Question: Question 27 (Mandatory) (3 points) Listen Your client has the opportunity to purchase a commercial property that is expected to generate an income of $45,000

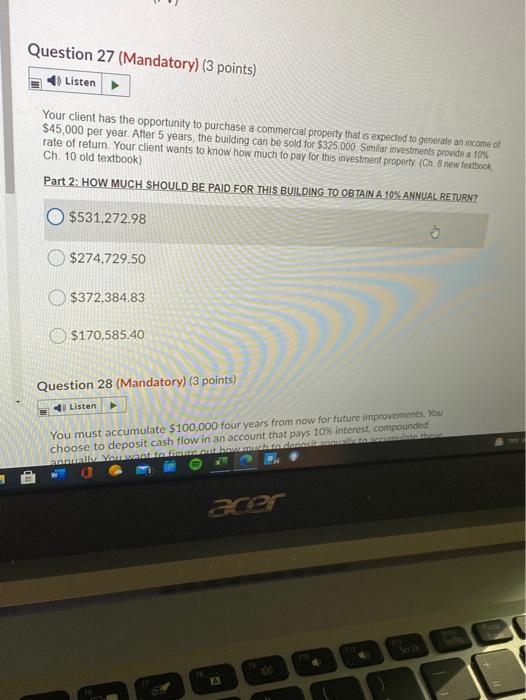

Question 27 (Mandatory) (3 points) Listen Your client has the opportunity to purchase a commercial property that is expected to generate an income of $45,000 per year. After 5 years, the building can be sold for $325,000. Similar investments provide a 10% rate of return. Your client wants to know how much to pay for this investment property (Ch 8 new foxtbook Ch. 10 old textbook) Part 2: HOW MUCH SHOULD BE PAID FOR THIS BUILDING TO OBTAIN A 10% ANNUAL RETURN? $531,272.98 $274,729.50 $372,384.83 $170,585.40 Question 28 (Mandatory) (3 points) Listen You must accumulate $100,000 four years from now for future improvements. You choose to deposit cash flow in an account that pays 10% interest, compounded na Vammattu baramuchita dan a er

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts