Question: 136B; HW 5 #2; Please explain steps! Current Attempt in Progress Carla Vista Co. purchased equipment that was installed and ready for use at the

136B; HW 5 #2; Please explain steps!

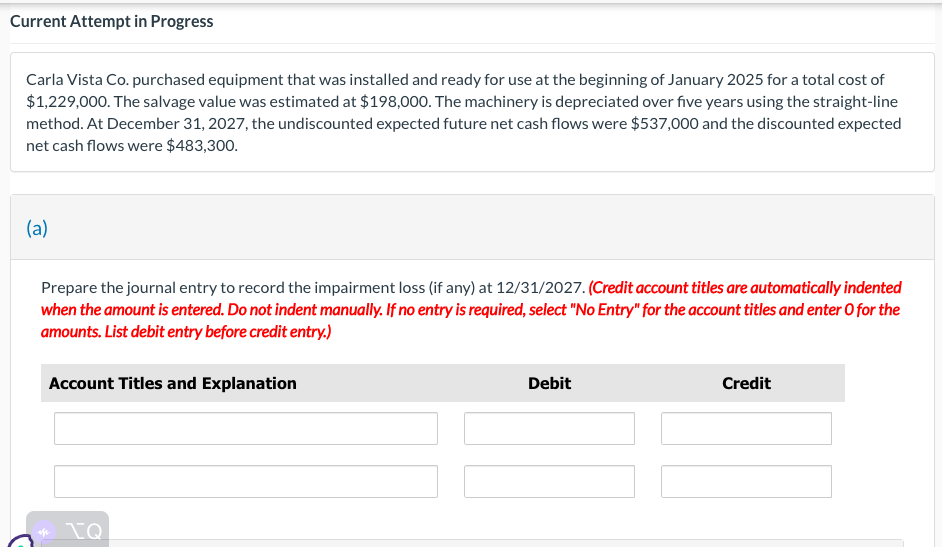

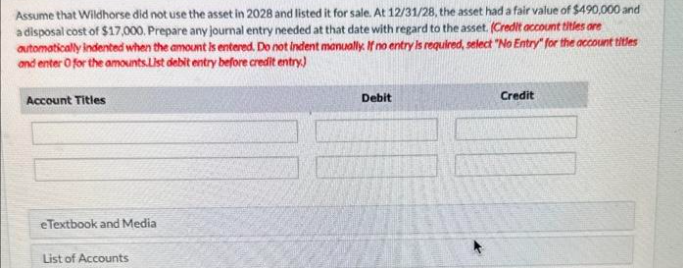

Current Attempt in Progress Carla Vista Co. purchased equipment that was installed and ready for use at the beginning of January 2025 for a total cost of $1,229,000. The salvage value was estimated at $198,000. The machinery is depreciated over five years using the straight-line method. At December 31, 2027, the undiscounted expected future net cash flows were $537,000 and the discounted expected net cash flows were $483,300. (a) Prepare the journal entry to record the impairment loss (if any) at 12/31/2027. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List debit entry before credit entry.) Assume that Wildhorse did not use the asset in 2028 and listed it for sale. At 12/31/28, the asset had a fair value of $490,000 and a disposal cost of $17,000. Prepare any journal entry needed at that date with regard to the asset. (Credit occount tities are outomatically indented when the amount is entered. Do not indent menually. If no entry/s required, select "No Entry" for the account titles ond enter 0 for the amounts. Lkst debit entry before credit entry)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts