Question: There are more than nine items, but we will limit our focus to the first nine items, which is where the most important information appears.

There are more than nine items, but we will limit our focus to the first nine items, which is where the most important information appears. The first nine items are described below.

Item 1 - Business requires a description of the companys business, including its main products and services, what subsidiaries it owns, and what markets it operates in. This section may also include information about recent events, competition the company faces, regulations that apply to it, labor issues, special operating costs, or seasonal factors. This is a good place to start to understand how the company operates. This section starts on page 3 for Costco and page 2 for Target. Be sure to use the page numbers on the actual report at the bottom of each page rather than in the PDF viewer shown at the top.

Item 1A - Risk Factors includes information about the most significant risks that apply to the company or to its securities. Companies generally list the risk factors in order of their importance. In practice, this section focuses on the risks themselves, not how the company addresses those risks. Some risks may be true for the entire economy, some may apply only to the companys industry sector or geographic region, and some may be unique to the company.

Item 1B - Unresolved Staff Comments requires the company to explain certain comments it has received from the SEC staff on previously filed reports that have not been resolved after an extended period of time. Check here to see whether the SEC has raised any questions about the companys statements that have not been resolved.

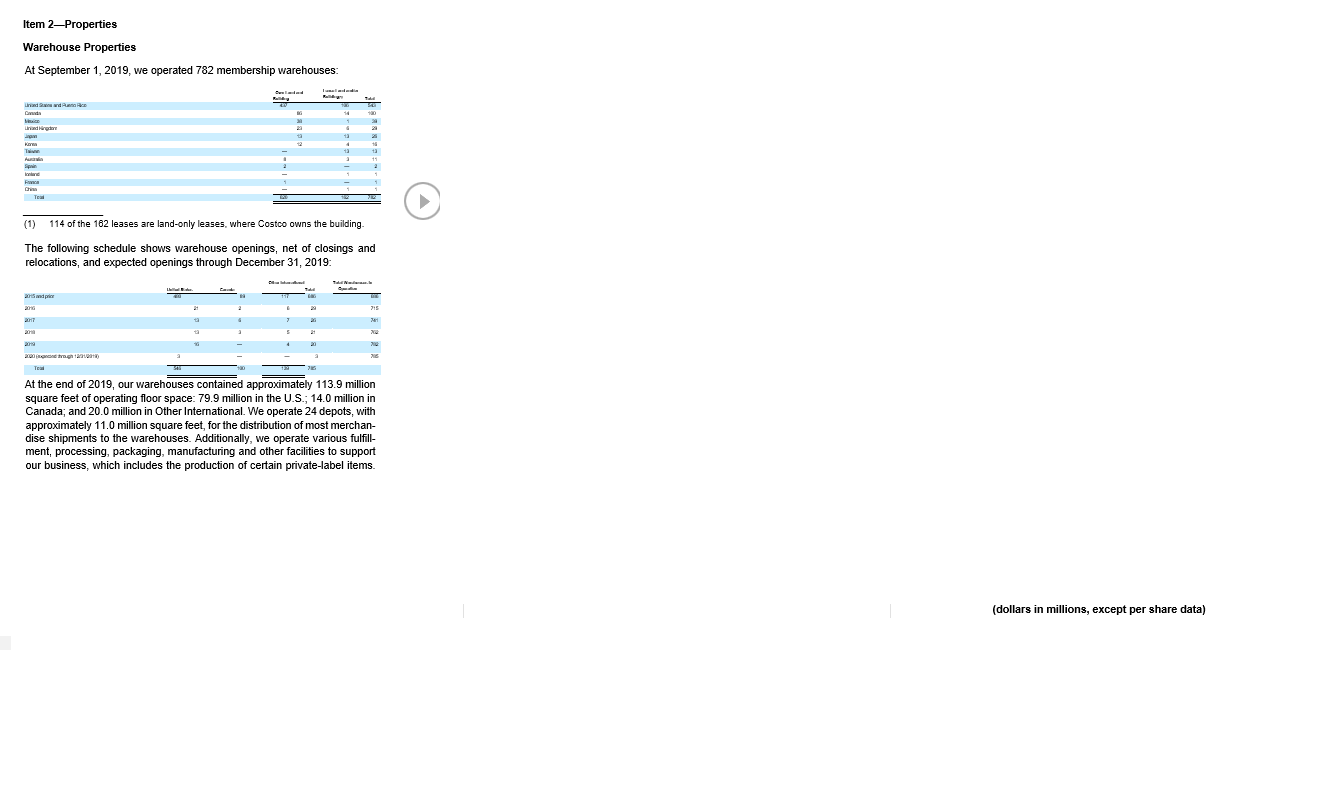

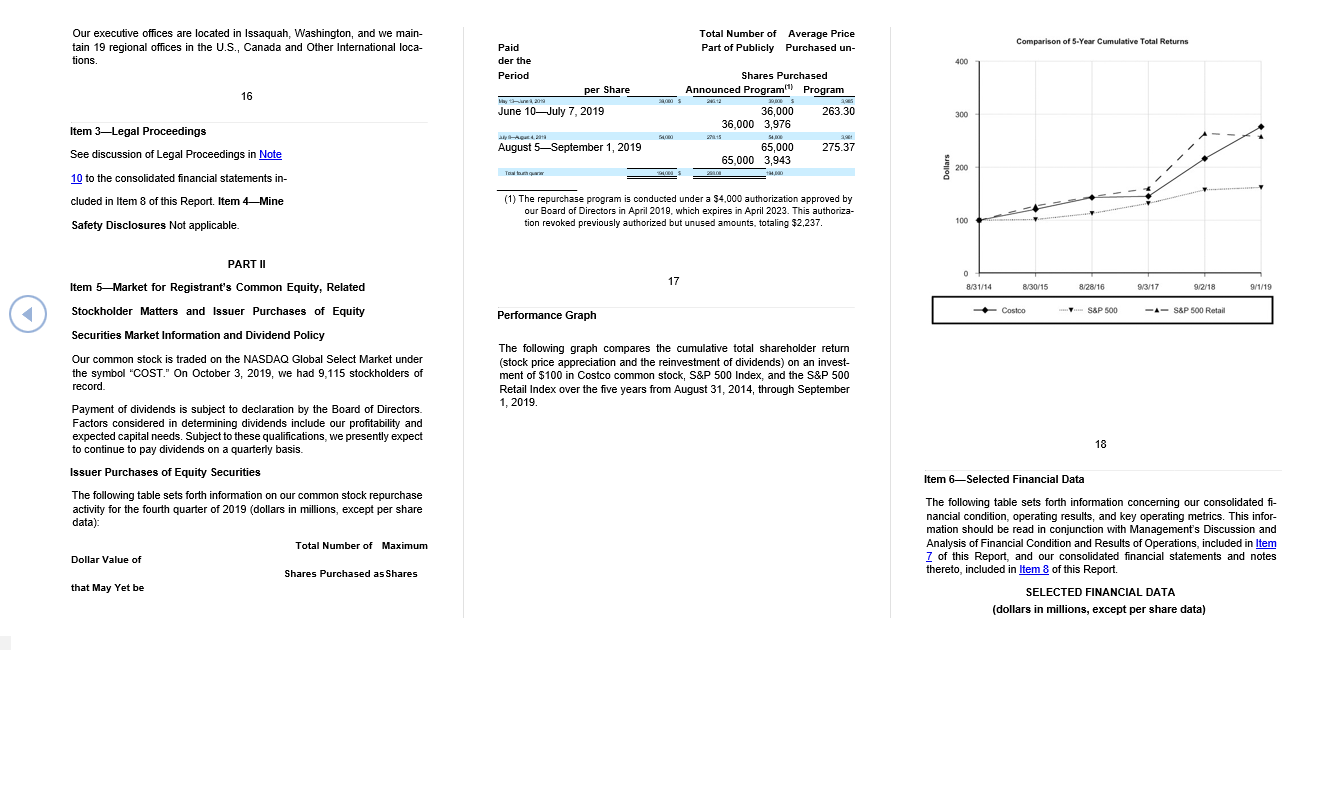

Item 2 - Properties includes information about the companys significant properties, such as principal plants, mines and other materially important physical properties. This section starts on page 16 for Costco and page 11 for Target.

Item 3 - Legal Proceedings requires the company to include information about significant pending lawsuits or other legal proceedings, other than ordinary litigation. Rather than repeating this information in two different places, this item often refers to the notes to the financial statements, which can be found under Item 8. This section starts on page 17 for Costco and page 12 for Target.

Item 4 - This item has no required information, but is reserved by the SEC for future rule-making.

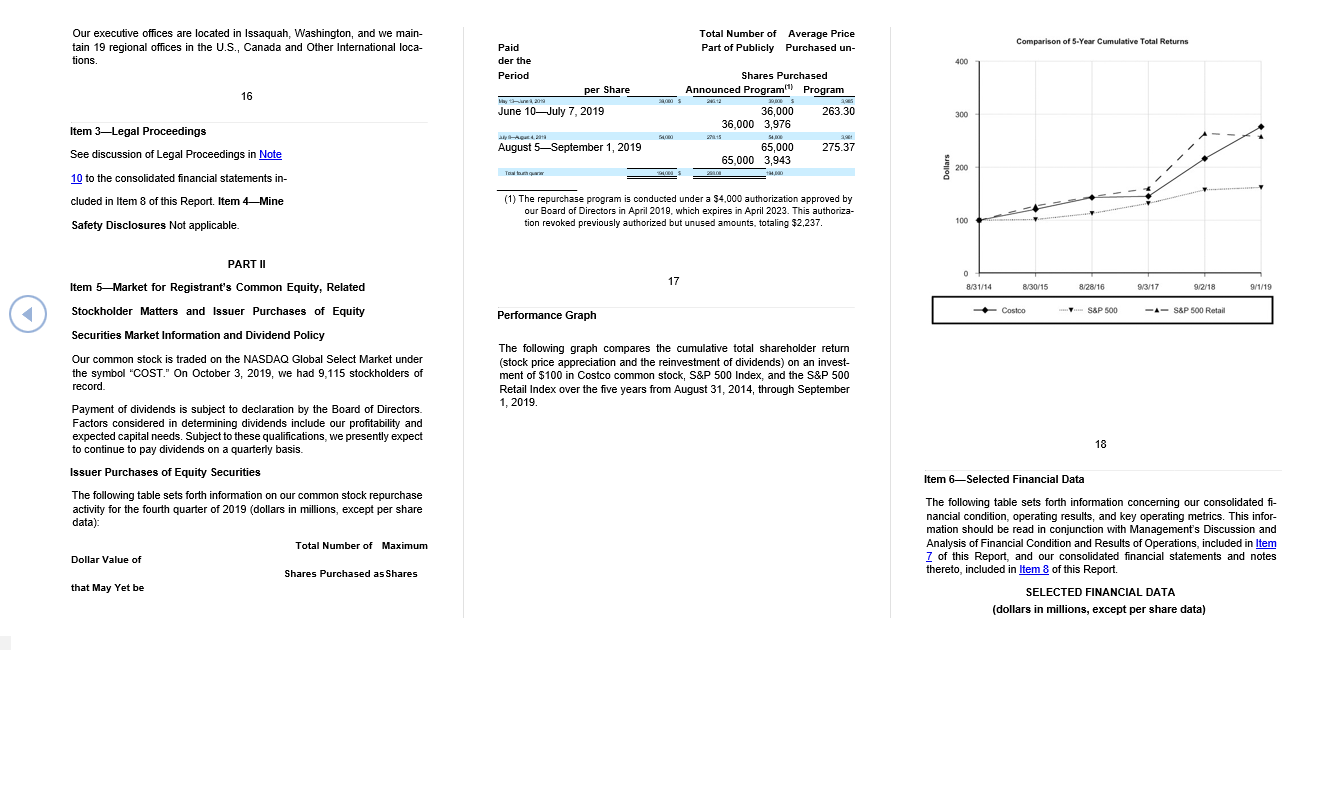

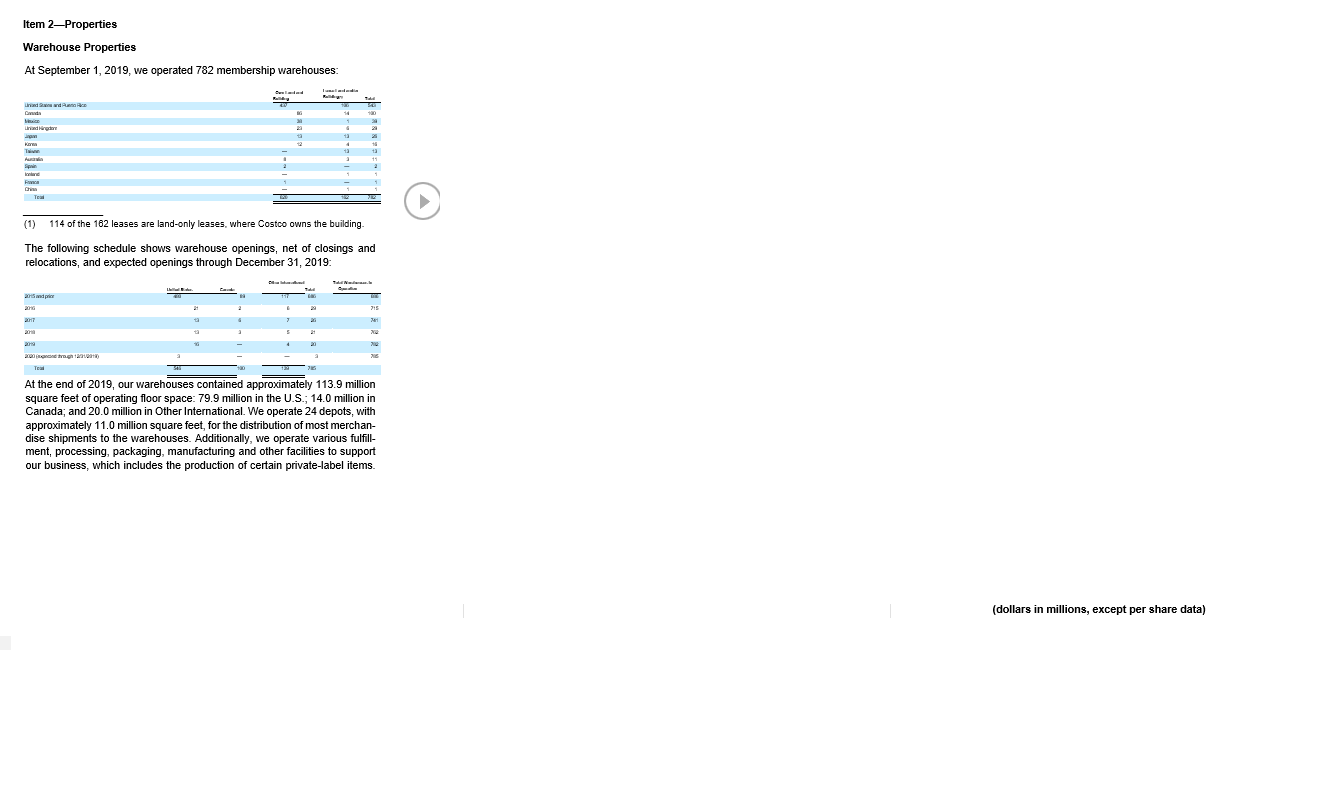

Item 5 - Market for Registrants Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities requires information about the companys equity securities, including market information, the number of holders of the shares, dividends, stock repurchases by the company, and similar information. This section starts on page 17 for Costco and page 14 for Target.

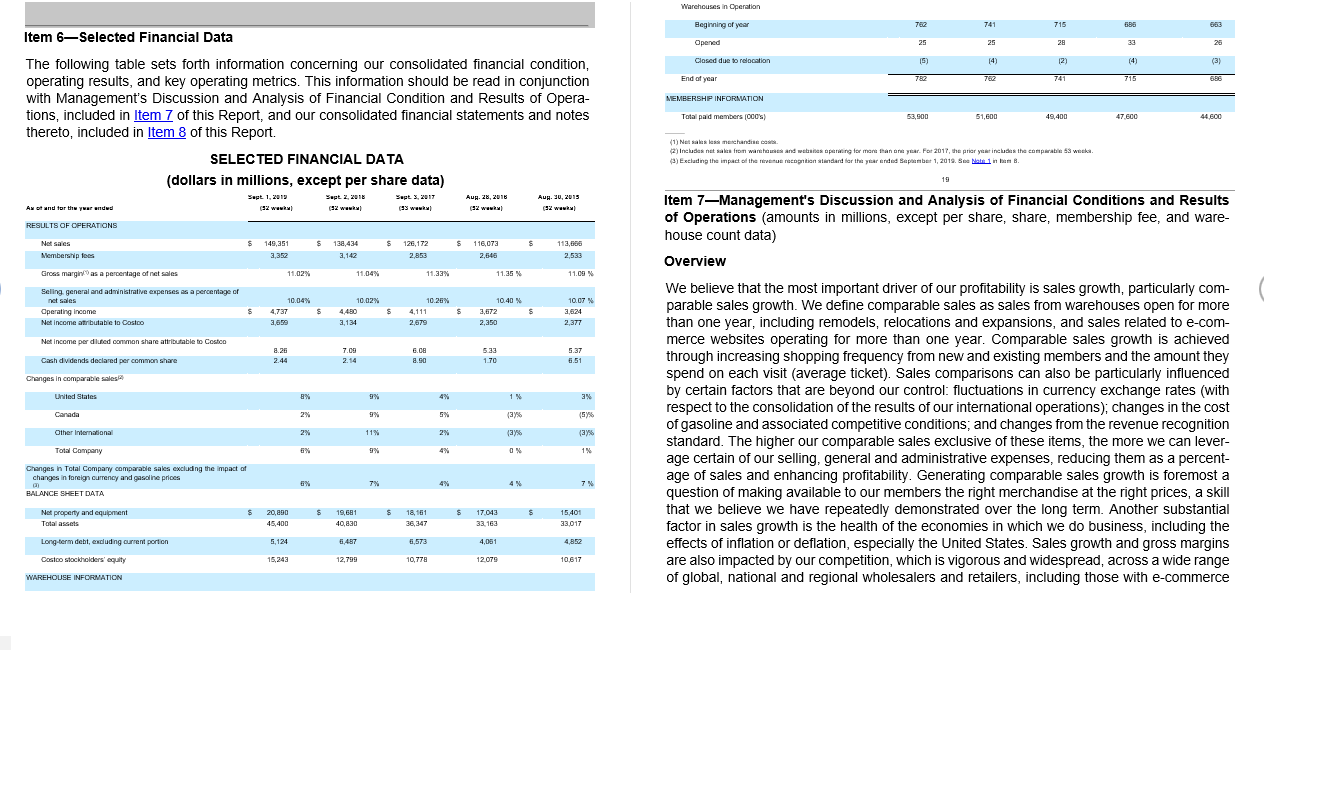

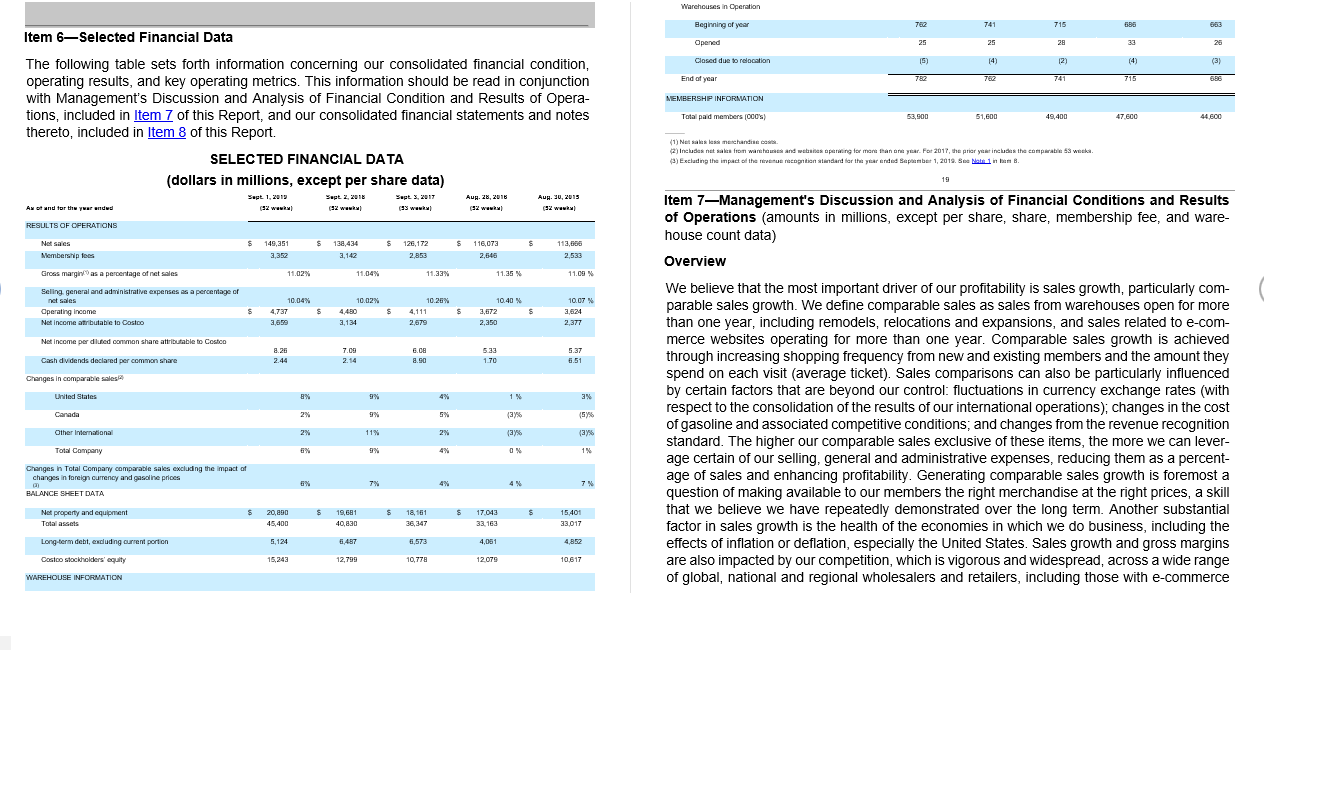

Item 6 - Selected Financial Data provides certain financial information about the company for the last five years. You can find much more detailed financial information on the past three years in a separate section Item 8, Financial Statements and Supplementary Data. This section starts on page 19 for Costco and page 16 for Target.

Item 7 - Managements Discussion and Analysis of Financial Condition and Results of Operations gives the companys perspective on the business results of the past financial year. This section, known as the MD&A for short, allows company management to tell its story in its own words. The MD&A section presents the companys operations and financial results, including information about the companys liquidity and capital resources and any known trends or uncertainties that could materially affect the companys results. This section may also discuss managements views of key business risks and what it is doing to address them. This section starts on page 20 for Costco and page 17 for Target.

Item 7A - Quantitative and Qualitative Disclosures about Market Risk requires information about the companys exposure to market risk, such as interest rate risk, foreign currency exchange risk, commodity price risk or equity price risk. The company may discuss how it manages its market risk exposures.

Item 8 - Financial Statements and Supplementary Data requires the companys audited financial statements. This includes the companys income statement (which is sometimes called the statement of earnings or the statement of operations), balance sheets, statement of cash flows and statement of stockholders equity. The financial statements are accompanied by notes that explain the information presented in the financial statements. This section starts on page 30 for Costco and page 32 for Target.

U.S. companies are required to present their financial statements according to a set of accounting standards, conventions and rules known as Generally Accepted Accounting Principles, or GAAP. An independent accountant audits the companys financial statements. For large companies, the independent accountant also reports on a companys internal controls over financial reporting. The auditors report is a key part of the 10K report. Most audit reports express an unqualified opinion that the financial statements fairly present the companys financial position in conformity with GAAP. If, however, an auditor expresses a qualified opinion or a disclaimer of opinion, investors should look carefully at what kept the auditor from expressing an unqualified opinion. Likewise, investors should carefully evaluate material weaknesses disclosed on internal controls over financial reporting.

Item 9 - Changes in and Disagreements with Accountants on Accounting and Financial Disclosure requires a company, if there has been a change in its accountants, to discuss any disagreements it had with those accountants. Many investors view this disclosure as a red flag. This section starts on page 62 for Costco and page 64 for Target.

Item 9A - Controls and Procedures includes information about the companys disclosure controls and procedures and its internal control over financial reporting.

Item 9B - Other Information includes any information that was required to be reported on a different form during the fourth quarter of the year covered by the 10K report, but was not yet reported.

Problem:

Write a paper analyzing three sections of information appearing in the annual report that relate to this class. It is your choice as to which three sections of information to discuss in this report, but I encourage you to use different sections throughout the 10K report rather than using three similar sections. For example, one section you might choose is in Item 1A (Risk Factors). You could write about two or three risk factors presented by the company, and this would be considered one section of information for your report. You should use sections of the 10K report that provide enough information to write a solid paragraph or two. If you only write a few sentences to describe and analyze one section of the 10K report, it won't be enough and you should consider writing about a different section. Please start the paragraph with a sentence describing the item and referring to the page within the Form 10K report where the item appears (for example: My first item relates to the consolidated statement of earnings appearing on page 31.)

(1) Use one sentence to summarize the section and include a page reference; then go on to describe the section and what it means for the company.

(2) Use one sentence to summarize the section and include a page reference; then go on to describe the section and what it means for the company.

(3) Use one sentence to summarize the section and include a page reference; then go on to describe the section and what it means for the company.

I am giving you information of Item 2, Item 5 Item 6 and Item 7 You can choose any 3 from these 4.

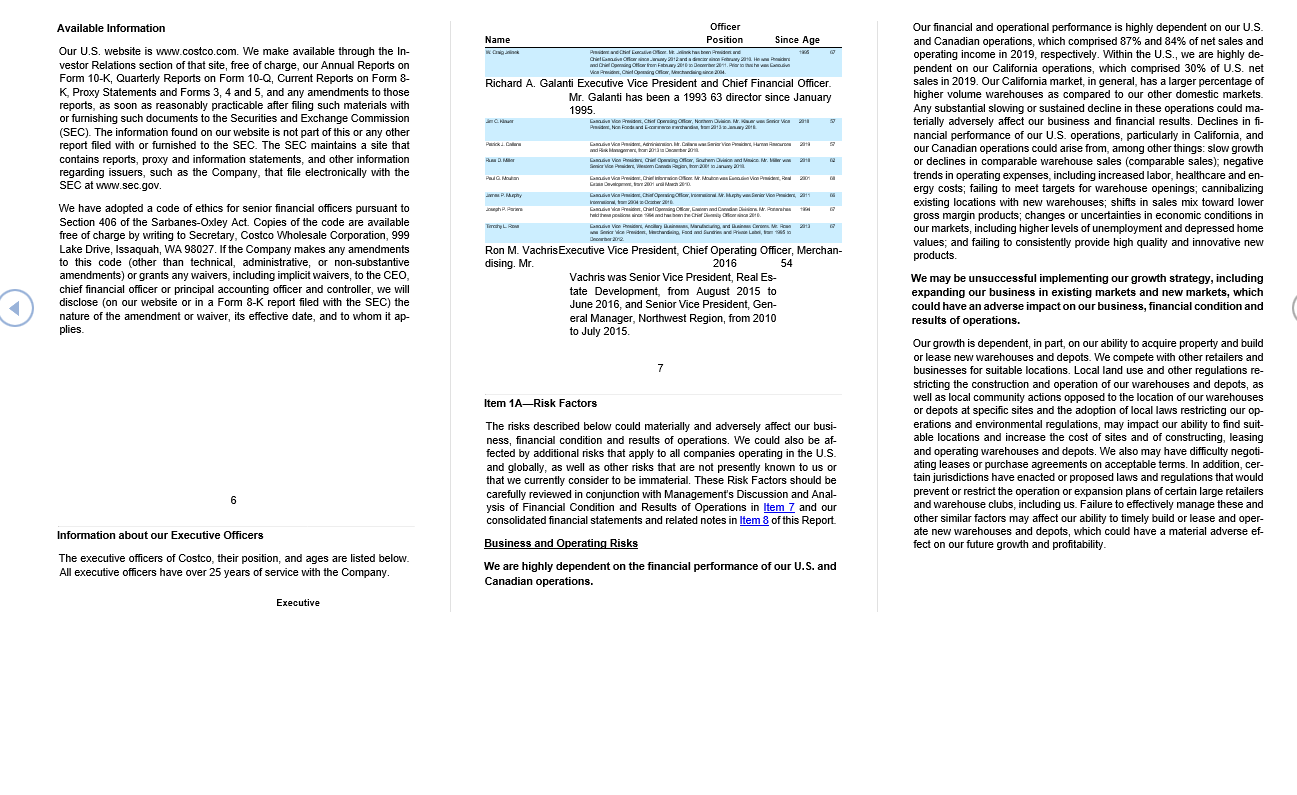

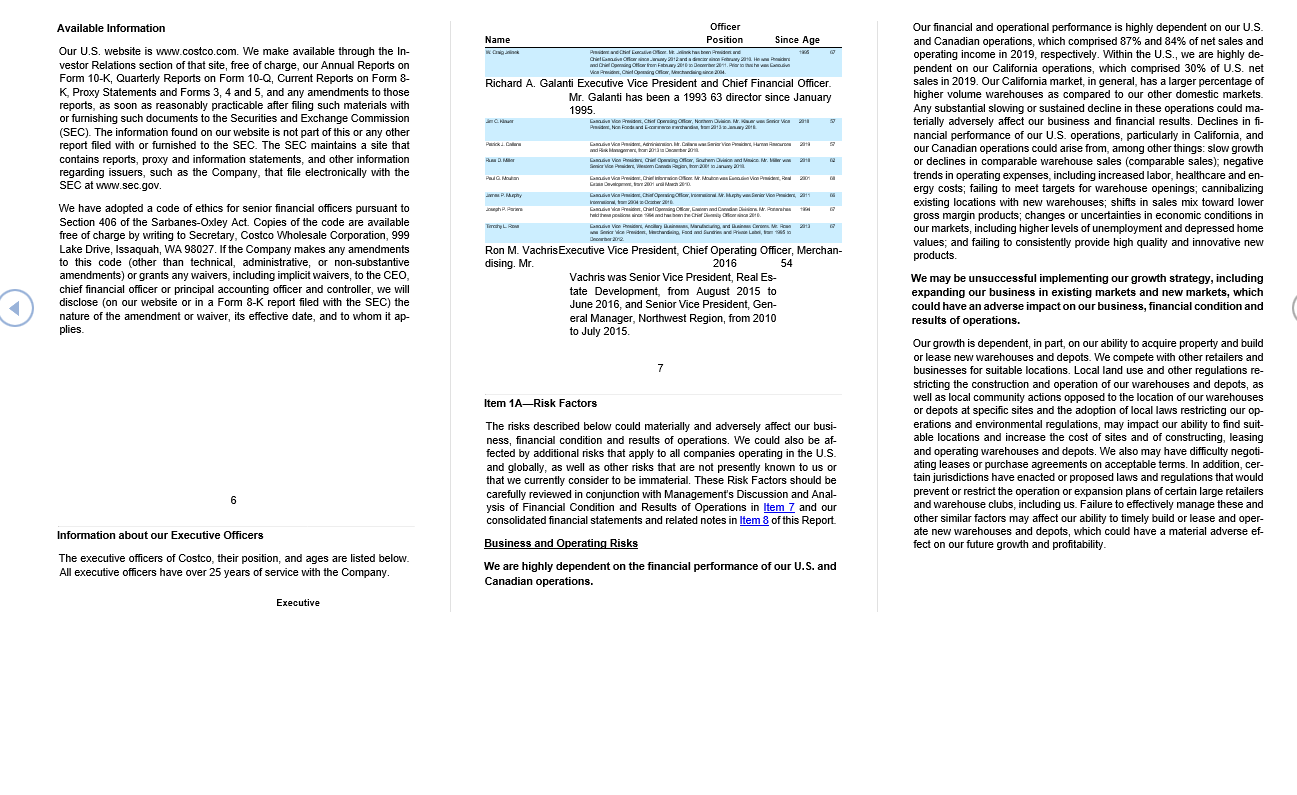

Officer Position Name Since Age Richard A. Galanti Executive Vice President and Chief Financial Officer Mr. Galanti has been a 1993 63 director since January 1995 Available Information Our U.S. website is www.costco.com. We make available through the In- vestor Relations section of that site, free of charge, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8- K Proxy Statements and Forms 3, 4 and 5, and any amendments to those reports, as soon as reasonably practicable after filing such materials with or furnishing such documents to the Securities and Exchange Commission (SEC). The information found on our website is not part of this or any other report filed with or furnished to the SEC. The SEC maintains a site that contains reports, proxy and information statements, and other information regarding issuers, such as the Company, that file electronically with the SEC at www.sec.gov. We have adopted a code of ethics for senior financial officers pursuant to Section 406 of the Sarbanes-Oxdey Act. Copies of the code are available free of charge by writing to Secretary, Costco Wholesale Corporation, 999 Lake Drive, Issaquah, WA 98027. If the Company makes any amendments to this code (other than technical, administrative, or non-substantive amendments) or grants any waivers, including implicit waivers, to the CEO, chief financial officer or principal accounting officer and controller, we will disclose on our website or in a Form 8-K report filed with the SEC) the nature of the amendment or waiver, its effective date, and to whom it ap. plies. Our financial and operational performance is highly dependent on our U.S. and Canadian operations, which comprised 87% and 84% of net sales and operating income in 2019, respectively. Within the U.S., we are highly de- pendent on our California operations, which comprised 30% of U.S. net sales in 2019. Our California market, in general, has a larger percentage of higher volume warehouses as compared to our other domestic markets Any substantial slowing or sustained decline in these operations could ma- terially adversely affect our business and financial results. Declines in - nancial performance of our U.S. operations, particularly in California, and our Canadian operations could arise from, among other things: slow growth or declines in comparable warehouse sales (comparable sales), negative trends in operating expenses, including increased labor, healthcare and en- ergy costs; failing to meet targets for warehouse openings, cannibalizing existing locations with new warehouses, shifts in sales mix toward lower gross margin products, changes or uncertainties in economic conditions in our markets, including higher levels of unemployment and depressed home values, and failing to consistently provide high quality and innovative new products Ron M. Vachris Executive Vice President, Chief Operating Officer, Merchan- dising. Mr. 2016 54 Vachris was Senior Vice President, Real Es- tate Development, from August 2015 to June 2016, and Senior Vice President, Gen- eral Manager, Northwest Region, from 2010 to July 2015 We may be unsuccessful implementing our growth strategy, including expanding our business in existing markets and new markets, which could have an adverse impact on our business, financial condition and results of operations. Item 1A-Risk Factors The risks described below could materially and adversely affect our busi- ness, financial condition and results of operations. We could also be af- fected by additional risks that apply to all companies operating in the U.S. and globally, as well as other risks that are not presently known to us or that we currently consider to be immaterial. These Risk Factors should be carefully reviewed in conjunction with Management's Discussion and Anal ysis of Financial Condition and Results of Operations in Item 7 and our consolidated financial statements and related notes in Item 8 of this Report. Our growth is dependent, in part, on our ability to acquire property and build or lease new warehouses and depots. We compete with other retailers and businesses for suitable locations. Local land use and other regulations re- stricting the construction and operation of our warehouses and depots, as well as local community actions opposed to the location of our warehouses or depots at specific sites and the adoption of local laws restricting our op- erations and environmental regulations, may impact our ability to find suit- able locations and increase the cost of sites and of constructing, leasing and operating warehouses and depots. We also may have difficulty negoti- ating leases or purchase agreements on acceptable terms. In addition, cer- tain jurisdictions have enacted or proposed laws and regulations that would prevent or restrict the operation or expansion plans of certain large retailers and warehouse clubs, including us. Failure to effectively manage these and other similar factors may affect our ability to timely build or lease and oper- ate new warehouses and depots, which could have a material adverse ef- fect on our future growth and profitability Information about our Executive Officers The executive officers of Costco, their position, and ages are listed below. All executive officers have over 25 years of service with the Company Business and Operating Risks We are highly dependent on the financial performance of our U.S. and Canadian operations. Executive We seek to expand in existing markets to attain a greater overall market share. A new warehouse may draw members away from our existing ware- houses and adversely affect their comparable sales performance, member traffic, and profitability. cessing, packaging, manufacturing and other facilities to support our busi- ness, which includes the production of certain private-label items. Although We believe that our operations are efficient, disruptions due to fires, torna- does, hurricanes, earthquakes or other catastrophic events, labor issues or other shipping problems may result in delays in the production and delivery of merchandise to our warehouses, which could adversely affect sales and the satisfaction of our members. We are currently making and will continue to make investments to improve or advance critical information systems and processing capabilities. Failure to monitor and choose the right investments and implement them at the right pace could be harmful. The risk of system disruption is increased when significant system changes are undertaken, although we believe that our change management process should mitigate this risk. Excessive techno- logical change could impact the effectiveness of adoption, and could make it more We intend to continue to open warehouses in new markets, including China Associated risks include difficulties in attracting members due to a lack of familiarity with us, attracting members of other wholesale club operators, our lesser familiarity with local member preferences, and seasonal differ- ences in the market. Entry into new markets may bring us into competition with new competitors or with existing competitors with a large, established market presence. We cannot ensure that new warehouses and new e-com- merce websites will be profitable and, as a result, future profitability could be delayed or otherwise materially adversely affected. We may not timely identify or effectively respond to consumer trends, which could negatively affect our relationship with our members, the demand for our products and services, and our market share. It is difficult to consistently and successfully predict the products and ser- vices that our members will desire. Our success depends, in part, on our ability to identify and respond to trends in demographics and consumer preferences. Failure to identify timely or effectively respond to changing consumer tastes, preferences (including those relating to sustainability of product sources and animal welfare) and spending patterns could nega- tively affect our relationship with our members, the demand for our products and services, and our market share. If we are not successful at predicting our sales trends and adjusting our purchases accordingly, we may have excess inventory, which could result in additional markdowns and reduce our operating performance. This could have an adverse effect on net sales, gross margin and operating income. difficult for us to realize benefits. Targeting the wrong opportunities, failing to make the best investments, or making an investment commitment signif- icantly above or below our needs could result in the loss of our competitive position and adversely impact our financial condition and results of opera- tions. The potential problems and interruptions associated with implement- ing technology initiatives could disrupt or reduce the efficiency of our oper- ations. These initiatives might not provide the anticipated benefits or may provide them on a delayed schedule or at a higher cost. Our failure to maintain membership growth, loyalty and brand recog- nition could adversely affect our results of operations. Membership loyalty and growth are essential to our business. The extent to which we achieve growth in our membership base, increase the penetration of Executive members, and sustain high renewal rates materially influences our profitability. Damage to our brands or reputation may negatively impact comparable sales, diminish member trust, and reduce renewal rates and, accordingly, net sales and membership fee revenue, negatively impacting our results of operations. We previously identified a material weakness in our internal control related to ineffective information technology general controls and if we fail to maintain an effective system of internal control in the future, this could result in loss of investor confidence and adversely impact our stock price. We rely extensively on information technology to process transac- tions, compile results, and manage our business. Failure or disruption of our primary and back-up systems could adversely affect our busi- ness. A failure to adequately update our existing systems and imple- ment new systems could harm our business and adversely affect our results of operations. We sell many products under our Kirkland Signature brand. Maintaining consistent product quality, competitive pricing, and availability of these products is essential to developing and maintaining member loyalty. These products also generally carry higher margins than national brand products carried in our warehouses and represent a growing portion of our overall sales. If the Kirkland Signature brand experiences a loss of member ac- ceptance or confidence, our sales and gross margin results could be ad- versely affected. Given the very high volume of transactions we process it is important that we maintain uninterrupted operation of our business-critical systems. Our systems, including our back-up systems, are subject to damage or interrup- tion from power outages, computer and telecommunications failures, com- puter viruses, internal or external security breaches, catastrophic events such as fires, earthquakes, tornadoes and hurricanes, and errors or mis- feasance by our employees. If our systems are damaged or cease to func- tion properly, we may have to make significant investments to fix or replace them, and we may suffer interruptions in our operations. Any material inter- ruption in these systems could have a material adverse effect on our busi- ness and results of operations. Internal controls related to the operation of technology systems are critical to maintaining adequate internal control over financial reporting. We re- ported in our Annual Report on Form 10-K as of September 2, 2018, a ma- terial weakness in internal control related to ineffective information technol- ogy general controls (ITGCs) in the areas of user access and program change-management over certain information technology systems that support the Company's financial reporting processes. During 2019, we completed the remediation measures related to the material weakness and concluded that our internal control over financial reporting was effective as of September 1, 2019. Completion of remediation does not provide assur- ance that our remediation or other controls will continue to operate properly. If we are unable to maintain effective internal control over financial reporting or disclosure controls and procedures, our ability to record, process and report financial information accurately, and to prepare financial statements within required time periods could be adversely affected, which could sub- ject us to litigation or investigations requiring management resources and Disruptions in our merchandise distribution or processing, packaging, manufacturing, and other facilities could adversely affect sales and member satisfaction. We depend on the orderly operation of the merchandise receiving and dis- tribution process, primarily through our depots. We also rely upon pro- payment of legal and other expenses, negatively affect investor confidence in our financial statements and adversely impact our stock price. If we do not maintain the privacy and security of personal and busi- ness information, we could damage our reputation with members and employees, incur substantial additional costs, and become subject to litigation. preventative measures. Any such breach or unauthorized access could re- sult in significant legal and financial exposure, damage to our reputation, and potentially have an adverse effect on our business and results of oper- ations. the products we buy comply with safety and other standards. While we are subject to governmental inspection and regulations and work to comply in all material respects with applicable laws and regulations, we cannot be sure that consumption or use of our products will not cause illness or injury or that we will not be subject to claims, lawsuits, or government investiga- tions relating to such matters, resulting in costly product recalls and other liabilities that could adversely affect our business and results of operations. Even if a product liability claim is unsuccessful or is not fully pursued, neg- ative publicity could adversely affect our reputation with existing and poten- tial members and our corporate and brand image, and these effects could be long term. We are subject to payment-related risks. We receive, retain, and transmit personal information about our members and employees and entrust that information to third-party business associ- ates, including cloud service-providers that perform activities for us. Our warehouse and online businesses depend upon the secure transmission of confidential information over public networks, including information permit- ting cashless payments. A compromise of our security systems or defects within our hardware or software, or those of our business associates, that results in our members' or employees' information being obtained by unau- thorized persons could adversely affect our reputation with our members and others, as well as our operations, results of operations, financial con- dition and liquidity, and could result in litigation, government actions, or the imposition of penalties. In addition, a breach could require expending sig- nificant additional resources related to the security of information systems and could disrupt our operations. If we do not successfully develop and maintain a relevant omnichannel experience for our members, our results of operations could be ad- versely impacted. We accept payments using a variety of methods, including cash and checks, select credit and debit cards, and our shop card. As we offer new payment options to our members, we may be subject to additional rules, regulations, compliance requirements, and higher fraud losses. For certain payment methods, we pay interchange and other related acceptance fees, along with additional transaction processing fees. We rely on third parties to provide payment transaction processing services for credit and debit cards and our shop card. It could disrupt our business if these companies become unwilling or unable to provide these services to us. We are also subject to evolving payment card association and network operating rules, including data security rules, certification requirements and rules governing electronic funds transfers. For example, we are subject to Payment Card Industry Data Security Standards ("PCI DSS"), which contain compliance guidelines and standards with regard to our security surrounding the phys- ical and electronic storage, processing and transmission of individual card- holder data. If our internal systems are breached or compromised, we may be liable for card re-issuance costs, subject to fines and higher transaction fees and lose our ability to accept card payments from our members, and our business and operating results could be adversely affected. Omnichannel retailing is rapidly evolving, and we must keep pace with changing member expectations and new developments by our competitors. Our members are increasingly using mobile phones, tablets, computers, and other devices to shop and to interact with us through social media. We are making investments in our websites and mobile applications. If we are unable to make, improve, or develop relevant member-facing technology in a timely manner, our ability to compete and our results of operations could be adversely affected. The use of data by our business and our business associates is highly reg- ulated in all of our operating countries. Privacy and information-security laws and regulations change, and compliance with them may result in cost increases due to, among other things, systems changes and the develop- ment of new processes. If we or those with whom we share information fail to comply with laws and regulations, such as the General Data Protection Regulation (GDPR) and California Consumer Privacy Act (CCPA), our rep- utation could be damaged, possibly resulting in lost business, and we could be subjected to additional legal risk or financial losses as a result of non- compliance We might sell products that cause illness or injury to our members, harm to our reputation, and expose us to litigation. Inability to attract, train and retain highly qualified employees could adversely impact our business, financial condition and results of op- erations. We have security measures and controls to protect personal and business information and continue to make investments to secure access to our in- formation technology network. These measures may be undermined, how- ever, due to the actions of outside parties, employee error, internal or ex- ternal malfeasance, or otherwise, and, as a result an unauthorized party may obtain access to our data systems and misappropriate business and personal information. Because the techniques used to obtain unauthorized access, disable or degrade service, or sabotage systems change frequently and may not immediately produce signs of intrusion, we may be unable to anticipate these techniques, timely discover or counter them, or implement adequate If our merchandise, such as food and prepared food products for human consumption, drugs, children's products, pet products and durable goods, do not meet or are perceived not to meet applicable safety standards or our members' expectations regarding safety, we could experience lost sales, increased costs, litigation or reputational harm. The sale of these items in- volves the risk of health-related illness or injury to our members. Such ill- nesses or injuries could result from tampering by unauthorized third parties, product contamination or spoilage, including the presence of foreign ob- jects, substances, chemicals, other agents, or residues introduced during the growing, manufacturing, storage, handling and transportation phases, or faulty design. Our suppliers are generally contractually required to com- ply with product safety laws, and we are dependent on them to ensure that Our success depends on the continued contributions of members of our senior management and other key operations, merchandising and admin- istrative personnel. Failure to identify and implement a succession plan for key senior management could negatively impact our business. We must attract, train and retain a large and growing number of qualified employees, while controlling related labor costs and maintaining our core values. Our ability to control labor and benefit costs is subject to numerous internal and external factors, including regulatory changes, prevailing wage rates, and healthcare and other insurance costs. We compete with other retail and non-retail businesses for these employees and invest significant resources in training and motivating them. There is no assurance that we will be able to attract or retain highly qualified employees in the future, which could have a material adverse effect on our business, financial condition and results of operations competitors may have greater financial resources and technology capabili- ties, better access to merchandise, and greater market penetration than we do. Our inability to respond effectively to competitive pressures, changes in the retail markets and member expectations could result in lost market share and negatively affect our financial results. Suppliers may be unable to timely supply us with quality merchandise at competitive prices or may fail to adhere to our high standards, re- sulting in adverse effects on our business, merchandise inventories, sales, and profit margins. We may incur property, casualty or other losses not covered by our insurance. General economic factors, domestically and internationally, may ad- versely affect our business, financial condition, and results of opera- tions. The Company is predominantly self-insured for employee health care ben- efits, workers' compensation, general liability property damage, directors' and officers' liability, vehicle liability, and inventory loss. Insurance cover- age is maintained in certain instances to limit exposures arising from very large losses. The types and amounts of insurance may vary from time to time based on our decisions with respect to risk retention and regulatory requirements. Significant claims or events, regulatory changes, a substan- tial rise in costs of health care or costs to maintain our insurance or the failure to maintain adequate insurance coverage could have an adverse impact on our financial condition and results of operations. We depend heavily on our ability to purchase quality merchandise in suffi- cient quantities at competitive prices. As the quantities we require continue to grow, we have no assurances of continued supply, appropriate pricing or access to new products, and any supplier has the ability to change the terms upon which they sell to us or discontinue selling to us. Member de- mands may lead to out-of-stock positions leading to loss of sales and prof- Higher energy and gasoline costs, inflation, levels of unemployment, healthcare costs, consumer debt levels, foreign-currency exchange rates, unsettled financial markets, weaknesses in housing and real estate mar- kets, reduced consumer confidence, changes and uncertainties related to government fiscal and tax policies including changes in tax rates, duties, tariffs, or other restrictions, sovereign debt crises, and other 12 Although we maintain specific coverages for catastrophic property losses, we still bear the risk of losses incurred as a result of any physical damage to, or the destruction of any warehouses, depots, manufacturing or home office facilities, loss or spoilage of inventory, and business interruption caused by any such events to the extent they are below catastrophic levels of coverage, as well as any losses to the extent they exceed our aggregate limits of applicable coverages. Such losses could materially impact our cash flows and results of operations. We buy from numerous domestic and foreign manufacturers and importers. Our inability to acquire suitable merchandise on acceptable terms or the loss of key suppliers could negatively affect us. We may not be able to de- velop relationships with new suppliers, and products from alternative sources, if any, may be of a lesser quality or more expensive. Because of our efforts to adhere to high quality standards for which available supply may be limited, particularly for certain food items, the large volumes we demand may not be consistently available. Our suppliers (and those they depend upon for materials and services) are subject to risks, including labor disputes, union organizing activities, finan- cial liquidity, inclement weather, natural disasters, supply constraints, and general economic and political conditions that could limit their ability to timely provide us with acceptable merchandise. One or more of our suppli- ers might not adhere to our quality control, legal, regulatory, labor, environ- mental or animal welfare standards. These deficiencies may delay or pre- clude delivery of merchandise to us and might not be identified before we sell such merchandise to our members. This failure could lead to recalls and litigation and otherwise damage our reputation and our brands, in- crease costs, and otherwise adversely impact our business. economic factors could adversely affect demand for our products and ser- vices, require a change in product mix, or impact the cost of or ability to purchase inventory. Additionally, actions in various countries, particularly China and the United States, have created uncertainty with respect to tariff impacts on the costs of some of our merchandise. The degree of our expo- sure is dependent on (among other things) the type of goods, rates im- posed, and timing of the tariffs. The impact to our business, including net sales and gross margin, will be influenced in part by merchandising and pricing strategies in response to potential cost increases by us and our competitors. While these potential impacts are uncertain, they could have an adverse impact on our financial results. Market and Other External Risks We face strong competition from other retailers and warehouse club operators, which could adversely affect our business, financial condi- tion and results of operations. Fluctuations in foreign exchange rates may adversely affect our re- sults of operations. The retail business is highly competitive. We compete for members, em- ployees, sites, products and services and in other important respects with a wide range of local, regional and national wholesalers and retailers, both in the United States and in foreign countries, including other warehouseclub operators, supermarkets, supercenters, internet retailers, gasoline stations, hard discounters, department and specialty stores and operators selling a single category or narrow range of merchandise. Such retailers and ware- house club operators compete in a variety of ways, including pricing, selec- tion and availability, services, location, convenience store hours, and the attractiveness and ease of use of websites and mobile applications. The evolution of retailing in online and mobile channels has improved the ability of customers to comparison shop, which has enhanced competition. Some Prices of certain commodities, including gasoline and consumable goods used in manufacturing and our warehouse retail operations, are historically volatile and are subject to fluctuations arising from changes in domestic and international supply and demand, labor costs, competition, market specu- lation, government regulations, taxes and periodic delays in delivery. Rapid and significant changes in commodity prices and our ability and desire to pass them through to our members may affect our sales and profit margins. These factors could also increase our merchandise costs and selling, gen- eral and administrative expenses, and otherwise adversely affect our oper- ations and financial results. General economic conditions can also be af- fected by events like the outbreak of war or acts of terrorism. During 2019, our international operations, including Canada, generated 27% and 35% of our net sales and operating income, respectively. Our in- ternational operations have accounted for an increasing portion of our warehouses, and we plan to continue international growth. To prepare our consolidated financial statements, we translate the financial statements of our international operations from local currencies into U.S. dollars using current exchange rates. Future fluctuations in exchange rates that are un- 14 favorable to us may adversely affect the financial performance of our Ca. nadian and Other International operations and have a corresponding ad- verse period-over-period effect on our results of operations. As we continue to expand internationally, our exposure to fluctuations in foreign exchange rates may increase pliance and merchandise costs, and other regulation affecting energy in- puts could materially affect our profitability. Climate change and extreme weather conditions, such as hurricanes, thunderstorms, tomadoes, and snow or ice storms, as well as rising sea levels could affect our ability to procure commodities at costs and in quantities we currently experience. We also sell a substantial amount of gasoline, the demand for which could be impacted by concerns about climate change and which could face in creased regulation. managing international operations, adverse tax consequences, and diffi- culty in enforcing intellectual property rights. Failure to meet financial market expectations could adversely affect the market price and volatility of our stock. A portion of the products we purchase is paid for in a currency other than the local currency of the country in which the goods are sold. Currency fluc- tuations may increase our cost of goods and may not be passed on to mem- bers. Consequently, fluctuations in currency exchange rates may adversely affect our results of operations. We believe that the price of our stock currently reflects high market expec- tations for our future operating results. Any failure to meet or delay in meet- ing these expectations, including our warehouse and e-commerce compa- rable sales growth rates, membership renewal rates, new member sign- ups, gross margin, earnings, earnings per share, new warehouse openings, or dividend or stock repurchase policies could cause the market price of our stock to decline Changes in accounting standards and subjective assumptions, esti- mates and judgments by management related to complex accounting matters could significantly affect our financial condition and results of operations. Accounting principles and related pronouncements, implementation guide- lines, and interpretations we apply to a wide range of matters that are rele- vant to our business, including self-insurance liabilities and income taxes, are highly complex and involve subjective assumptions, estimates and judgments by our management. Changes in rules or interpretation or changes in underlying assumptions, estimates or judgments by our man agement could significantly change our reported or expected financial per- formance and have a material impact on our consolidated financial state- ments Natural disasters or other catastrophes could negatively affect our business, financial condition, and results of operations. Legal and Regulatory Risks Our international operations subject us to risks associated with the legislative, judicial, accounting, regulatory, political and economic factors specific to the countries or regions in which we operate, which could adversely affect our business, financial condition and results of operations. Natural disasters, such as hurricanes, typhoons or earthquakes, particularly in California or Washington state, where our centralized operating systems and administrative personnel are located, could negatively affect our oper- ations and financial performance. Such events could result in physical dam. age to our properties, the temporary closure of warehouses, depots, man- ufacturing or home office facilities, the temporary lack of an adequate work force, the temporary or long-term disruption in the supply of products from some local or overseas suppliers, the temporary disruption in the transport of goods to or from overseas, delays in the delivery of goods to our ware- houses or depots, and the temporary reduction in the availability of products in our warehouses. Public health issues, whether occurring in the U.S. or abroad, could disrupt our operations, disrupt the operations of suppliers or members, or have an adverse impact on consumer spending and confi- dence levels. These events could also reduce demand for our products or make it difficult or impossible to procure products. We may be required to suspend operations in some or all of our locations, which could have a ma- terial adverse effect on our business, financial condition and results of op. erations At the end of 2019, we operated 239 warehouses outside of the U.S., and we plan to continue expanding our international operations. Future operat- ing results internationally could be negatively affected by a variety of fac tors, many similar to those we face in the U.S., certain of which are beyond our control. These factors include political and economic conditions, regu- latory constraints, currency regulations, policy changes such as the U.K.'s vote to withdraw from the European Union, commonly known as "Brexit", and other matters in any of the countries or regions in which we operate, now or in the future. Other factors that may impact international operations include foreign trade (including tariffs and trade sanctions), monetary and fiscal policies and the laws and regulations of the U.S. and foreign govern- ments, agencies and similar organizations, and risks associated with hav- ing major facilities in locations which have been historically less stable than the U.S. Risks inherent in international operations also include, among oth- ers, the costs and difficulties of We could be subject to additional tax liabilities. We are subject to a variety of taxes and tax collection and remittance obli- gations in the U.S. and numerous foreign jurisdictions. Additionally, at any point in time, we may be under examination for value added, sales-based, payroll, product, import or other non-income taxes. We may recognize ad- ditional tax expense, be subject to additional tax liabilities, or incur losses and penalties, due to changes in laws, regulations, administrative practices, principles, assessments by authorities and interpretations related to tax, in- cluding tax rules in various jurisdictions. We compute our income tax provi- sion based on enacted tax rates in the countries in which we operate. As tax rates vary among countries, a change in earnings attributable to the various jurisdictions in which we operate could result in an unfavorable change in our overall tax provision. Additionally, changes in the enacted tax rates or adverse outcomes in tax audits, including transfer pricing disputes, could have a material adverse effect on our financial condition and results of operations Factors associated with climate change could adversely affect our business. We use natural gas, diesel fuel, gasoline, and electricity in our distribution and warehouse operations. U.S. and foreign government regulations limit- ing carbon dioxide and other greenhouse gas emissions may increase com- Significant changes in or failure to comply with regulations relating to the use, storage, discharge and disposal of hazardous materials, haz- ardous and non-hazardous wastes and other environmental matters could adversely impact our business, financial condition and results of operations. Our executive offices are located in Issaquah, Washington, and we main- tain 19 regional offices in the U.S., Canada and Other International loca- tions Total Number of Average Price Part of Publicly Purchased un- Comparison of S-Year Cumulative Total Returns Paid der the Period per Share June 10July 7, 2019 Shares Purchased Announced Program Program 36,000 263.30 36,000 3,976 65,000 275.37 65,000 3,943 August 5September 1, 2019 Item 34Legal Proceedings See discussion of Legal Proceedings in Note 10 to the consolidated financial statements in- cluded in Item 8 of this report. Item 4Mine Safety Disclosures Not applicable. (1) The repurchase program is conducted under a $4,000 authorization approved by our Board of Directors in April 2019, which expires in April 2023. This authoriza- tion revoked previously authorized but unused amounts, totaling $2,237 PARTI 8/31/14 3/30/15 8/28/16 /3/17 912/18 9/11 Item 5Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Costco - S&P 500 -.- S&P 500 Retail Performance Graph Securities Market Information and Dividend Policy Our common stock is traded on the NASDAQ Global Select Market under the symbol "COST." On October 3, 2019, we had 9,115 stockholders of record. The following graph compares the cumulative total shareholder retum (stock price appreciation and the reinvestment of dividends) on an invest- ment of $100 in Costco common stock, S&P 500 Index, and the S&P 500 Retail Index over the five years from August 31, 2014, through September 1, 2019 Payment of dividends is subject to declaration by the Board of Directors Factors considered in determining dividends include our profitability and expected capital needs. Subject to these qualifications, we presently expect to continue to pay dividends on a quarterly basis. Issuer Purchases of Equity Securities Item 6-Selected Financial Data The following table sets forth information on our common stock repurchase activity for the fourth quarter of 2019 (dollars in millions, except per share data) The following table sets forth information concerning our consolidated fl- nancial condition, operating results, and key operating metrics. This infor- mation should be read in conjunction with Management's Discussion and Analysis of Financial Condition and Results of Operations, included in Item 7 of this Report, and our consolidated financial statements and notes thereto, included in Item 8 of this Report. Total Number of Maximum Dollar Value of Shares Purchased as Shares that May Yet be SELECTED FINANCIAL DATA (dollars in millions, except per share data) Item 2Properties Warehouse Properties At September 1, 2019, we operated 782 membership warehouses: (1) 114 of the 162 leases are land-only leases, where Costco owns the building The following schedule shows warehouse openings, net of closings and relocations, and expected openings through December 31, 2019 2008 Tea At the end of 2019, our warehouses contained approximately 113.9 million square feet of operating floor space: 79.9 million in the U.S., 14.0 million in Canada; and 20.0 million in Other International. We operate 24 depots, with approximately 11.0 million square feet, for the distribution of most merchan- dise shipments to the warehouses. Additionally, we operate various fulfill- ment, processing, packaging, manufacturing and other facilities to support our business, which includes the production of certain private-label items. (dollars in millions, except per share data) Warehouses in Operation Beginning of year Item 6-Selected Financial Data Opened Closed due to relocation End of year MEMBERSHIP INFORMATION Total paid members 1000's) 53,900 51,600 49,400 47,600 44.800 The following table sets forth information concerning our consolidated financial condition, operating results, and key operating metrics. This information should be read in conjunction with Management's Discussion and Analysis of Financial Condition and Results of Opera- tions, included in Item 7 of this Report, and our consolidated financial statements and notes thereto, included in Item 8 of this Report. SELECTED FINANCIAL DATA (dollars in millions, except per share data) (1) Notes les marchandise (2) Includes nationware and was pang forma anonynar For 2017, the prior year includes the comparable 53 wik 3) Excluding the impact of the un itions andard for the year ended Super 1, 2019. See Natt 1 in B. 2015 Supt. 1.2019 (92 week Sept. (92 k Sept. 5, 2017 W Aug. 28, 2015 (92 Web Auh. 30, 2015 (92 www Anot und for the year and RESULTS OF OPERATIONS Item 7Management's Discussion and Analysis of Financial Conditions and Results of Operations (amounts in millions, except per share, share, membership fee, and ware- house count data) Overview $ $ $ 126,172 5 $ 149,351 3,352 138,434 3,142 116,073 2,645 113,056 2533 Membership fees Grog margiry as a percentage of net sales 11.02% 11.04% 11.33% 11.35 11.09 Selling general and administrative expenses as a percentage of 10.04% 4.737 S 3,659 4 10.02% ,480 3,134 10:40 2,672 Operating income Net Income attributable to Costco $ 10.26% 4,111 2,679 $ 10.07 3.624 2,377 Net Income per diluted common share attributable to Costco 5.33 8.25 2.44 7.09 2.14 6.00 8.90 5.37 6.51 Cach dividends declared per common share 1.70 Changes in comparable sales United States Canada Other international We believe that the most important driver of our profitability is sales growth, particularly com- parable sales growth. We define comparable sales as sales from warehouses open for more than one year, including remodels, relocations and expansions, and sales related to e-com- merce websites operating for more than one year. Comparable sales growth is achieved through increasing shopping frequency from new and existing members and the amount they spend on each visit (average ticket). Sales comparisons can also be particularly influenced by certain factors that are beyond our control: fluctuations in currency exchange rates with respect to the consolidation of the results of our international operations); changes in the cost of gasoline and associated competitive conditions, and changes from the revenue recognition standard. The higher our comparable sales exclusive of these items, the more we can lever- age certain of our selling, general and administrative expenses, reducing them as a percent- age of sales and enhancing profitability. Generating comparable sales growth is foremost a question of making available to our members the right merchandise at the right prices, a skill that we believe we have repeatedly demonstrated over the long term. Another substantial factor in sales growth is the health of the economies in which we do business, including the effects of inflation or deflation, especially the United States. Sales growth and gross margins are also impacted by our competition, which is vigorous and widespread, across a wide range of global, national and regional wholesalers and retailers, including those with e-commerce Total Company Changes in Total Company comparable sales excluding the impact of changes in foreign currency and gasoline prices BALANCE SHEET DATA $ $ $ 5 Net property and equipment Total assets 19,681 40,830 18,161 36,347 17.043 33.163 15.401 33.017 20,890 45,400 5,124 15,243 Long-term debt, excluding current portion 6,487 4,051 4.852 6,573 10,778 Costco stockholders' equity 12.799 12.079 10.617 WAREHOUSE INFORMATION Officer Position Name Since Age Richard A. Galanti Executive Vice President and Chief Financial Officer Mr. Galanti has been a 1993 63 director since January 1995 Available Information Our U.S. website is www.costco.com. We make available through the In- vestor Relations section of that site, free of charge, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8- K Proxy Statements and Forms 3, 4 and 5, and any amendments to those reports, as soon as reasonably practicable after filing such materials with or furnishing such documents to the Securities and Exchange Commission (SEC). The information found on our website is not part of this or any other report filed with or furnished to the SEC. The SEC maintains a site that contains reports, proxy and information statements, and other information regarding issuers, such as the Company, that file electronically with the SEC at www.sec.gov. We have adopted a code of ethics for senior financial officers pursuant to Section 406 of the Sarbanes-Oxdey Act. Copies of the code are available free of charge by writing to Secretary, Costco Wholesale Corporation, 999 Lake Drive, Issaquah, WA 98027. If the Company makes any amendments to this code (other than technical, administrative, or non-substantive amendments) or grants any waivers, including implicit waivers, to the CEO, chief financial officer or principal accounting officer and controller, we will disclose on our website or in a Form 8-K report filed with the SEC) the nature of the amendment or waiver, its effective date, and to whom it ap. plies. Our financial and operational performance is highly dependent on our U.S. and Canadian operations, which comprised 87% and 84% of net sales and operating income in 2019, respectively. Within the U.S., we are highly de- pendent on our California operations, which comprised 30% of U.S. net sales in 2019. Our California market, in general, has a larger percentage of higher volume warehouses as compared to our other domestic markets Any substantial slowing or sustained decline in these operations could ma- terially adversely affect our business and financial results. Declines in - nancial performance of our U.S. operations, particularly in California, and our Canadian operations could arise from, among other things: slow growth or declines in comparable warehouse sales (comparable sales), negative trends in operating expenses, including increased labor, healthcare and en- ergy costs; failing to meet targets for warehouse openings, cannibalizing existing locations with new warehouses, shifts in sales mix toward lower gross margin products, changes or uncertainties in economic conditions in our markets, including higher levels of unemployment and depressed home values, and failing to consistently provide high quality and innovative new products Ron M. Vachris Executive Vice President, Chief Operating Officer, Merchan- dising. Mr. 2016 54 Vachris was Senior Vice President, Real Es- tate Development, from August 2015 to June 2016, and Senior Vice President, Gen- eral Manager, Northwest Region, from 2010 to July 2015 We may be unsuccessful implementing our growth strategy, including expanding our business in existing markets and new markets, which could have an adverse impact on our business, financial condition and results of operations. Item 1A-Risk Factors The risks described below could materially and adversely affect our busi- ness, financial condition and results of operations. We could also be af- fected by additional risks that apply to all companies operating in the U.S. and globally, as well as other risks that are not presently known to us or that we currently consider to be immaterial. These Risk Factors should be carefully reviewed in conjunction with Management's Discussion and Anal ysis of Financial Condition and Results of Operations in Item 7 and our consolidated financial statements and related notes in Item 8 of this Report. Our growth is dependent, in part, on our ability to acquire property and build or lease new warehouses and depots. We compete with other retailers and businesses for suitable locations. Local land use and other regulations re- stricting the construction and operation of our warehouses and depots, as well as local community actions opposed to the location of our warehouses or depots at specific sites and the adoption of local laws restricting our op- erations and environmental regulations, may impact our ability to find suit- able locations and increase the cost of sites and of constructing, leasing and operating warehouses and depots. We also may have difficulty negoti- ating leases or purchase agreements on acceptable terms. In addition, cer- tain jurisdictions have enacted or proposed laws and regulations that would prevent or restrict the operation or expansion plans of certain large retailers and warehouse clubs, including us. Failure to effectively manage these and other similar factors may affect our ability to timely build or lease and oper- ate new warehouses and depots, which could have a material adverse ef- fect on our future growth and profitability Information about our Executive Officers The executive officers of Costco, their position, and ages are listed below. All executive officers have over 25 years of service with the Company Business and Operating Risks We are highly dependent on the financial performance of our U.S. and Canadian operations. Executive We seek to expand in existing markets to attain a greater overall market share. A new warehouse may draw members away from our existing ware- houses and adversely affect their comparable sales performance, member traffic, and profitability. cessing, packaging, manufacturing and other facilities to support our busi- ness, which includes the production of certain private-label items. Although We believe that our operations are efficient, disruptions due to fires, torna- does, hurricanes, earthquakes or other catastrophic events, labor issues or other shipping problems may result in delays in the production and delivery of merchandise to our warehouses, which could adversely affect sales and the satisfaction of our members. We are currently making and will continue to make investments to improve or advance critical information systems and processing capabilities. Failure to monitor and choose the right investments and implement them at the right pace could be harmful. The risk of system disruption is increased when significant system changes are undertaken, although we believe that our change management process should mitigate this risk. Excessive techno- logical change could impact the effectiveness of adoption, and could make it more We intend to continue to open warehouses in new markets, including China Associated risks include difficulties in attracting members due to a lack of familiarity with us, attracting members of other wholesale club operators, our lesser familiarity with local member preferences, and seasonal differ- ences in the market. Entry into new markets may bring us into competition with new competitors or with existing competitors with a large, established market presence. We cannot ensure that new warehouses and new e-com- merce websites will be profitable and, as a result, future profitability could be delayed or otherwise materially adversely affected. We may not timely identify or effectively respond to consumer trends, which could negatively affect our relationship with our members, the demand for our products and services, and our market share. It is difficult to consistently and successfully predict the products and ser- vices that our members will desire. Our success depends, in part, on our ability to identify and respond to trends in demographics and consumer preferences. Failure to identify timely or effectively respond to changing consumer tastes, preferences (including those relating to sustainability of product sources and animal welfare) and spending patterns could nega- tively affect our relationship with our members, the demand for our products and services, and our market share. If we are not successful at predicting our sales trends and adjusting our purchases accordingly, we may have excess inventory, which could result in additional markdowns and reduce our operating performance. This could have an adverse effect on net sales, gross margin and operating income. difficult for us to realize benefits. Targeting the wrong opportunities, failing to make the best investments, or making an investment commitment signif- icantly above or below our needs could result in the loss of our competitive position and adversely impact our financial condition and results of opera- tions. The potential problems and interruptions associated with implement- ing technology initiatives could disrupt or reduce the efficiency of our oper- ations. These initiatives might not provide the anticipated benefits or may provide them on a delayed schedule or at a higher cost. Our failure to maintain membership growth, loyalty and brand recog- nition could adversely affect our results of operations. Membership loyalty and growth are essential to our business. The extent to which we achieve growth in our membership base, increase the penetration of Executive members, and sustain high renewal rates materially influences our profitability. Damage to our brands or reputation may negatively impact comparable sales, diminish member trust, and reduce renewal rates and, accordingly, net sales and membership fee revenue, negatively impacting our results of operations. We previously identified a material weakness in our internal control related to ineffective information technology general controls and if we fail to maintain an effective system of internal control in the future, this could result in loss of investor confidence and adversely impact our stock price. We rely extensively on information technology to process transac- tions, compile results, and manage our business. Failure or disruption of our primary and back-up systems could adversely affect our busi- ness. A failure to adequately update our existing systems and imple- ment new systems could harm our business and adversely affect our results of operations. We sell many products under our Kirkland Signature brand. Maintaining consistent product quality, competitive pricing, and availability of these products is essential to developing and maintaining member loyalty. These products also generally carry higher margins than national brand products carried in our warehouses and represent a growing portion of our overall sales. If the Kirkland Signature brand experiences a loss of member ac- ceptance or confidence, our sales and gross margin results could be ad- versely affected. Given the very high volume of transactions we process it is important that we maintain uninterrupted operation of our business-critical systems. Our systems, including our back-up systems, are subject to damage or interrup- tion from power outages, computer and telecommunications failures, com- puter viruses, internal or external security breaches, catastrophic events such as fires, earthquakes, tornadoes and hurricanes, and errors or mis- feasance by our employees. If our systems are damaged or cease to func- tion properly, we may have to make significant investments to fix or replace them, and we may suffer interruptions in our operations. Any material inter- ruption in these systems could have a material adverse effect on our busi- ness and results of operations. Internal controls related to the operation of technology systems are critical to maintaining adequate internal control over financial reporting. We re- ported in our Annual Report on Form 10-K as of September 2, 2018, a ma- terial weakness in internal control related to ineffective information technol- ogy general controls (ITGCs) in the areas of user access and program change-management over certain information technology systems that support the Company's financial reporting processes. During 2019, we completed the remediation measures related to the material weakness and concluded that our internal control over financial reporting was effective as of September 1, 2019. Completion of remediation does not provide assur- ance that our remediation or other controls will continue to operate properly. If we are unable to maintain effective internal control over financial reporting or disclosure controls and procedures, our ability to record, process and report financial information accurately, and to prepare finan