Question: 13.3 Exercises MyLab Math The shaded sections below contain solutions to help you get a QUICK START on the various types of exercises. Find the

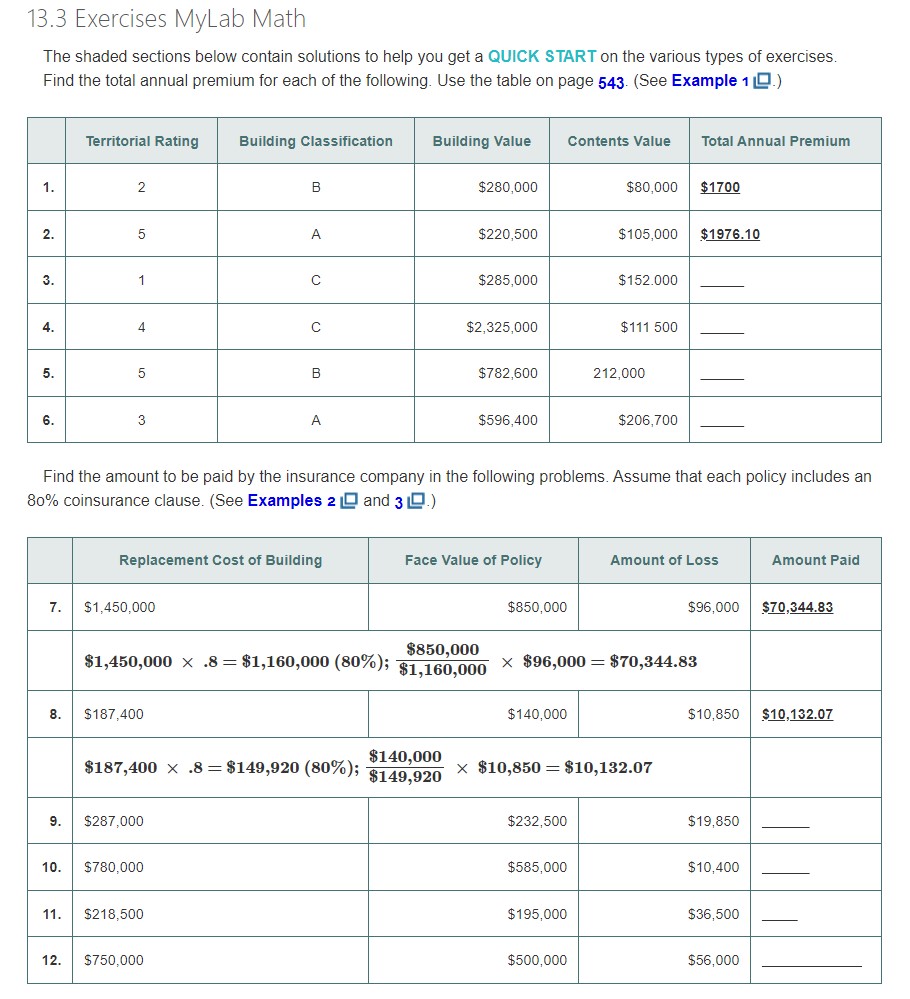

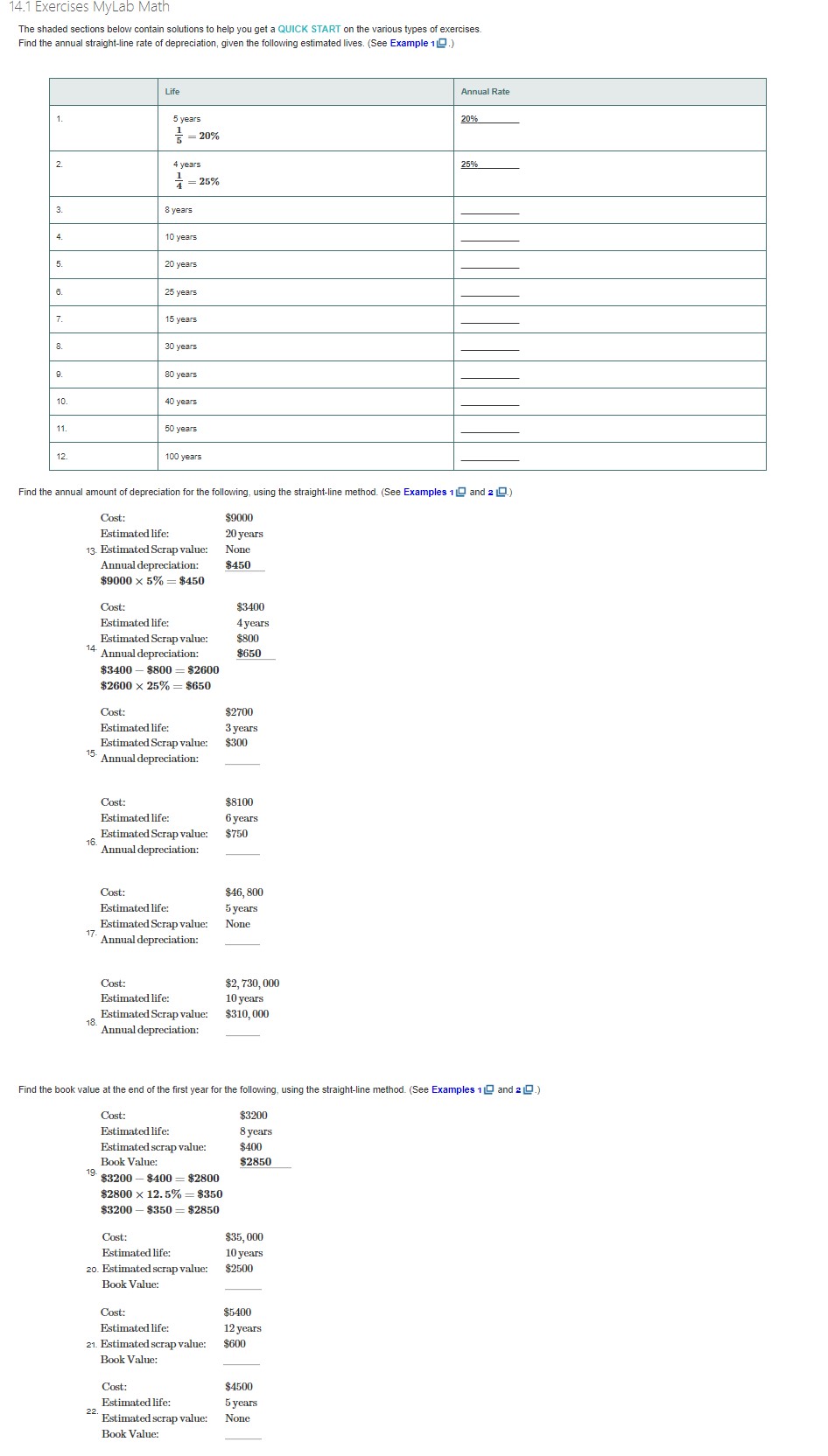

13.3 Exercises MyLab Math The shaded sections below contain solutions to help you get a QUICK START on the various types of exercises. Find the total annual premium for each of the following. Use the table on page 543. (See Example 1 10.) Territorial Rating Building Classification Building Value Contents Value Total Annual Premium 1. 2 B $280,000 $80,000 $1700 2 5 A $220,500 $105,000 $1976.10 3 C $285,000 $152.000 4 C $2,325,000 $111 500 5 B $782,600 212,000 6. 3 A $596,400 $206,700 Find the amount to be paid by the insurance company in the following problems. Assume that each policy includes an 80% coinsurance clause. (See Examples 2 0 and 3 10.) Replacement Cost of Building Face Value of Policy Amount of Loss Amount Paid 7. $1,450,000 $850,000 $96,000 $70,344.83 $850,000 $1,450,000 x .8 = $1,160,000 (80%); $1,160,000 * $96,000 = $70,344.83 8. $187,400 $140,000 $10,850 $10,132.07 $187,400 X .8 = $149,920 (80%%); $149.920 * $10,850 = $10,132.07 $140,000 9. $287,000 $232,500 $19,850 10. $780,000 $585,000 $10,400 11. $218,500 $195,000 $36,500 12. $750,000 $500,000 $56,00014.1 Exercises MyLab Math The shaded sections below contain solutions to help you get a QUICK START on the various types of exercises. Find the annual straight-line rate of depreciation, given the following estimated lives. (See Example 10.) Life Annual Rate 5 years 20% = 20% 2 * years 25% * = 25% 8 years 10 years 20 years 25 years 15 years 30 years 30 years 10 40 years 11. 50 years 12. 100 years Find the annual amount of depreciation for the following, using the straight-line method. (See Examples 1 0 and 2 [B.) Cost: $9000 Estimated life: 20 years 13 Estimated Scrap value: None Annual depreciation $450 $9000 x 5% = $450 Cost: $3400 Estimated life: 4 years Estimated Scrap value: $800 14 Annual depreciation: $650 $3400 - $800 = $2600 $2600 x 25% = $650 Cost: $2700 Estimated life: 3 years Estimated Scrap value: $300 5 Annual depreciation: Cost: $8100 Estimated life: 6 years Estimated Scrap value: $750 6. Annual depreciation: Cost: $46, 800 Estimated life: 5 years Estimated Scrap value: None 17- Annual depreciation: Cost: $2, 730, 000 Estimated life: 10 years Estimated Scrap value: $310, 000 8. Annual depreciation: Find the book value at the end of the first year for the following, using the straight-line method. (See Examples 1 0 and 2 0.) Cost: $3200 Estimated life: 8 years Estimated scrap value: $400 Book Value: $2850 $3200 - $400 = $2800 $2800 x 12.5% = $350 $3200 - $350 = $2850 Cost: $35, 000 Estimated life: 10 years 20. Estimated scrap value: $2500 Book Value: Cost: $5400 Estimated life: 12 years 21. Estimated scrap value: $600 Book Value: Cost: $4500 Estimated life: 5 years 22. Estimated scrap value: None Book Value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts