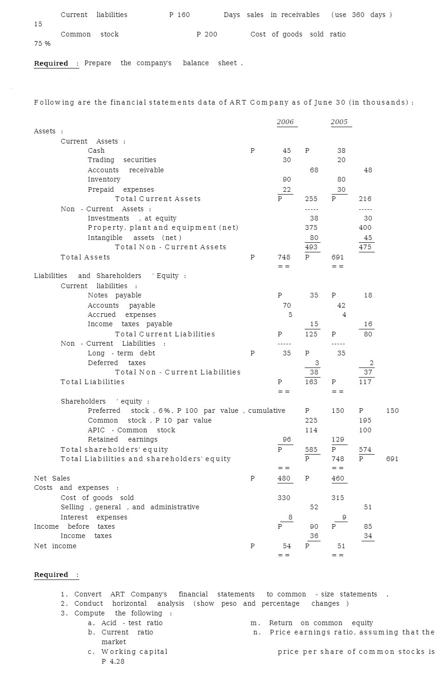

Question: 15 75 % Current liabilities Common stock Assets Required! Prepare the company's balance sheet. Current Assets Cash Trading securities Accounts receivable Inventory Prepaid expenses

15 75 % Current liabilities Common stock Assets Required! Prepare the company's balance sheet. Current Assets Cash Trading securities Accounts receivable Inventory Prepaid expenses Following are the financial statements date of ART Company as of June 30 (in thousands): Non Current Assets Total Assets Total Current Assets P 100 Investments at equity Property, plant and equipment (net) Intangible assets (net) Liabilities and Shareholders Equity Current liabilities Notes payable. Accounts payable Accrued expenses Income taxes payable Non Current Liabilities Long term debt Deferred taxes Total Non Current Assets P 200 Total Liabilities Net income Total Current Liabilities Shareholders equity Net Sales Costs and expenses Days sales in receivables (use 360 days) Cost of goods sold ratio Total Non Current Liabilities APIC- Common stock Retained earnings Total shareholders' equity Total Liabilities and shareholders' equity Income before taxes Income taxes Cost of goods sold Selling general and administrative Interest expenses P P P 2006 P 45 30 745 P Preferred stock 6%, P 100 par value cumulative Common stock. P 10 par value 70 P 35 P J 480 330 P 68 255 38 375 80 493 P 35: 15 125 P 38 163 P 225 114 585 P DO 2005 38 20 691 == P 80 30 P 42 35 P 129 P 748 400 315 48 D 216 ***** 30 400 45 475 10 150 P 16 37 117 195 100 574 P 51 85 150 601 Required 1. Convert ART Company's financial statements to common size statements. 2. Conduct horizontal analysis (show peso and percentage changes) 3. Compute the following a. Acid test ratio b. Current ratio market c. Working capital P 4.28 m. Return on common equity n. Price earnings ratio, assuming that the price per share of common stocks is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts