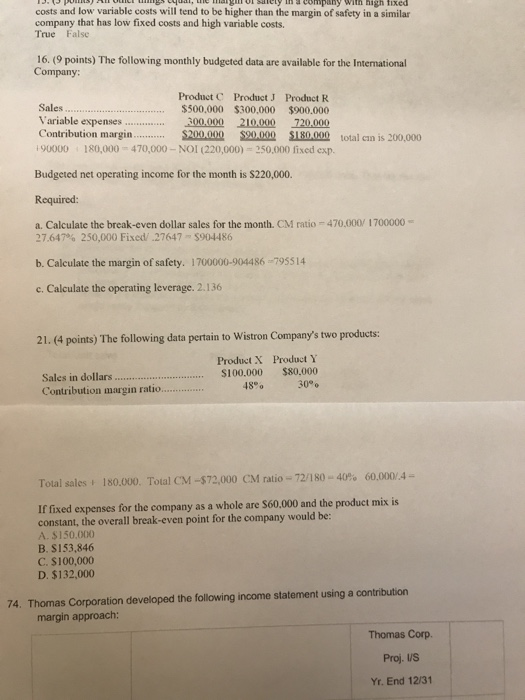

Question: 16 & 21 ng a ,the igm o sa lety in company with high fixed costs and low variable costs will tend to be higher

ng a ,the igm o sa lety in company with high fixed costs and low variable costs will tend to be higher than the margin of safety in a similar company that has low fixed costs and high variable costs. True False 16. (9 points) The following monthly budgeted data are available for the Intermational Company: Product C Product J Product R $500,000 $300,000 $900.000 Sales Variable expenses0,000 210,000 720,000 Contribution margin 90000 180,000 470,000 NOI (220,000) 250,000 fixed exp. $200,000 $90,000 S180,000 total cin is 200,000 Budgeted net operating income for the month is $220,000 Required: a. Calculate the break-even dollar sales for the month. CM ratio-470,000 1700000 27.647% 250,000 Fixed/ ,27647-5904486 b. Calculate the margin of safety. 1700000-904486 795514 c. Calculate the operating leverage. 2.136 21. (4 points) The following data pertain to Wistron Company's two products: Product X Product Y Sales in dollar$100.000 $80,000 Contribution margin ratio 48% 30 Total sales l 180.000. Tual CM-$72,000 CM ratio-72/180-40% 60.000.4- If fixed expenses for the company as a whole are $60.000 and the product mix is constant, the overall break-even point for the company would be: A. $150,000 B. S153,846 C. $100,000 D. $132,000 74. Thomas Corporation developed the following income statement using a contribution margin approach: Thomas Corp Proj US Yr. End 12/31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts