Question: #15 and 16, please show work! CHAPTER 3 Working with Financial Statem Working with Financial Statements LO.3 ng the following ratios are constant, what is

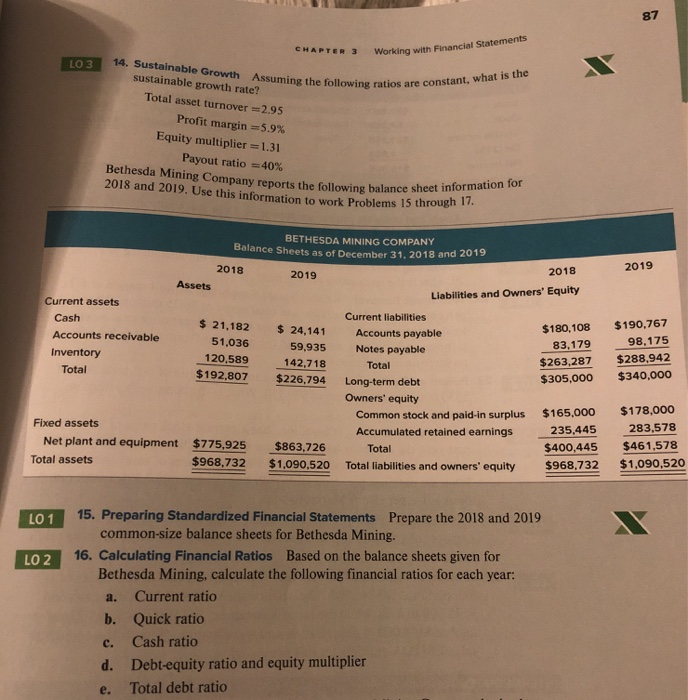

CHAPTER 3 Working with Financial Statem Working with Financial Statements LO.3 ng the following ratios are constant, what is the 14. Sustainable Growth Assuming the following ra sustainable growth rate? Total asset turnover =2.95 Profit margin=5.9% Equity multiplier =1.31 Payout ratio = 40% Bethesda Mining Company reports the following balance sheet 2018 and 2019. Use this information to work Problems 15 ving balance sheet information for BETHESDA MINING COMPANY Balance Sheets as of December 31, 2018 and 2019 2018 2019 2019 Assets Current assets Cash Accounts receivable Inventory Total $ 21,182 51,036 120.589 $ 192,807 $ 24,141 59,935 142,718 $226,794 2018 Liabilities and Owners' Equity Current liabilities Accounts payable $180,108 Notes payable 83,179 Total $263,287 Long-term debt $305,000 Owners' equity Common stock and paid-in surplus $165,000 Accumulated retained earnings 235,445 Total $400,445 Total liabilities and owners' equity $968.732 $190,767 98,175 $288.942 $340,000 Fixed assets Net plant and equipment Total assets $775,925 $968,732 $178,000 283,578 $461,578 $1,090,520 $863,726 $1.090.520 101 LO 2 15. Preparing Standardized Financial Statements Prepare the 2018 and 2019 common-size balance sheets for Bethesda Mining. 16. Calculating Financial Ratios Based on the balance sheets given for Bethesda Mining, calculate the following financial ratios for each year: a. Current ratio b. Quick ratio c. Cash ratio d. Debt-equity ratio and equity multiplier e. Total debt ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts