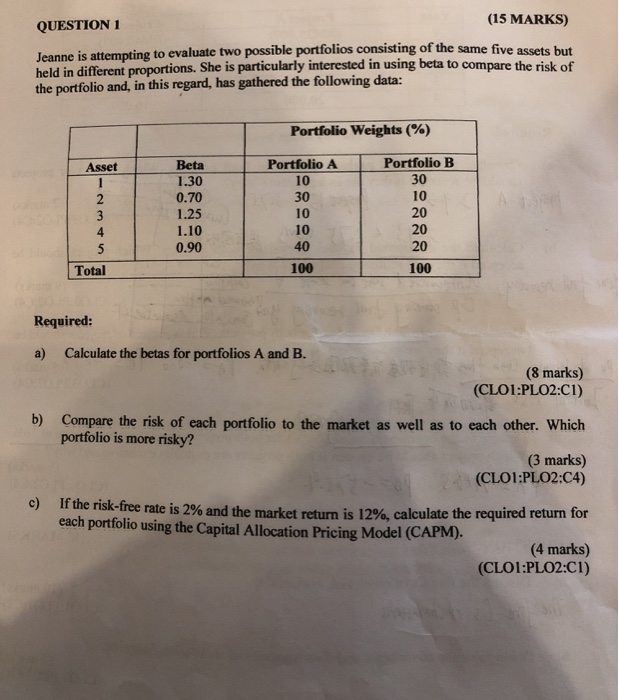

Question: (15 MARKS) QUESTION Jeanne is attempting to evaluate two possible portfolios consisting of the same five assets but held in different proportions. She is particularly

(15 MARKS) QUESTION Jeanne is attempting to evaluate two possible portfolios consisting of the same five assets but held in different proportions. She is particularly interested in using beta to compare the risk of the portfolio and, in this regard, has gathered the following data: Portfolio Weights (%) Portfolio B Portfolio A Beta Asset 1.30 30 10 10 0.70 30 1.25 1.10 0.90 20 10 3 20 10 40 20 5 100 100 Total Required: Calculate the betas for portfolios A and B. a) (8 marks) (CLO1:PLO2:C1) b) Compare the risk of each portfolio to the market as well as to each other. Which portfolio is more risky? (3 marks) (CLO1:PLO2:C4) c) If the risk-free rate is 2% and the market return is 12%, calculate the required return for each portfolio using the Capital Allocation Pricing Model (CAPM). (4 marks) (CLO1:PLO2:C1)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts