Question: 13. What is the difference between fixed and flexible exchange-rate regimes? Discuss the advantages and disadvantages of the two regimes. 14. Calculating the rate of

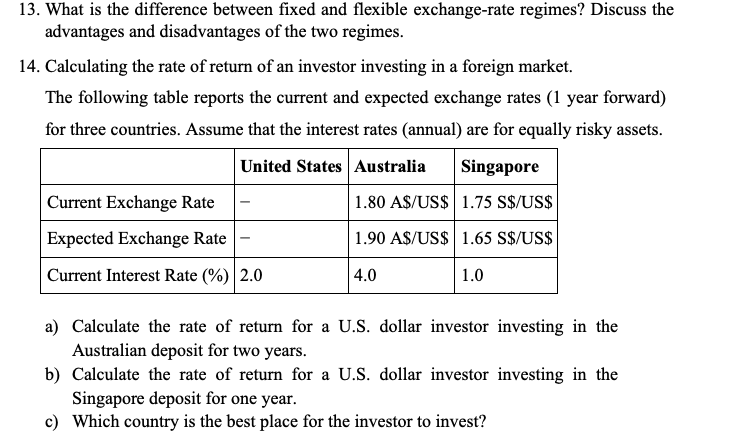

13. What is the difference between fixed and flexible exchange-rate regimes? Discuss the advantages and disadvantages of the two regimes. 14. Calculating the rate of return of an investor investing in a foreign market. The following table reports the current and expected exchange rates (1 year forward) for three countries. Assume that the interest rates (annual) are for equally risky assets. United States Australia Singapore Current Exchange Rate 1.80 A$/US$ 1.75 S$/US$ Expected Exchange Rate 1.90 A$/US$ 1.65 S$/US$ Current Interest Rate (%) 2.0 4.0 1.0 a) Calculate the rate of return for a U.S. dollar investor investing in the Australian deposit for two years. b) Calculate the rate of return for a U.S. dollar investor investing in the Singapore deposit for one year. c) Which country is the best place for the investor to invest? 13. What is the difference between fixed and flexible exchange-rate regimes? Discuss the advantages and disadvantages of the two regimes. 14. Calculating the rate of return of an investor investing in a foreign market. The following table reports the current and expected exchange rates (1 year forward) for three countries. Assume that the interest rates (annual) are for equally risky assets. United States Australia Singapore Current Exchange Rate 1.80 A$/US$ 1.75 S$/US$ Expected Exchange Rate 1.90 A$/US$ 1.65 S$/US$ Current Interest Rate (%) 2.0 4.0 1.0 a) Calculate the rate of return for a U.S. dollar investor investing in the Australian deposit for two years. b) Calculate the rate of return for a U.S. dollar investor investing in the Singapore deposit for one year. c) Which country is the best place for the investor to invest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts