Question: 14(((((Please, I want a very fast solution. I need a solution in less than half an hour. Help me LOCU. HOME 2 3 4 5

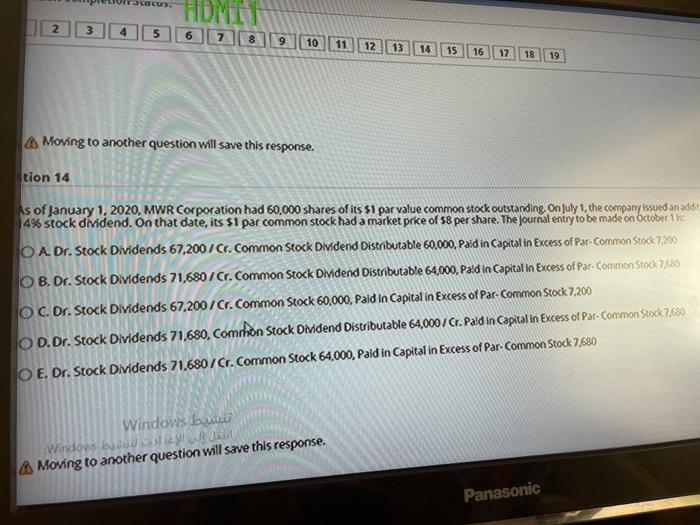

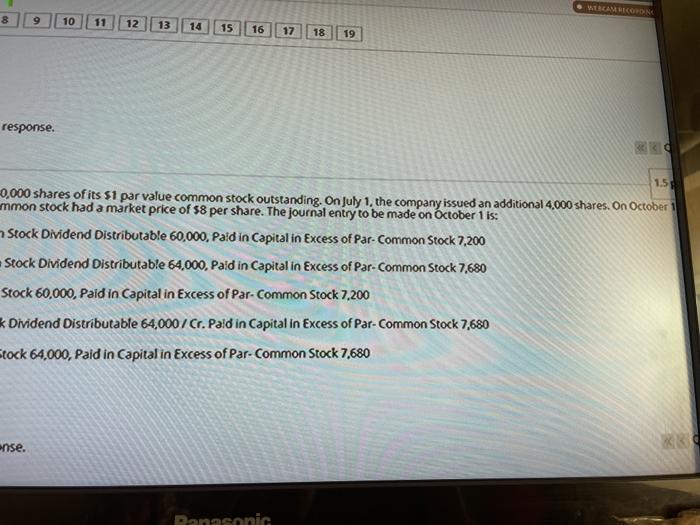

LOCU. HOME 2 3 4 5 6 7 8 9 10 12 13 14 15 16 17 18 19 A Moving to another question will save this response. tion 14 As of January 1, 2020, MWR Corporation had 60,000 shares of its 51 par value common stock outstanding, on July 1, the company issued an addit 4% stock dividend. On that date, its $1 par common stock had a market price of 58 per share. The Journal entry to be made on October 1s. O A. Dr. Stock Dividends 67,2007 Cr. Common Stock Dividend Distributable 60,000, Pald in Capital in excess of Par. Common Stock 7,200 B. Dr. Stock Dividends 71,680 / Cr. Common Stock Dividend Distributable 64,000, Pald in Capital in excess of Par-Common Stock 7680 OC. Dr. Stock Dividends 67,200 / Cr. Common Stock 60,000, Pald in Capital in excess of Par. Common Stock 7,200 O D.Dr. Stock Dividends 71,680, Comrbon Stock Dividend Distributable 64,000/ Cr. Paid in Capital in Excess of Par-Common Stock 7,680) O E. Dr. Stock Dividends 71,680 / Cr. Common Stock 64,000, Paid in Capital in Excess of Par-Common Stock 7,680 Windows Windows A Moving to another question will save this response. Panasonic WEBCAMSIOON 8 9 10 11 12 13 14 15 16 17 18 19 response. 1.58 -0,000 shares of its 51 par value common stock outstanding. On July 1, the company issued an additional 4,000 shares. On October 1 mmon stock had a market price of 58 per share. The journal entry to be made on october 1 is: Stock Dividend Distributable 60,000, Pald in Capital in Excess of Par. Common Stock 7,200 Stock Dividend Distributable 64,000, Paid in Capital in excess of Par-Common Stock 7,680 Stock 60,000, Paid in Capital in excess of Par-Common Stock 7,200 k Dividend Distributable 64,000 / Cr. Pald in Capital in excess of Par-Common Stock 7,680 Stock 64,000, Paid in Capital in Excess of Par-Common Stock 7.680 ense. Panasonic LOCU. HOME 2 3 4 5 6 7 8 9 10 12 13 14 15 16 17 18 19 A Moving to another question will save this response. tion 14 As of January 1, 2020, MWR Corporation had 60,000 shares of its 51 par value common stock outstanding, on July 1, the company issued an addit 4% stock dividend. On that date, its $1 par common stock had a market price of 58 per share. The Journal entry to be made on October 1s. O A. Dr. Stock Dividends 67,2007 Cr. Common Stock Dividend Distributable 60,000, Pald in Capital in excess of Par. Common Stock 7,200 B. Dr. Stock Dividends 71,680 / Cr. Common Stock Dividend Distributable 64,000, Pald in Capital in excess of Par-Common Stock 7680 OC. Dr. Stock Dividends 67,200 / Cr. Common Stock 60,000, Pald in Capital in excess of Par. Common Stock 7,200 O D.Dr. Stock Dividends 71,680, Comrbon Stock Dividend Distributable 64,000/ Cr. Paid in Capital in Excess of Par-Common Stock 7,680) O E. Dr. Stock Dividends 71,680 / Cr. Common Stock 64,000, Paid in Capital in Excess of Par-Common Stock 7,680 Windows Windows A Moving to another question will save this response. Panasonic WEBCAMSIOON 8 9 10 11 12 13 14 15 16 17 18 19 response. 1.58 -0,000 shares of its 51 par value common stock outstanding. On July 1, the company issued an additional 4,000 shares. On October 1 mmon stock had a market price of 58 per share. The journal entry to be made on october 1 is: Stock Dividend Distributable 60,000, Pald in Capital in Excess of Par. Common Stock 7,200 Stock Dividend Distributable 64,000, Paid in Capital in excess of Par-Common Stock 7,680 Stock 60,000, Paid in Capital in excess of Par-Common Stock 7,200 k Dividend Distributable 64,000 / Cr. Pald in Capital in excess of Par-Common Stock 7,680 Stock 64,000, Paid in Capital in Excess of Par-Common Stock 7.680 ense. Panasonic

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts