Question: 6. (15 points) Consider the following general 1-step binomial model: A non-dividend paying stock has current price So. In one year's time there are

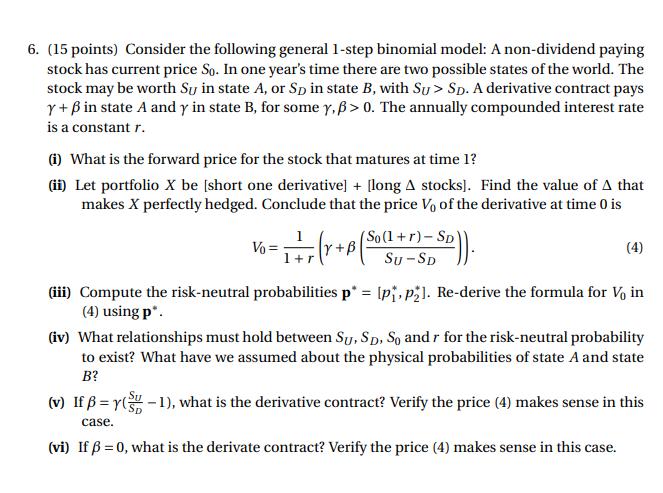

6. (15 points) Consider the following general 1-step binomial model: A non-dividend paying stock has current price So. In one year's time there are two possible states of the world. The stock may be worth Sy in state A, or Sp in state B, with Su> Sp. A derivative contract pays y + in state A and y in state B, for some y, > 0. The annually compounded interest rate is a constant r. (i) What is the forward price for the stock that matures at time 1? (ii) Let portfolio X be [short one derivative] + [long A stocks]. Find the value of A that makes X perfectly hedged. Conclude that the price Vo of the derivative at time 0 is -SD)). Vo= 1 1 7 / ( x + 1 (So(1+r)-SD) SU-SD (4) (iii) Compute the risk-neutral probabilities p* = [p, p1. Re-derive the formula for V in (4) using p*. (iv) What relationships must hold between Su, Sp, So and r for the risk-neutral probability to exist? What have we assumed about the physical probabilities of state A and state B? (v) If = y(S-1), what is the derivative contract? Verify the price (4) makes sense in this case. (vi) If = 0, what is the derivate contract? Verify the price (4) makes sense in this case.

Step by Step Solution

3.40 Rating (147 Votes )

There are 3 Steps involved in it

i Forward price for the stick that matures at time 1 ... View full answer

Get step-by-step solutions from verified subject matter experts