Question: Consider the multifactor model APT with three factors. Portfolio A has a beta of 0.8 on factor 1, a beta of 1.1 on factor 2,

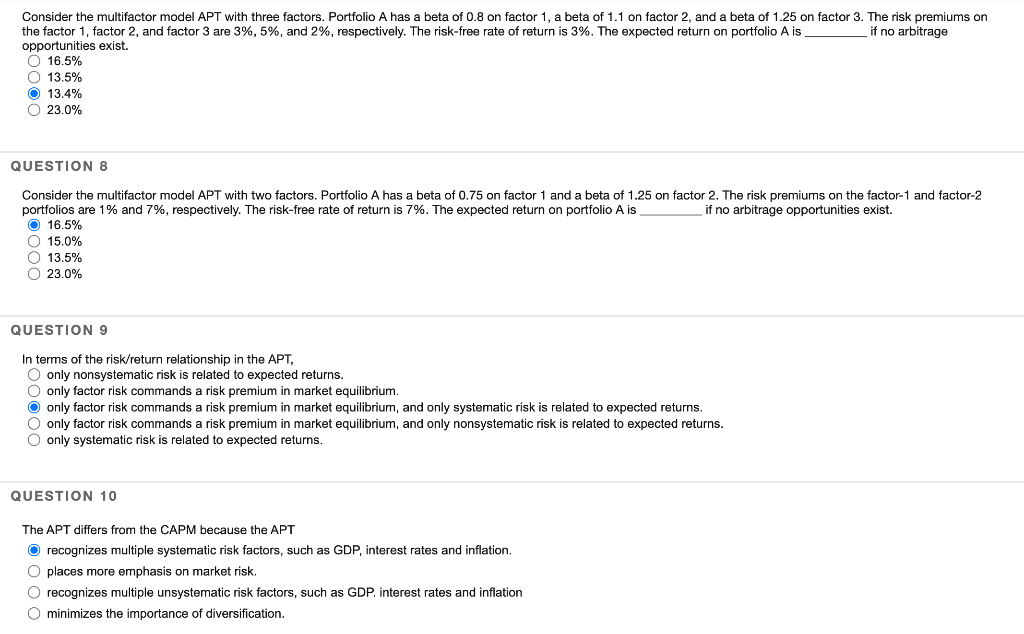

Consider the multifactor model APT with three factors. Portfolio A has a beta of 0.8 on factor 1, a beta of 1.1 on factor 2, and a beta of 1.25 on factor 3. The risk premiums on the factor 1, factor 2, and factor 3 are 3%, 5%, and 2%, respectively. The risk-free rate of return is 3%. The expected return on portfolio A is if no arbitrage opportunities exist. O 16.5% O 13.5% O 13.4% O 23.0% QUESTION 8 Consider the multifactor model APT with two factors. Portfolio A has a beta of 0.75 on factor 1 and a beta of 1.25 on factor 2. The risk premiums on the factor-1 and factor-2 portfolios are 1% and 7%, respectively. The risk-free rate of return is 7%. The expected return on portfolio A is if no arbitrage opportunities exist. 16.5% O 15.0% O 13.5% O 23.0% QUESTION 9 In terms of the risk/return relationship in the APT, O only nonsystematic risk is related to expected returns. O only factor risk commands a risk premium in market equilibrium. only factor risk commands a risk premium in market equilibrium, and only systematic risk is related to expected returns. O only factor risk commands a risk premium in market equilibrium, and only nonsystematic risk is related to expected returns. O only systematic risk is related to expected returns. QUESTION 10 The APT differs from the CAPM because the APT recognizes multiple systematic risk factors, such as GDP, interest rates and inflation. O places more emphasis on market risk. O recognizes multiple unsystematic risk factors, such as GDP. interest rates and inflation O minimizes the importance of diversification

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts