Question: 14) [the information in this question is the same as the last question] You have the following information for Boukouzis Industries: Debt: 15,000 bonds with

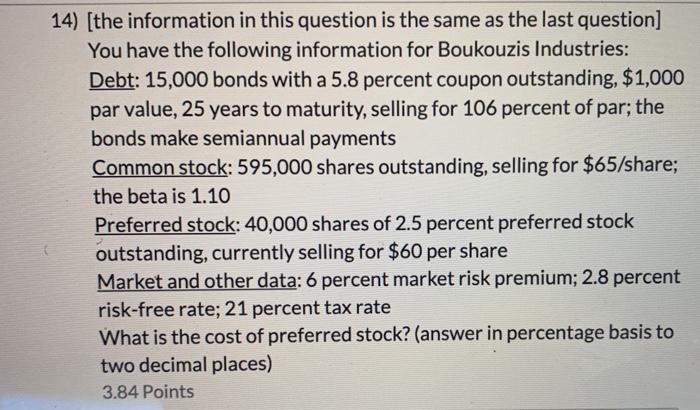

14) [the information in this question is the same as the last question] You have the following information for Boukouzis Industries: Debt: 15,000 bonds with a 5.8 percent coupon outstanding, $1,000 par value, 25 years to maturity, selling for 106 percent of par; the bonds make semiannual payments Common stock: 595,000 shares outstanding, selling for $65/share; the beta is 1.10 Preferred stock: 40,000 shares of 2.5 percent preferred stock outstanding, currently selling for $60 per share Market and other data: 6 percent market risk premium; 2.8 percent risk-free rate; 21 percent tax rate What is the cost of preferred stock? (answer in percentage basis to two decimal places) 3.84 Points

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts