Question: 15. For Suppose a commercial developer is considering purchasing a group of small office buildings in an established business district. The developer can use multiple

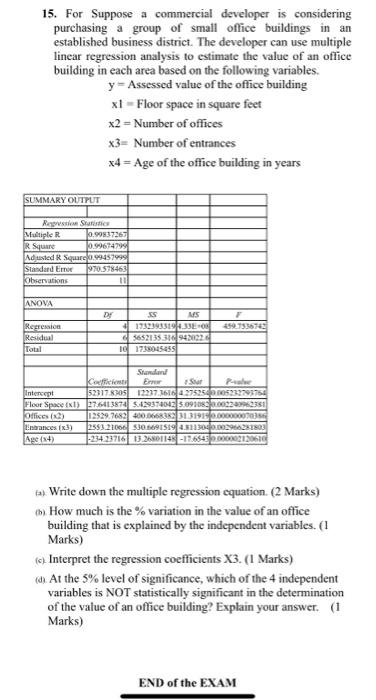

15. For Suppose a commercial developer is considering purchasing a group of small office buildings in an established business district. The developer can use multiple linear regression analysis to estimate the value of an office building in each area based on the following variables. y - Assessed value of the office building xl - Floor space in square feet x2 = Number of offices x3= Number of entrances x4 = Age of the office building in years SUMMARY OUTPUT Repti Statistics Multiple R 0.99837267 R Square 10.9967479 Adusted R Square.99457999 Standard Emer 1970.578464 Observations 11 ANOVA D MS 459.73357 Repression Residual Total 41732393319 4:33E09 3652135 310 4032 10 1711045455 Standard Em Keefest Intercept 52317.8205 121716104252627229175 Floor Space Ext) 27.6413874 5:429370043 3:09108-0032363351 Offices (2) 12529.7682430.066633313190.000 Entrances (x3) 2583.21000 $30.9194.5183093103 Age (x4) 23423716 13.26801145 -19.6545200002130616 tax Write down the multiple regression equation. (2 Marks) (h) How much is the variation in the value of an office building that is explained by the independent variables. (1 Marks) (c) Interpret the regression coefficients X3. (1 Marks) a. At the 5% level of significance, which of the 4 independent variables is NOT statistically significant in the determination of the value of an office building? Explain your answer. (1 Marks) END of the EXAM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts