Question: (15 points) You are asked to do an asset allocation using one risk-free asset and one risky asset. The expected return for the risky asset

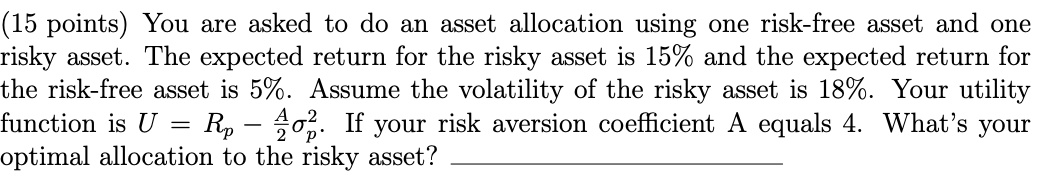

(15 points) You are asked to do an asset allocation using one risk-free asset and one risky asset. The expected return for the risky asset is \15 and the expected return for the risk-free asset is \5. Assume the volatility of the risky asset is \18. Your utility function is \\( U=R_{p}-\\frac{A}{2} \\sigma_{p}^{2} \\). If your risk aversion coefficient A equals 4. What's your optimal allocation to the risky asset

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock