Question: 145 Reporting Changes in Shareholders' Equity The shareholders' equity accounts for Erle Enterprises Inc. at the beginning of the year were as follows: Preferred shares

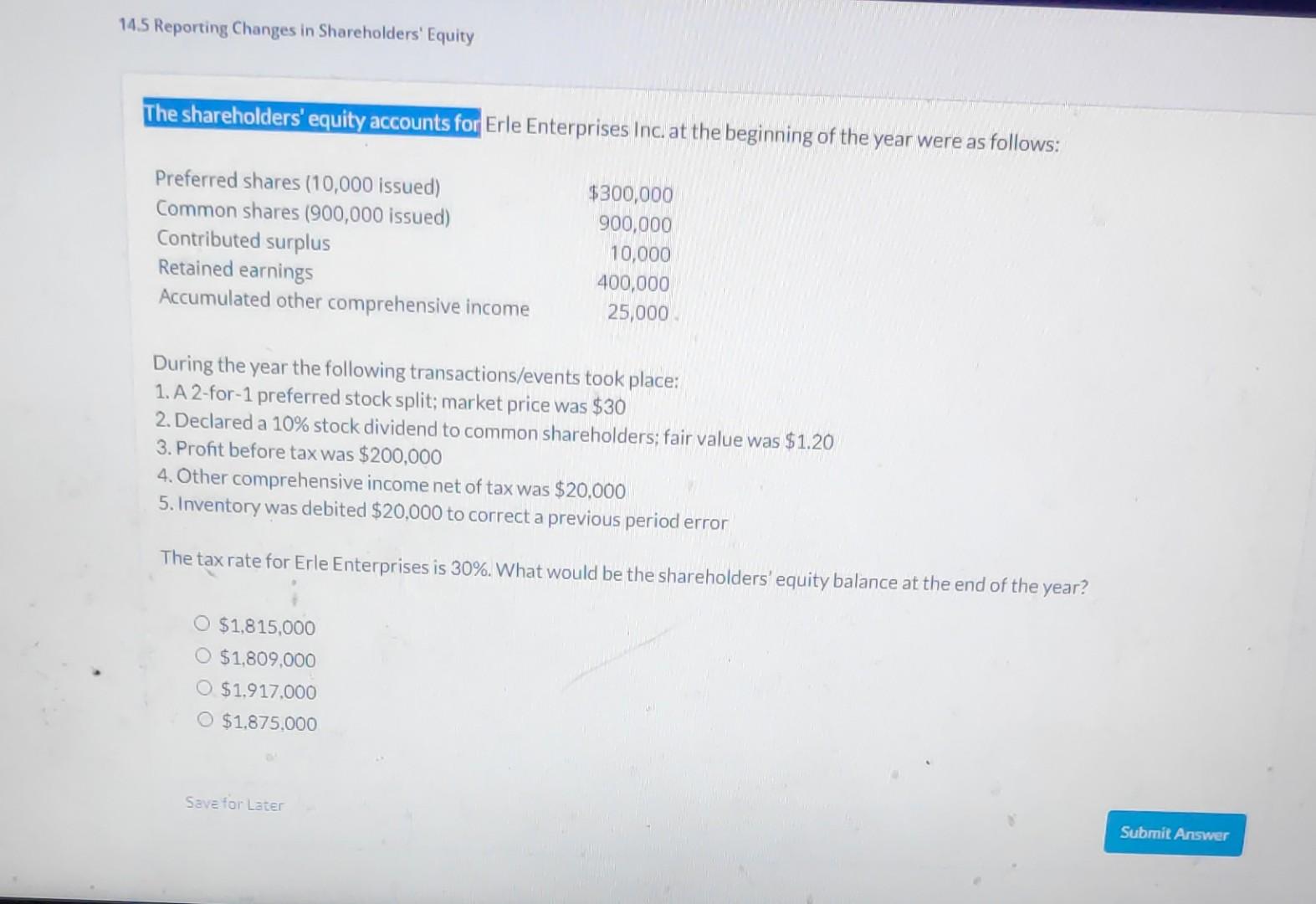

145 Reporting Changes in Shareholders' Equity The shareholders' equity accounts for Erle Enterprises Inc. at the beginning of the year were as follows: Preferred shares (10,000 issued) Common shares (900,000 issued) Contributed surplus Retained earnings Accumulated other comprehensive income $300,000 900,000 10,000 400,000 25,000 During the year the following transactions/events took place: 1. A 2-for-1 preferred stock split; market price was $30 2. Declared a 10% stock dividend to common shareholders; fair value was $1.20 3. Profit before tax was $200,000 4. Other comprehensive income net of tax was $20,000 5. Inventory was debited $20,000 to correct a previous period error The tax rate for Erle Enterprises is 30%. What would be the shareholders' equity balance at the end of the year? $1,815,000 O $1,809,000 O $1.917.000 O $1.875.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts