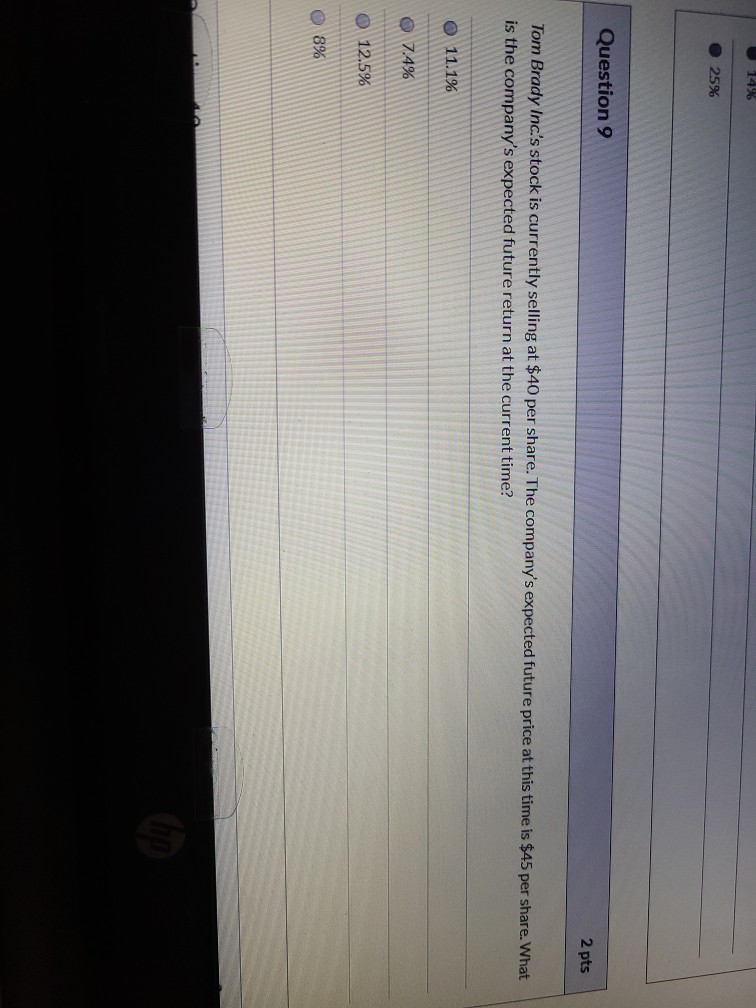

Question: 14% e 25% Question 9 2 pts Tom Brady Inc.'s stock is currently selling at $40 per share. The company's expected future price at this

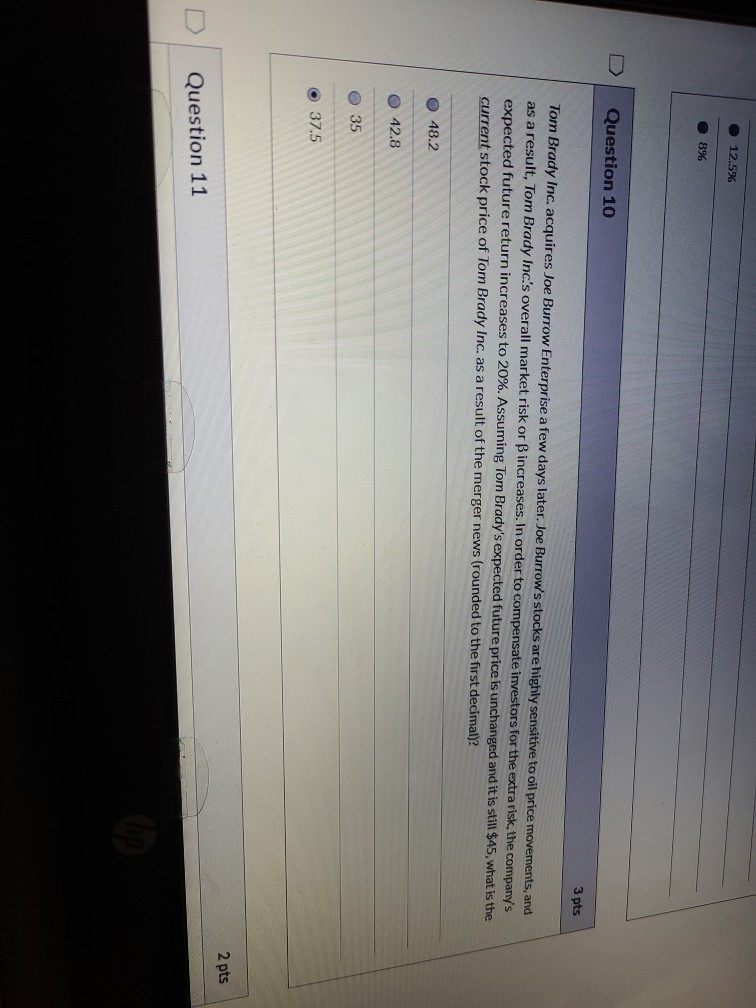

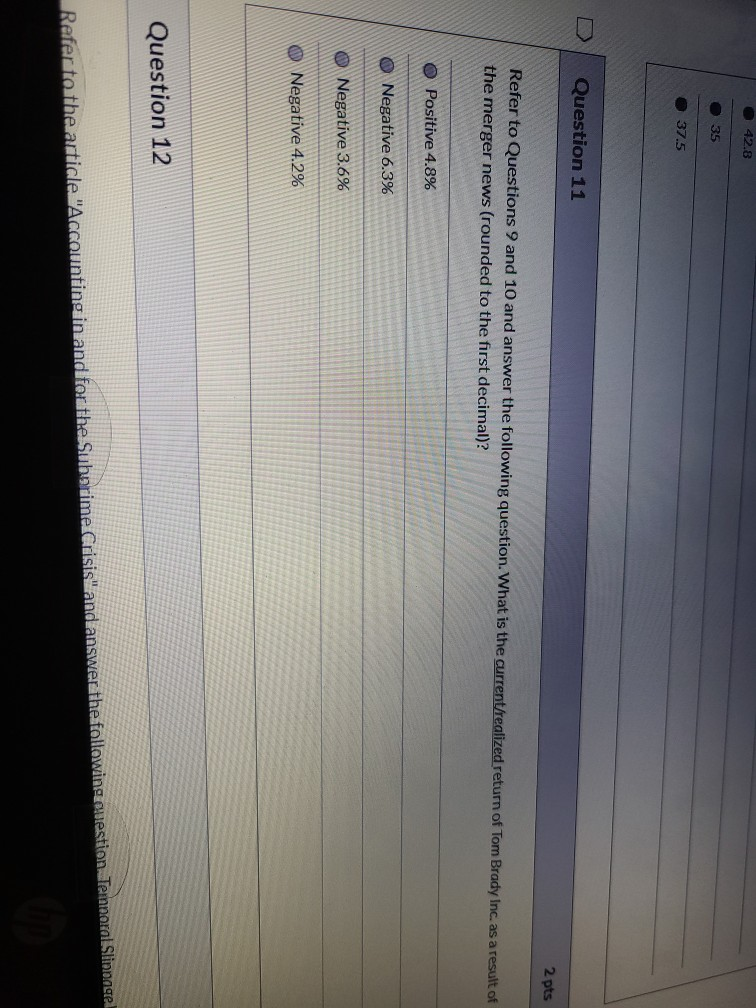

14% e 25% Question 9 2 pts Tom Brady Inc.'s stock is currently selling at $40 per share. The company's expected future price at this time is $45 per share. What is the company's expected future return at the current time? O 11.1% O 7.4% O 12.5% O 8% 12.5% 8% 3 pts Question 10 Tom Brady Inc. acquires Joe Burrow Enterprise a few days later.Joe Burrow's stocks are highly sensitive to oil price movements, and as a result, Tom Brady Inc's overall market risk or increases. In order to compensate investors for the extra risk, the company's expected future return increases to 20%. Assuming Tom Brady's expected future price is unchanged and it is still $45, what is the current stock price of Tom Brady Inc. as a result of the merger news (rounded to the first decimal)? 48.2 42.8 35 . 37.5 2 pts Question 11 42.8 35 37.5 Question 11 2 pts Refer to Questions 9 and 10 and answer the following question. What is the current/realized return of Tom Brady Inc. as a result of the merger news (rounded to the first decimal)? Positive 4.8% Negative 6.3% O Negative 3.6% Negative 4.2% Question 12 Refer to the article. "Accounting in and for the Subarime Crisis and answer the following question Temneral Slinge

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts