Question: 15. (5pts) Bootstrap Given instruments in below table Instrument 6m (182 day) T-Bill 2y Treasury 3y Treasury 5y Treasury 7y Treasury 10y Treasury Semi-annual Market

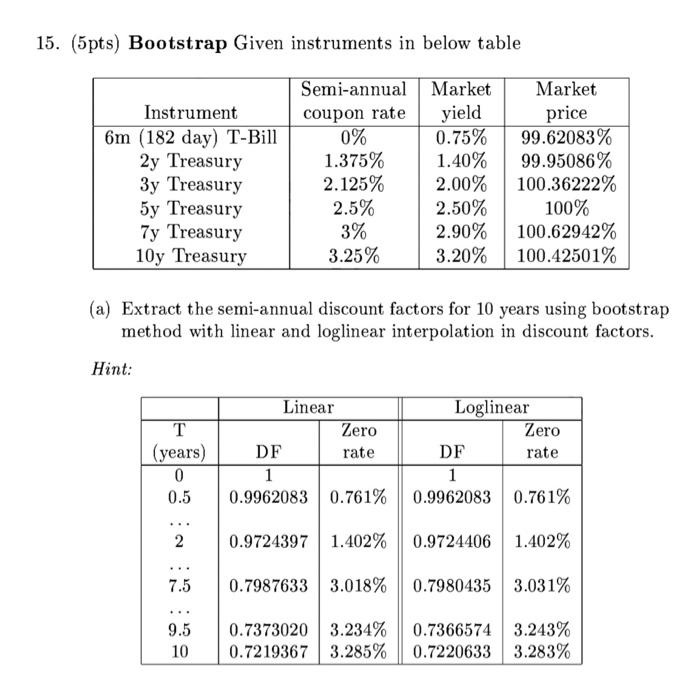

15. (5pts) Bootstrap Given instruments in below table Instrument 6m (182 day) T-Bill 2y Treasury 3y Treasury 5y Treasury 7y Treasury 10y Treasury Semi-annual Market coupon rate yield 0% 0.75% 1.375% 1.40% 2.125% 2.00% 2.5% 2.50% 3% 2.90% 3.25% 3.20% Market price 99.62083% 99.95086% 100.36222% 100% 100.62942% 100.42501% (a) Extract the semi-annual discount factors for 10 years using bootstrap method with linear and loglinear interpolation in discount factors. Hint: (years) 0 0.5 Linear Zero DF rate 1 0.9962083 0.761% Loglinear Zero DF rate 1 0.9962083 0.761% 2 0.9724397 1.402% 0.9724406 1.402% 7.5 0.7987633 3.018% 0.7980435 3.031% 9.5 10 0.7373020 3.234% 0.7219367 3.285% 0.7366574 3.243% 0.7220633 3.283% 15. (5pts) Bootstrap Given instruments in below table Instrument 6m (182 day) T-Bill 2y Treasury 3y Treasury 5y Treasury 7y Treasury 10y Treasury Semi-annual Market coupon rate yield 0% 0.75% 1.375% 1.40% 2.125% 2.00% 2.5% 2.50% 3% 2.90% 3.25% 3.20% Market price 99.62083% 99.95086% 100.36222% 100% 100.62942% 100.42501% (a) Extract the semi-annual discount factors for 10 years using bootstrap method with linear and loglinear interpolation in discount factors. Hint: (years) 0 0.5 Linear Zero DF rate 1 0.9962083 0.761% Loglinear Zero DF rate 1 0.9962083 0.761% 2 0.9724397 1.402% 0.9724406 1.402% 7.5 0.7987633 3.018% 0.7980435 3.031% 9.5 10 0.7373020 3.234% 0.7219367 3.285% 0.7366574 3.243% 0.7220633 3.283%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts