, David purchased a total of shares. At the end of the last investment period, his investment is worth $ per share, which means that David's final account balance would be s However, David has invested a total of $4,500, which means that he has received a of S Round your answers to nearest dollar. Enter all values as positive. . In the declining market, David purchased a total of shares. At the end of the last investment period, his investment is worth per share, which means that David's final account balance would be However, David has invested a total of $4,500, which means that he has received a of 1. If you are using a dollar-cost averaging strategy, and if you sell your investment shares when the market is significantly down, you will not profit. This means that you should keep investing as long as the longer-term prospect suggests an eventual increase in price. Round your answers to nearest dollar. Enter all values as positive. . In the rising market, David purchased a total of shares. At the end of the last investment period, his investment is worth $ per share, which means that David's final account balance would be s However, David has invested a total of $4,500, which means that he has received a of You will generally profit from dollar-cost averaging in a rising market because you will buy fewer and fewer shares as the price continues to rise. 13. Strategy 4 - Asset allocation Asset allocation is the proportion of your overall investment portfolio that you have invested in various categories of assets. Typical asset categories include, for example, equities (stocks or stock mutual funds), bonds (or bond funds), and cash (or cash equivalents such as Treasury bills). The following table illustrates several model portfolios that you can use as a basis for your own investment plan, depending on various factors, such as your time horizon, your risk tolerance, and your investment philosophy: Risk Tolerance/Investment Philosophy Asset Allocation and Time Horizons 0-5 Years 6-10 Years 11+ Years 10% Cash 20% Bonds 100% Equities 30% Bonds 80% Equities 60% Equities High Risk/ Aggressive 20% Cash 10% Cash 20% Bonds Moderate Risk/Moderate 30% Bonds 80% Equities 40% Bonds 40% Equities 60% Equities 35% Cash 20% Cash 10% Cash Low Risk/Conservative 40% Bonds 40% Bonds 30% Bonds 25% Equities 40% Equities 60% Equities Hints: To calculate the average share price, simply divide the share price total by the number of investment periods (5). To calculate the average share cost, simply divide the total amount invested by the total number of shares purchased. Round your answers to nearest dollar. Enter all values as positive. In the fluctuating market, David purchased a total of shares. At the end of the last investment period, his investment is worth $ per share, which means that David's final account balance would be s However, David has invested a total of $4,500, which means that he has received a of S Round your answers to nearest dollar. Enter all values as positive. . In the declining market, David purchased a total of shares. At the end of the last investment period, his investment is worth per share, which means that David's final account balance would be However, David has invested a total of $4,500, which means that he has received a of 1. If you are using a dollar-cost averaging strategy, and if you sell your investment shares when the market is significantly down, you will not profit. This means that you should keep investing as long as the longer-term prospect suggests an eventual increase in price. Round your answers to nearest dollar. Enter all values as positive. . In the rising market, David purchased a total of shares. At the end of the last investment period, his investment is worth $ per share, which means that David's final account balance would be s However, David has invested a total of $4,500, which means that he has received a of You will generally profit from dollar-cost averaging in a rising market because you will buy fewer and fewer shares as the price continues to rise

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts