Question: 14. Using Treasury Quotes Locate the Treasury bond in L Figure 6.4 maturing in February 2037. Is this a premium or a discount bond? What

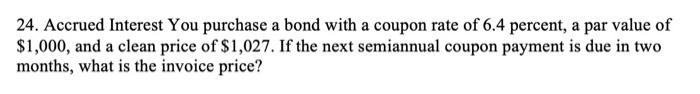

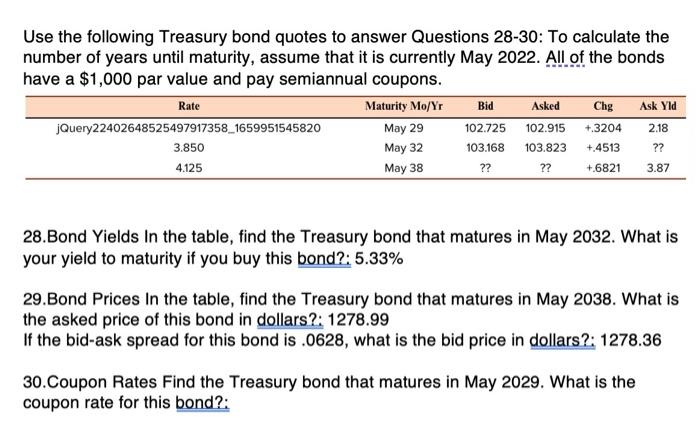

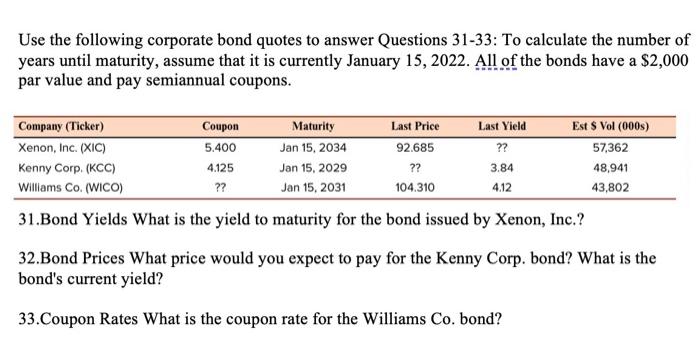

14. Using Treasury Quotes Locate the Treasury bond in L Figure 6.4 maturing in February 2037. Is this a premium or a discount bond? What is its current yield? What is its yield to maturity? What is the bid-ask spread for a $10,000 par value bond? U.S. Thessury Quotes 24. Accrued Interest You purchase a bond with a coupon rate of 6.4 percent, a par value of $1,000, and a clean price of $1,027. If the next semiannual coupon payment is due in two months, what is the invoice price? Use the following Treasury bond quotes to answer Questions 28-30: To calculate the number of years until maturity, assume that it is currently May 2022. All of the bonds have a $1,000 par value and pay semiannual coupons. 28.Bond Yields In the table, find the Treasury bond that matures in May 2032. What is your yield to maturity if you buy this bond?: 5.33% 29.Bond Prices In the table, find the Treasury bond that matures in May 2038. What is the asked price of this bond in dollars?: 1278.99 If the bid-ask spread for this bond is .0628 , what is the bid price in dollars?: 1278.36 30.Coupon Rates Find the Treasury bond that matures in May 2029. What is the coupon rate for this bond?: Use the following corporate bond quotes to answer Questions 31-33: To calculate the number of years until maturity, assume that it is currently January 15, 2022. All of the bonds have a $2,000 par value and pay semiannual coupons. 31.Bond Yields What is the yield to maturity for the bond issued by Xenon, Inc.? 32.Bond Prices What price would you expect to pay for the Kenny Corp. bond? What is the bond's current yield? 33.Coupon Rates What is the coupon rate for the Williams Co. bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts