Question: 1314; 17-18 please i need help solving. Your client has the opportunity to purchase a commercial property that is expected to generate an income of

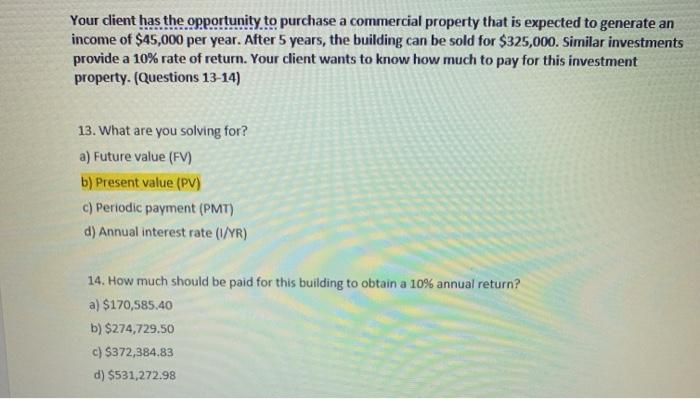

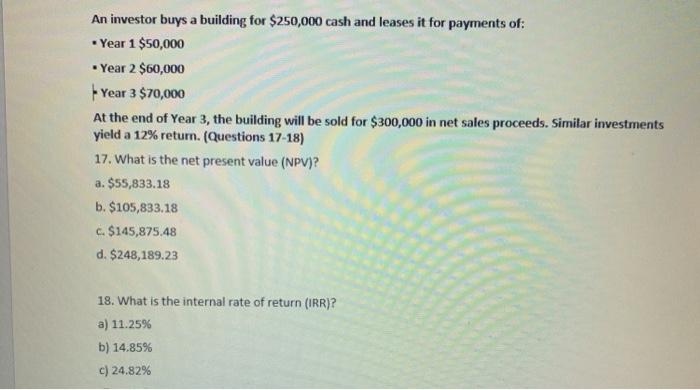

Your client has the opportunity to purchase a commercial property that is expected to generate an income of $45,000 per year. After 5 years, the building can be sold for $325,000. Similar investments provide a 10% rate of return. Your client wants to know how much to pay for this investment property. (Questions 13-14) 13. What are you solving for? a) Future value (FV) b) Present value (PV) c) Periodic payment (PMT) d) Annual interest rate (1/YR) 14. How much should be paid for this building to obtain a 10% annual return? a) $170,585.40 b) $274,729.50 c) $372,384.83 d) $531,272.98 An investor buys a building for $250,000 cash and leases it for payments of: -Year 1 $50,000 Year 2 $60,000 Year 3 $70,000 At the end of Year 3, the building will be sold for $300,000 in net sales proceeds. Similar investments yield a 12% return. (Questions 17-18) 17. What is the net present value (NPV)? a. $55,833.18 b. $105,833.18 c. $145,875.48 d. $248,189.23 18. What is the internal rate of return (IRR)? a) 11.25% b) 14.85% C) 24.82%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts