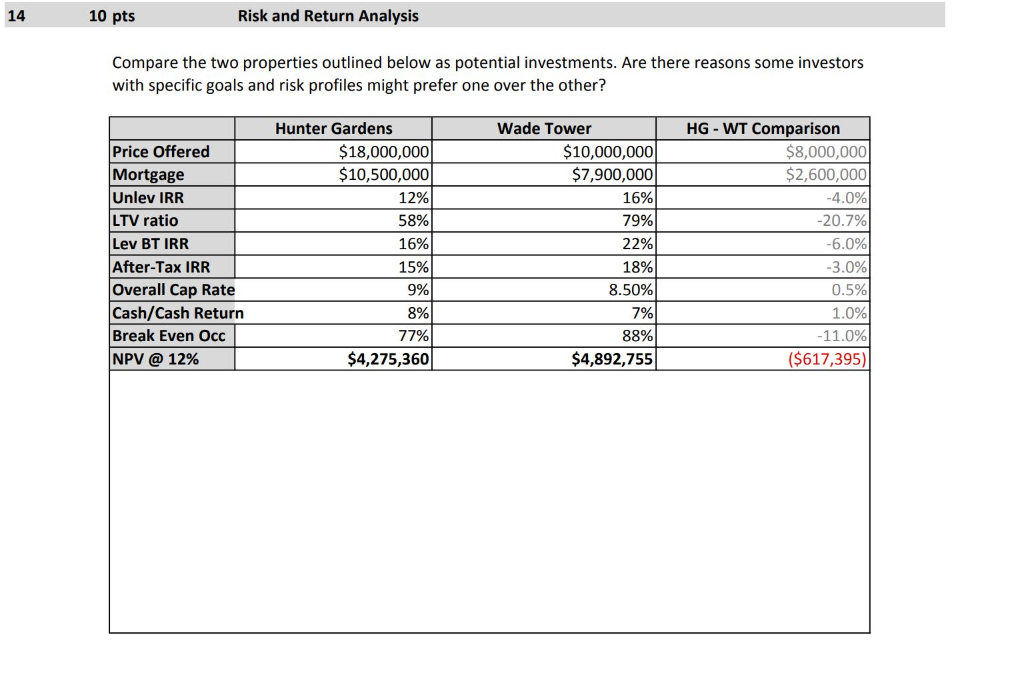

Question: 14 10 pts Risk and Return Analysis Compare the two properties outlined below as potential investments. Are there reasons some investors with specific goals and

14 10 pts Risk and Return Analysis Compare the two properties outlined below as potential investments. Are there reasons some investors with specific goals and risk profiles might prefer one over the other? Price Offered Mortgage Unlev IRR LTV ratio Lev BT IRR After-Tax IRR Overall Cap Rate Cash/Cash Return Break Even Occ NPV @ 12% Hunter Gardens $18,000,000 $10,500,000 12% 58% 16% 15% 9% 8% 77% $4,275,360 Wade Tower $10,000,000 $7,900,000 16% 79% 22% 18% 8.50% 7% 88% $4,892,755 HG - WT Comparison $8,000,000 $2,600,000 -4.0% -20.7% -6.0% -3.0% 0.5% 1.0% -11.0% ($617,395)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts