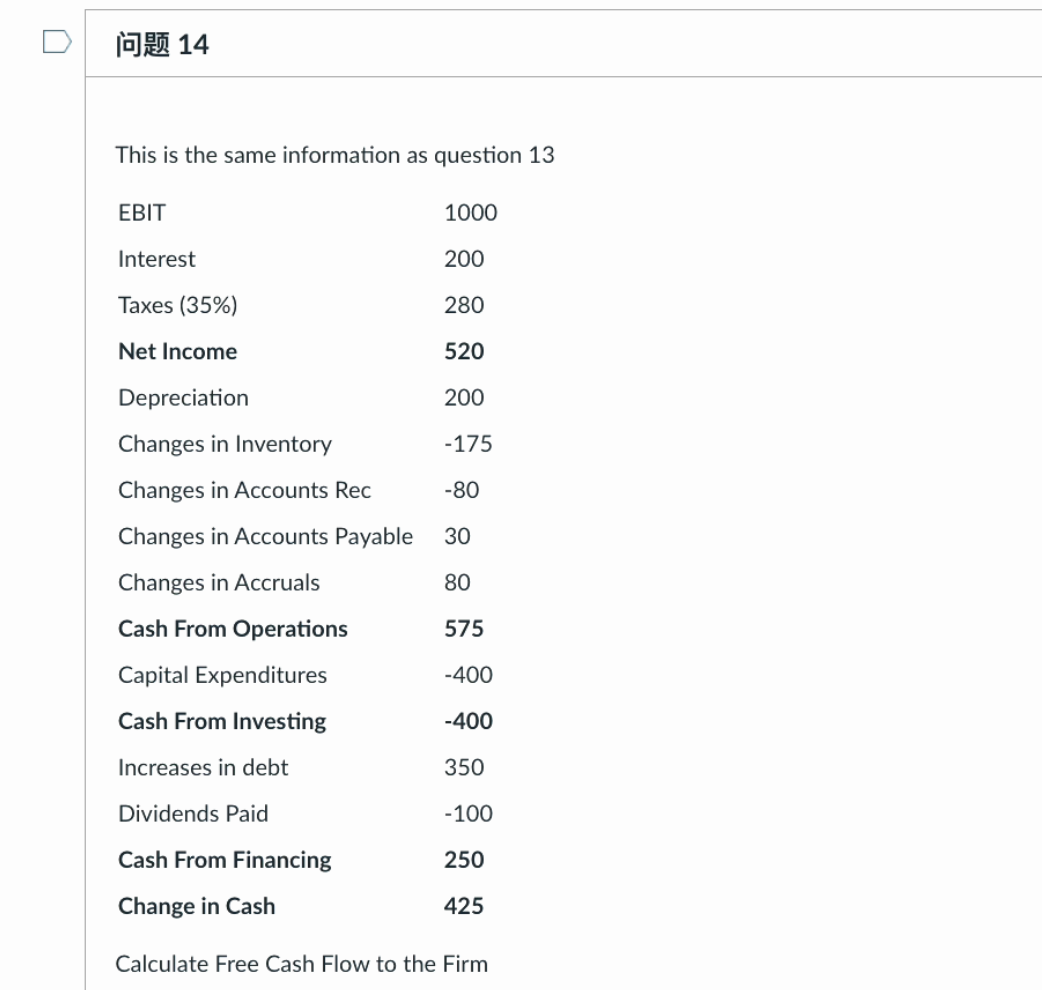

Question: 14 This is the same information as question 13 EBIT 1000 Interest 200 Taxes (35%) 280 Net Income 520 200 - 175 -80 30 Depreciation

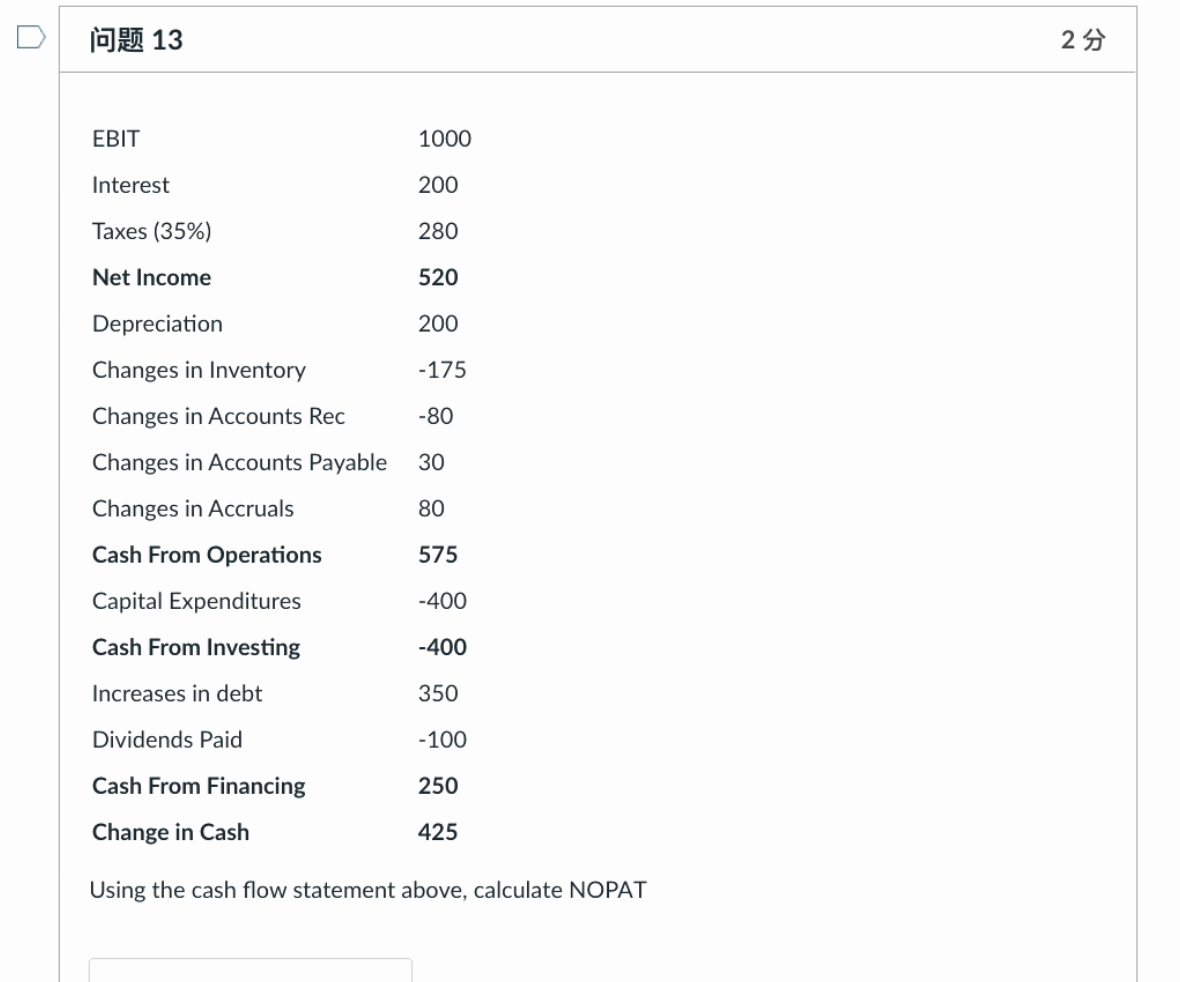

14 This is the same information as question 13 EBIT 1000 Interest 200 Taxes (35%) 280 Net Income 520 200 - 175 -80 30 Depreciation Changes in Inventory Changes in Accounts Rec Changes in Accounts Payable Changes in Accruals Cash From Operations Capital Expenditures Cash From Investing 80 575 -400 -400 Increases in debt 350 -100 Dividends Paid Cash From Financing Change in Cash 250 425 Calculate Free Cash Flow to the Firm 13 25 EBIT 1000 Interest 200 Taxes (35%) 280 Net Income 520 Depreciation 200 -175 -80 30 80 Changes in Inventory Changes in Accounts Rec Changes in Accounts Payable Changes in Accruals Cash From Operations Capital Expenditures Cash From Investing Increases in debt 575 -400 -400 350 Dividends Paid - 100 250 Cash From Financing Change in Cash 425 Using the cash flow statement above, calculate NOPAT 12 19 Which of these will likely make a company have better corporate governance? Elephants on the board of directors Large blockholders who own many shares CEO duality O Many retail investors

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts