Question: 15) Jefferson & Sons is evaluating a project that will increase annual sales by $145,000 and annual cash ed costs by $94,000. The project will

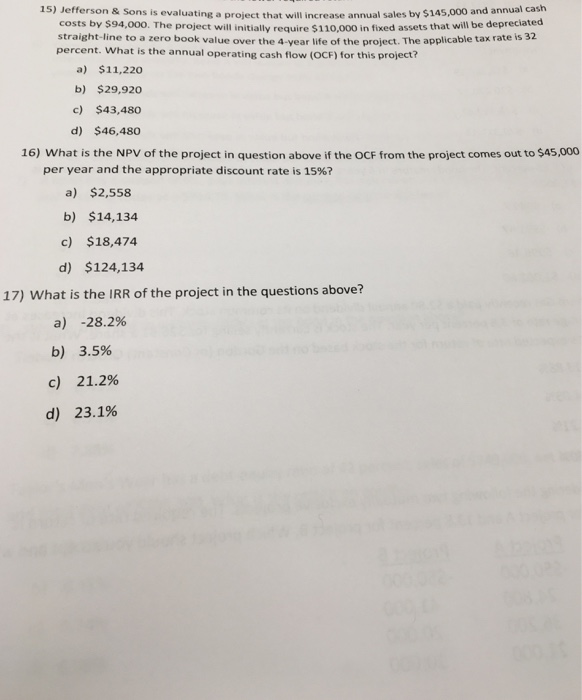

15) Jefferson & Sons is evaluating a project that will increase annual sales by $145,000 and annual cash ed costs by $94,000. The project will initially require $110,000 in fixed assets that will be depreciat straight-line to a zero book value over the 4-year life of the project. The applicable tax rate is percent. What is the annual operating cash flow (OCF) for this project? 32 a) $11,220 b) $29,920 c) $43,480 d) $46,480 16) What is the NPV of the project in question above if the OCF from the project comes out to $45,000 per year and the appropriate discount rate is 15%? a) $2,558 b) $14,134 c) $18,474 d) $124,134 17) What is the IRR of the project in the questions above? a) -28.2% b) 3.5% c) 21.2% d) 23.1%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts