Question: 15. (3 points) Consider the multifactor APT model with two factors. Portfolio A has a beta of.5 on factor one and a beta of 1.25

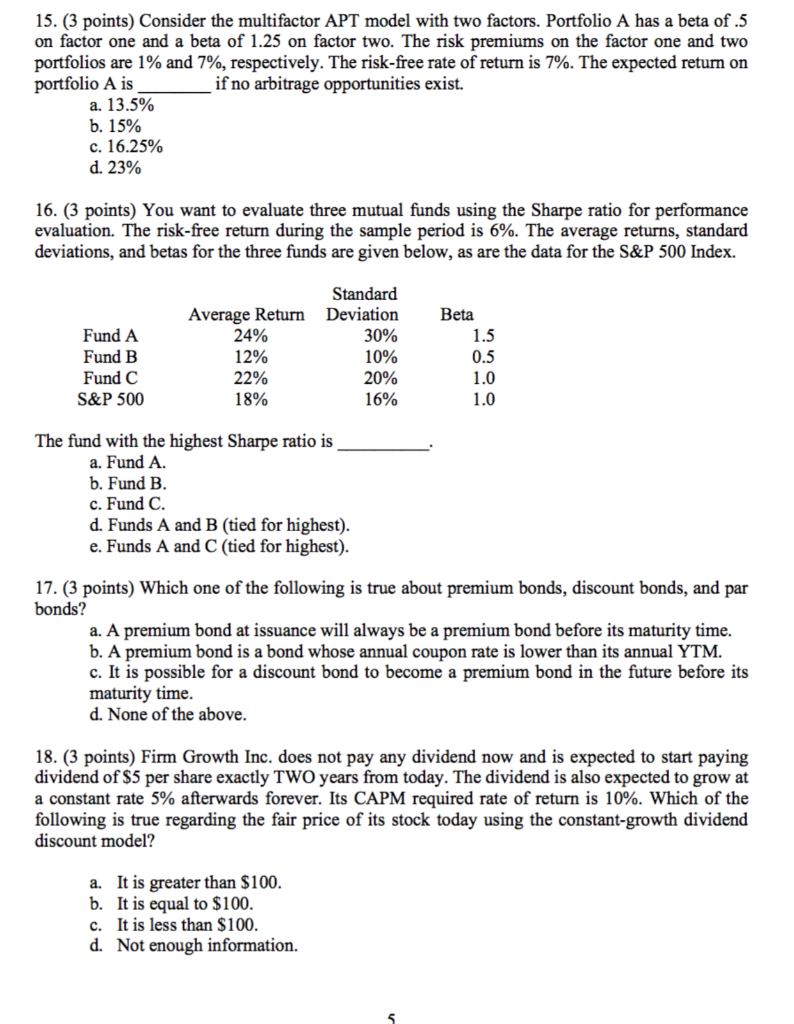

15. (3 points) Consider the multifactor APT model with two factors. Portfolio A has a beta of.5 on factor one and a beta of 1.25 on factor two. The risk premiums on the factor one and two portfolios are 1% and 7%, respectively. The risk-free rate of return is 7%. The expected return on portfolio A is if no arbitrage opportunities exist. a. 13.5% b. 15% c. 16.25% d. 23% 16. (3 points) You want to evaluate three mutual funds using the Sharpe ratio for performance evaluation. The risk-free return during the sample period is 6%. The average returns, standard deviations, and betas for the three funds are given below, as are the data for the S&P 500 Index. Standard Deviation 30% Beta 1.5 Average Return 24% 12% 22% 18% Fund A Fund B Fund C S&P 500 10% 20% 16% The fund with the highest Sharpe ratio is__ a. Fund A. b. Fund B. c. Fund C. d. Funds A and B (tied for highest). e. Funds A and C (tied for highest). 17. (3 points) Which one of the following is true about premium bonds, discount bonds, and par bonds? a. A premium bond at issuance will always be a premium bond before its maturity time. b. A premium bond is a bond whose annual coupon rate is lower than its annual YTM. c. It is possible for a discount bond to become a premium bond in the future before its maturity time. d. None of the above. 18. (3 points) Firm Growth Inc. does not pay any dividend now and is expected to start paying dividend of $5 per share exactly TWO years from today. The dividend is also expected to grow at a constant rate 5% afterwards forever. Its CAPM required rate of return is 10%. Which of the following is true regarding the fair price of its stock today using the constant-growth dividend discount model? a. It is greater than $100. b. It is equal to $100. c. It is less than $100. d. Not enough information

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts