Question: 133 CHAPTER 3 Financial Statements and Ratio Analysis Common-size statement analysis A common-size income statement for Enterprises' 2018 operations follows. Using the firm's 2019 income

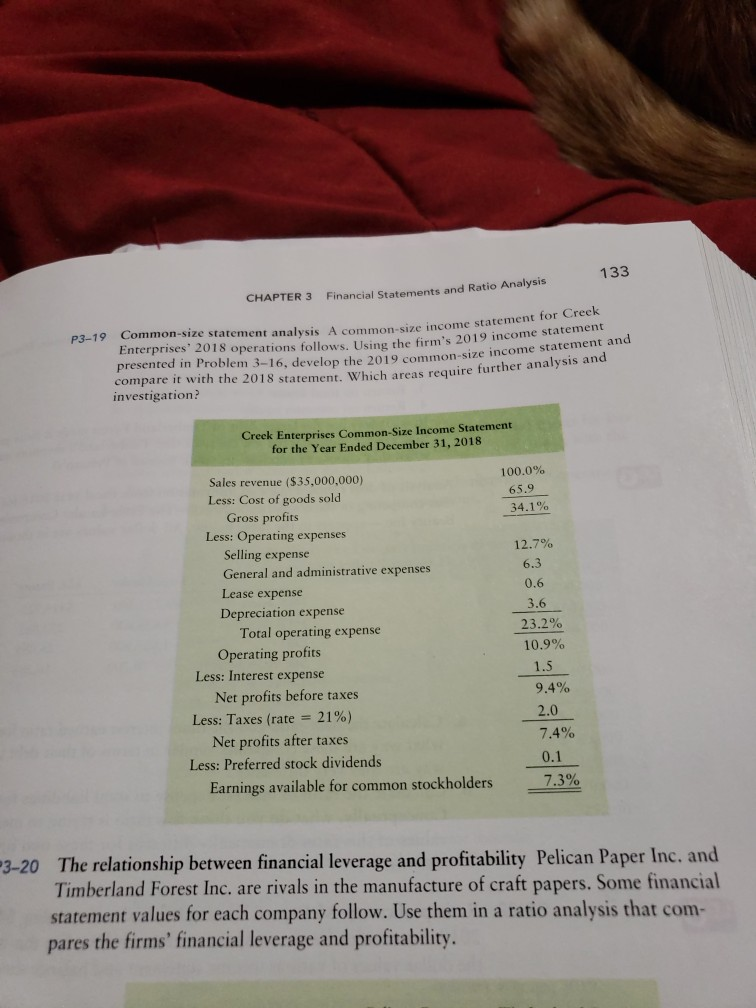

133 CHAPTER 3 Financial Statements and Ratio Analysis Common-size statement analysis A common-size income statement for Enterprises' 2018 operations follows. Using the firm's 2019 income stater Creek ment P3-19 em 3-16, develop the 2019 common-size income statement and compare it with the 2018 statement. Which areas require further analysis and investigation? Creek Enterprises Common-Size Income Statement for the Year Ended December 31, 2018 100.0% 65.9 34.1 % Sales revenue ($35,000,000) Less: Cost of goods sold Gross profits Less: Operating expenses Selling expense General and administrative expenses Lease expense 12.7% 6.3 0.6 3.6 23.2% 10.9% Depreciation expense Total operating expense Operating profits Less: Interest expense 1.5 9.4% 2.0 7.4% 0.1 7.3% Net profits before taxes Less: Taxes (rate 21 %) Net profits after taxes Less: Preferred stock dividends Earnings available for common stockholders The relationship between financial leverage and profitability Pelican Paper Inc. and Timberland Forest Inc. are rivals in the manufacture of craft papers. Some financial statement values for each company follow. Use them in a ratio analysis that com- pares the firms' financial leverage and profitability 3-20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts