Question: (14) Very Briefly, Explain how, in the right circumstances a trader might be able to do a Cash-and-Carry arbitrage in the real world crude oil

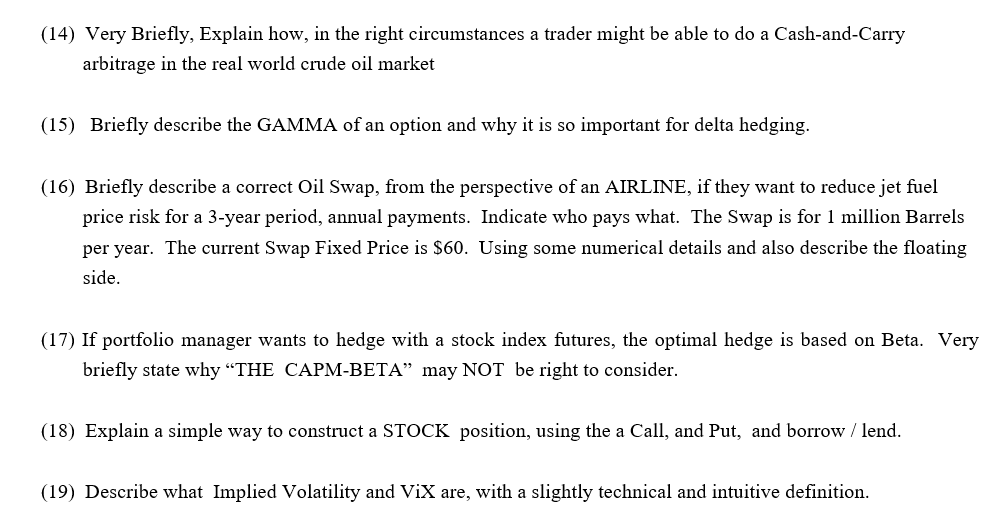

(14) Very Briefly, Explain how, in the right circumstances a trader might be able to do a Cash-and-Carry arbitrage in the real world crude oil market (15) Briefly describe the GAMMA of an option and why it is so important for delta hedging. (16) Briefly describe a correct Oil Swap, from the perspective of an AIRLINE, if they want to reduce jet fuel price risk for a 3-year period, annual payments. Indicate who pays what. The Swap is for 1 million Barrels per year. The current Swap Fixed Price is $60. Using some numerical details and also describe the floating side. (17) If portfolio manager wants to hedge with a stock index futures, the optimal hedge is based on Beta. Very briefly state why THE CAPM-BETA may NOT be right to consider. (18) Explain a simple way to construct a STOCK position, using the a Call, and Put, and borrow / lend. (19) Describe what Implied Volatility and ViX are, with a slightly technical and intuitive definition

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts