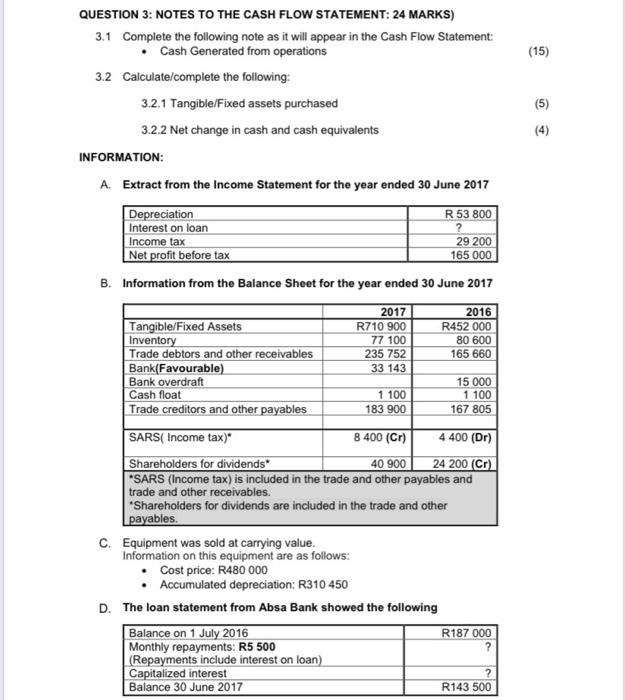

Question: (15) QUESTION 3: NOTES TO THE CASH FLOW STATEMENT: 24 MARKS) 3.1 Complete the following note as it will appear in the Cash Flow Statement:

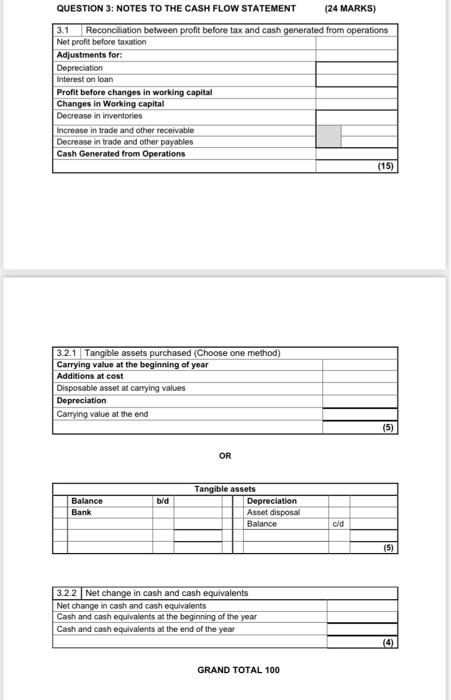

(15) QUESTION 3: NOTES TO THE CASH FLOW STATEMENT: 24 MARKS) 3.1 Complete the following note as it will appear in the Cash Flow Statement: Cash Generated from operations 3.2 Calculate/complete the following: 3.2.1 Tangible/Fixed assets purchased 3.2.2 Net change in cash and cash equivalents INFORMATION: A. Extract from the Income Statement for the year ended 30 June 2017 (5) (4) Depreciation R 53 800 Interest on loan ? Income tax 29 200 Net profit before tax 165 000 B. Information from the Balance Sheet for the year ended 30 June 2017 2017 2016 Tangible/Fixed Assets R710 900 R452 000 Inventory 77 100 80 600 Trade debtors and other receivables 235 752 165 660 Bank(Favourable) 33 143 Bank overdraft 15 000 Cash float 1 100 1 100 Trade creditors and other payables 183 900 167 805 SARS( Income tax)" 8 400 (CT) 4 400 (Dr) Shareholders for dividends* 40 900 24 200 (Cr) "SARS (Income tax) is included in the trade and other payables and trade and other receivables. "Shareholders for dividends are included in the trade and other payables. C. Equipment was sold at carrying value. Information on this equipment are as follows: Cost price: R480 000 Accumulated depreciation: R310 450 D. The loan statement from Absa Bank showed the following Balance on 1 July 2016 R187 000 Monthly repayments: R5 500 (Repayments include interest on loan) Capitalized interest Balance 30 June 2017 R143 500 ? QUESTION 3: NOTES TO THE CASH FLOW STATEMENT (24 MARKS) 3.1 Reconciliation between profit before tax and cash generated from operations Net profit before taxation Adjustments for: Depreciation Interest on loan Profit before changes in working capital Changes in Working capital Decrease in inventories Increase in trade and other receivable Decrease in trade and other payables Cash Generated from Operations (15) 3.2.1 Tangible assets purchased (Choose one method) Carrying value at the beginning of year Additions at cost Disposable asset at carrying values Depreciation Carrying value at the end (5) OR bid Balance Bank Tangible assets Depreciation Asset disposal Balance cld (5) 3.2.2 Net change in cash and cash equivalents Net change in cash and cash equivalents Cash and cash equivalents at the beginning of the year Cash and cash equivalents at the end of the year (4) GRAND TOTAL 100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts