Question: (15 points) Consider the following general 1-step binomial model: A non-dividend paying stock has current price So. In one year's time there are two possible

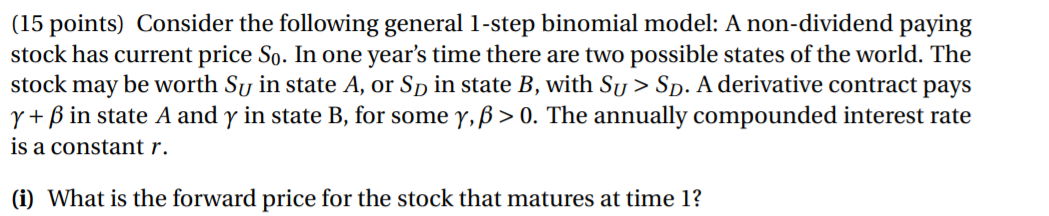

(15 points) Consider the following general 1-step binomial model: A non-dividend paying stock has current price So. In one year's time there are two possible states of the world. The stock may be worth Sy in state A, or Sp in state B, with Su > Sp. A derivative contract pays y + in state A and y in state B, for some y, > 0. The annually compounded interest rate is a constant r. (i) What is the forward price for the stock that matures at time l

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts