Question: 16 and 17 u=5 Normal XA Caption 2.A. E No Spacing . ADD Dictate e Replace Select Editing nt Voice Paragraph Styles 14. Compute the

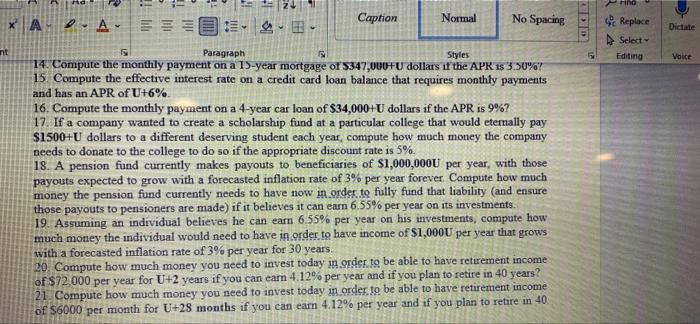

Normal XA Caption 2.A. E No Spacing . ADD Dictate e Replace Select Editing nt Voice Paragraph Styles 14. Compute the monthly payment on a 15-year mortgage of 5347,000FU dollars at the APR 15 3.50%! 15. Compute the effective interest rate on a credit card loan balance that requires monthly payments and has an APR of U+6% 16. Compute the monthly payment on a 4-year car loan of $34,000+U dollars if the APR is 9%? 17. If a company wanted to create a scholarship fund at a particular college that would eternally pay $1500+U dollars to a different deserving student each year, compute how much money the company needs to donate to the college to do so if the appropriate discount rate is 5%. 18. A pension fund currently makes payouts to beneficiaries of $1,000,000U per year, with those payouts expected to grow with a forecasted inflation rate of 3% per year forever. Compute how much money the pension fund currently needs to have now in order to fully fund that liability and ensure those payouts to pensioners are made) if it believes it can earn 6.55% per year on its investments 19. Assuming an individual believes he can earn 6.55% per year on his investments, compute how much money the individual would need to have in order to have income of $1,000U per year that grows with a forecasted inflation rate of 3% per year for 30 years. 20. Compute how much money you need to invest today in order to be able to have retirement income of $72.000 per year for U+2 years if you can earn 4.12% per year and if you plan to retire in 40 years? 21 Compute how much money you need to invest today in order to be able to have retirement income of $6000 per month for U+28 months if you can earn 4.12% per year and if you plan to retire in 40

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts