Question: -15 E View Policies Current Attempt in Progress The Crane Partnership reported profit of $60,200 for the year ended February 28, 2021. Salary allowances are

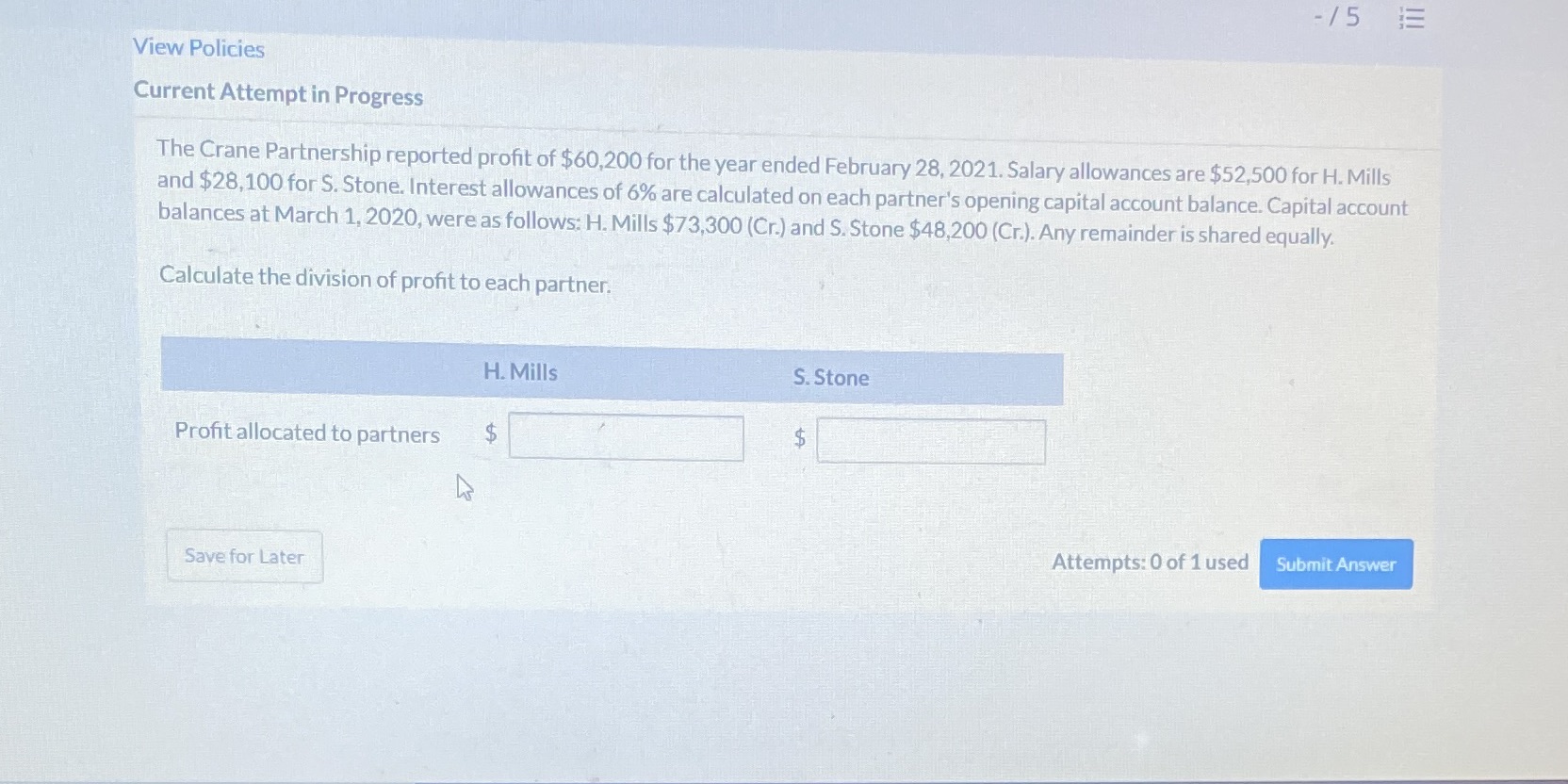

-15 E View Policies Current Attempt in Progress The Crane Partnership reported profit of $60,200 for the year ended February 28, 2021. Salary allowances are $52,500 for H. Mills and $28,100 for S. Stone. Interest allowances of 6% are calculated on each partner's opening capital account balance. Capital account balances at March 1, 2020, were as follows: H. Mills $73,300 (Cr.) and S. Stone $48,200 (Cr.). Any remainder is shared equally. Calculate the division of profit to each partner. H. Mills S. Stone Profit allocated to partners $ LA Attempts: 0 of 1 used Submit Answer Save for Later

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts