Question: from this whole case study I need to know these information: 1. Industry Analysis (one to two pages) Identify the industry within which the company

from this whole case study I need to know these information:

1.

Industry Analysis (one to two pages)

Identify the industry within which the company competes.

Describe the overall size of the industry, its state of maturity and growth pattern.

Describe the external environment in which the company competes (nationally or internationally as applicable)

2.

Target Market Profile (one to two pages)

Define the value proposition.

Describe size, segment, trends and customer profiles of the target market.

Describe key attributes that drive customers' buying decisions.

Describe potential product or service substitutes.

3. Competition (one to two pages)

Identify primary and secondary competitors within the target market.

Describe competitors' strengths and weaknesses compared to the company.

4. Marketing Strategy and Sales Plan (one to two pages)

Describe the marketing plan and distribution channels.

Describe the sales efforts including how to attract and retain customers.

Outline the pricing strategy and any sales incentives or promotions used.

5. Research, Development and Technology (up to one page)

Describe plans for research and development efforts.

Explain how the business will improve or develop products and what resources will be needed.

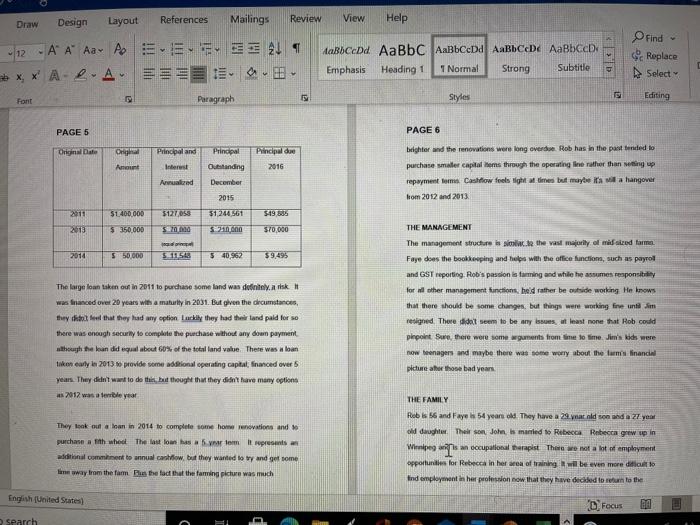

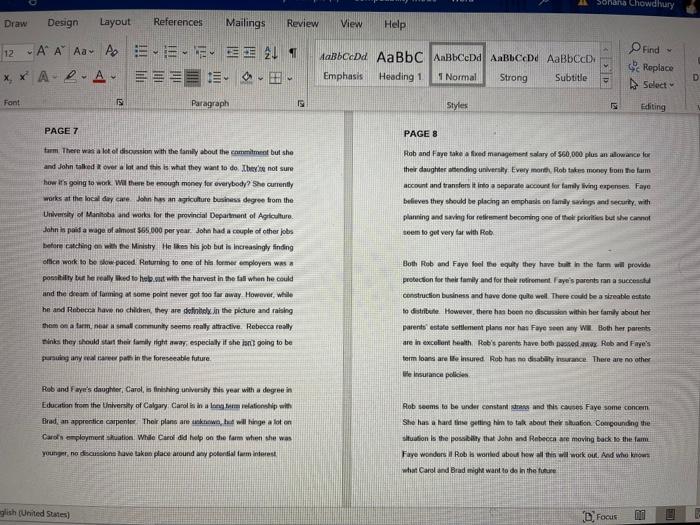

Business Plan - Case Farm Rob and Faye Sample (1) - Compatibility Mode - Word Sohana Chowdhury Review View Help 60 Insert Draw Design Layout References Mailings 12 A A A A 21 XX A AaBbced AaBbc ABCD ABCD ABCD Emphasis Heading 1 Normal Strong Subtitle Find Replace Select Editing Dictate Paragraph Font Styles Voice PAGE 2 ROB and FAYE SAMPLE SAMPLE FARMS LTD. A CASE STUDY en capacity Theeling tady is now my over capacity to what was originally designed PAGE 1 In the winner of 201516 Rolandayo have some decision to make. They had been managing 2012 and 2013 when they had a couple of aly. och pon 2007 was especially bough with poor yields. Things Improved may in 2014 and 2015 There was though. They least a longum, hard working employee just before harvest They were able to get through the harvest but without their entployee, I was tough There were long hats and the sves were ligle Rob and Faye race that they need to take som action as they don't want to find themselves in the situation again BACKGROUND Rob and Fayehurve ben faming in Manitoba for 3 years. They purchased e land in 1981 from Rot's other paying 200.000 for it. A few years they puchaned an adjoining hall section for 2000 The Restland purchase was paid off in 1990 end the second purchase was paid off in the year 2000 They purchased the plus some outbuildings, In 2017 for. A cher and long term lindont had wwwted to sell and they really think they had any option but to make the purchase. They had dideda grein handling system about how. The old, smaller ganades Roboterhad used were usoal en modern Beth Rob and Faxe feel they 4.200 collated res the farm is ugh We have what we want says Rob We work hard and don't seem to have a lot of time away from the seven though we have some excelente They were uning a lulle employee and some season assistance during the summer and full It was always struggle to find good employees or sometimes even to find an employee at Years ago, when Reband Faye believed they just needed help during seeding and harvest, they would try to find help those poroda. Che they found inquilid, reliable and fed poople Faye len said they sembramient, not y caring about anything but the paycheck. We had one guy who would ma wote where goes paycheck It was told trying to end and keep people. They decided to find and Ropa talline employee (Jim) with some seasonal assistance as a way to manage theme of getting the help they needed when they needed. The concept came with a co was a challenge to keep people busy dating the winter worked only well until Jim who was a long time employer by left it before a yew The namely sure why he let was lucky that it was an openaland that John the secondo tack to that Year N English (United States D FOCUS 10 e search 2 AA AA EEEE 21 ** A-2AEE. OB AaB CcDd AaBb C AaBbceDd AaBbceDd AaBbccD. Emphasis Heading 1 1 Normal Strong Subtitle Find Replace Select Editing ant Paragraph 5 Styles PAGE 3 PAGE 4 Recently, wth family imminently set to come back to the form Rob and Faye have been wondering some investing in some other business might be the last way to go Rob and Faye farm together in a corporate structure. They each own 50% of the common shares The land they bought from their father and the next parcel is in both their personal names hold outside the company There is no rental arrangement with the corporation for island. The most recent land acquisition was purchased by the company and is held ride the corporation. They : sure what was the best way structure the purchase but after a lot of dscussion they opted to have the company own the land Rob says that their lenders do not appear to be very but do seem to be asking for more and more information Granted. I was won a couple of years ago but now, even after a couple of pretty go year, there a requirement for more and more reporting and information THE FARM BUSINESS Managing a success form these days is much like a fugging act with the daily demands of the business and the seasonal production urgences can get to be biletul They have been looking at the costs in their business and ways in which they could redeem For example, the costs associated with the custom work they require. It is fait.siandicant It seems every year that the Timing of getting the sudom work done what it should be and that sometimes it allocs quility and yield They run one combine and one seeding unit. Both are med into o capacity. Rob's equipment could stand to be upgraded somewhat is a bit older and the capacity would have to be greater if they were to useless custom work I why they started with the custom work in the first place. The capital investment would mean more debt but would climate a lot of the custom work of the hard work and low profit from time to time, Rob and Faye deel that Farming has given them a good We Right now, Rob and Faye should be beginning to enjoy more of the benefits associated with farming The farm should be comfortably paying b way They have accurated intover $1,700 000 in owner's equity or about $3,500,000 ofequity net worth) when the shareholder loans are excluded and market value of the assets, including personally held land is factores They have three temas, an eperating low and some accounts payabile. The operating has not evolved in the last two or three years. The table below sumes the existing to loans Focus LO glish (United States arch Design Layout Draw References Mailings Review View Help 12 - A Aa. Po E. EL 1 *x, X AP.A. EEEE .. . Emphasis Heading 1 Normal Strong Subtitle Find Replace Select Font Paragraph Styles Editing PAGE 5 PAGE 6 Originale Principal and Org Amount Principal Outstanding December Principale 2016 Interest brighter and the renovations were long overde Rob has in the pattended to purchase aer capitalems through the operating line rather than tingu repayment forms Cashflow feels light time but maybe it's a hangover kom 2012 and 2013 Analized 2011 2013 $19.95 $1.400.000 $ 350.000 2015 $1,244.561 Sin 0 $127.055 S2000 $70,000 2014 550.000 5115 5 40.962 $9.495 The large loan taken out in 2011 to purchase some land was definitely a risk was financed over 20 years with a maturity in 2031. But given the circumstances, they feel that they had any option Luckily they had their and paid for so there was enough security to complete the purchase without any down payment though the loan did equal about 60% of the total land value. There was a loan taken carly in 2013. provide some additional operating capital financed over years. They didn't want to do the thought that they didn't have many options 2012 was able year THE MANAGEMENT The management structures.to the vast majority of med farme Faye does the bookkeeping and help with the office functions, such as payroll and GST reporting Rob's passion is tamming and while he assumes responsible for lother management functions, held rather be outside working He knows that there should be some changes, but things were working fine unlim resigned. There dida't seem to be any issues at least one that Rob could pinpoint Sure there were somewguments from time to time. Jim's kids were now teenagers and maybe there was some worry about the larms financial picture for those bad years THE FAMILY Rob is 56 and Faye h 54 years old. They have a 29 yar old son anda 27 year old daughter Their son John, smiled Rebecca Rebecca grew Tin They look out alan in 2014 to complete some home renovations and to purchase a th who The low as a representa additional ment to annual controw, but they wanted low and get some lanet wway from the farm Bus the fact that the farming picture was much Winnipeg 1 an occupational Sorapist Theata we not a lot of employment opportunities for Rebecca in her sea of training will be even more do to Ind employment in her profession now that they have decided to return to the English (United States) Focus Search Sonana Chowdhury Draw Design Layout References Mailings Review View Help 12 - A A A A 2 211 XX A2-A EEEE E- AaBbced AaBb C AnBbced AaBbced AaBbcc Emphasis Heading 1 1 Normal Strong Subtitle Find Replace Select D Font Paragraph Styles Editing PAGE 7 PAGE 8 Rob and Faye take a fred management salary of $60,000 plus an allowance for ther daughter ending university Every month, Rob takes money from the farm account and transfers into a separate account for family living expenses Faye believes they should be placing an emphasis on family wings and security, with planning and saving for retirement becoming one of the peoties but she canet seem to get very far with Rob tarm There was a lot of hom with the family about the commitment but she and John talked over a lot and this is what they want to do they not sure how it's going to work will there be ough money for everybody? She currently works at the local daycare John has an agriculture business degree from the University of Manitoba and works for the provincial Department of Agriculture John is paid a wage of almost $65.000 per year. John had a couple of other jobs before catching with the Ministry He his job but is increasingly finding office work to be slow paced Returning to one of his former employers was polity but he really liked to helbut with the harvest in the fall when he could and the dream of farming at some point never got too far away. However, while he and Rebes have no children, they are definitely in the picture and raising them on a farmacounty seme really attractive. Rebecca really hinks they should their family right way, especially if she and going to be pursuing any law path in the foreseeable future. Both Rob and Faye folegut they have built in the farm will provide protection for the family and for the retirement Faye's parents on a success Construction business and have done quite well. There could be a sizeable estate to distributie. However, there has been to discussion within her family about her parents to settlement plans nor has Faye seen any W Both her parents are in excellent health Rob's parents have both de Rob and Faye's term loans are insured Rob has no disability insurance. There are no other le sulance policies Rob and Faye's daughter, Carol, is finishing university this year with a degree in Education from the University of Calgary Carolis in a relationship Brad an apprentice carpenter Their plans are two but will bringe a lot on Carolcmploymeet Suation Wide Carol didep on the farm when she was youngno doudona have taken place around any potential for interest Rob seems to be under constant dans and this case Faye some concem She has a hard time getting him to talk about their station Corgounding the situation is the possibly the John and Rebecca e moving back to the farm Faye Wonders Rob is worried about how this will work ou. And who knows wat Caroland Brad might want to do in the are glish (United States) D. Focus > Emphasis Heading 1 Normal Strong Subte S Paragraph KI Styles PAGE 9 THE FUTURE As mentioned, they were able to get through the harvest without too much difficulty but feel that they need to take some action as they don't want to find themselves in a situation like that again. But what to do? How do they avoid hiring someone that will leave within a year or two? Now that Rebecca and John have committed to returning to the farm, how is this all going to work out? Font Alignment KI Clipboard X P5 E A 1 Sample Farms Ltd. Income Statement 2012 2013 2014 2015 2016 $1056,547 $860,058 $1456.785 $1307,341 13547832 $1265882 358458 $670053 $2.004033 SUSIS 5 INCOME Crop Sales Inventory Change $GROSS REVENUE 10 11 PRODUCTION EXPENSES 12 Fertilizer Chemieal 14 Seed/grain purchases Crop Insurance 16 Total $281.717 $147,110 1226,839 $19.511 $241624 $150,966 $179.022 $56,370 15877382 $278.728 $154,134 $204.872 30 $638,734 1223.288 $114958 $240.896 $240.577 $164,351 $38.217 1684141 177544 3639.96 $31313 $1256,49 166375 367,355 142.136 16 GROSS MARGIN 19 20 OPERATING EXPENSES Custom Vork Fuel and oil Vages (direct) Repairs & Maintenance - Machinery Total Operating Expenses CONTRIBUTION MARGIN $76,637 354,447 358,670 $85932 127691 $17,990 $44,441 $61212 $33530 $15701 182,229 372.40 $73,374 149235 $276 878 194,101 $65.821 $97,864 $69,225 191503 $264,150 1904 $379,471 1845364 ADMINISTRATION and OVERHEAD EXPENSES 30 Utilities $13,273 31 Rent $64,659 92 Repairs & Maintenance - Building $26,333 39 Insurance $34,731 34. Interest & Bank eharges $16.677 Interest on Long Term Debt $91216 03 Office $34,020 37 Professional Fees $10.468 38 Property Taxes $23.521 39. Salaries & Benefits $67 212 40 Amortization 99,037 41 Total Overhead & Administration Expe $481,147 42 NET OPERATING PROFIT ($1063341 $11,431 $56.969 $20.286 $33,195 $19.887 $82,664 $24,577 $7,134 $26.284 373.299 $91976 3453,702 $14,953 $61201 $11473 $39.532 $28.932 $87,054 $25,530 $7,475 $22,743 $72.167 $107.625 $488.685 $12,143 $60,304 128.179 $30,876 $22,554 396,254 131860 $3,050 $11,687 $74,276 $106.818 $485,999 $15,898 $71,652 $11,230 $30,646 $22,638 $102.084 $21029 38,740 $14.998 $73,259 $79,652 $451.826 16 $493,472 45 OTHER REVENUE (EXPENSE) 46 Programs (Government) 47 Rebates 19 Custom work 19. Gain /(Loss) on capital assets 50 Total Other 55 52 NET INCOME 1231382 $17.667 $10.326 $13,389 $18.888 316,384 13.255 826513 $290,477 $25.226 10903 1316220 $291058 $17,194 103857 30 $32,09 $117,295 $22.437 $17,083 10 $156,815 $17530 3013391 35543 Balance Sheet Income Statement Clipboard Fort Alignment Number PS X fi E F 2015 2016 $860,058 $1,144,035 $1,456,785 $394,331 $2,004,093 $1,851 116 A B D 1 Sample Farms Ltd. Income Statement 2 3 2012 2013 2014 4 5 INCOME 6 Crop Sales $1,265 882 $1,307,341 $1,056,547 7 Inventory Change $58,458 (5547,832) ($386 494) 8 9 GROSS REVENUE $1,324,340 $759,509 $570,053 10 11 PRODUCTION EXPENSES 12 Fertilizer $291 717 $241,624 $279,728 13 Chemical $147,110 $150,966 $154,134 14 Seed/grain purchases $226,939 $179,022 $204,872 15 Crop Insurance $18,611 $16,370 $0 16 Total $684 377 $587,982 $638,734 17 18 GROSS MARGIN $639,963 $171,527 $31,319 19 20 OPERATING EXPENSES 21 Custom Work $67,355 $76,637 $17,990 22 Fuel and oil $42,186 $54,447 $44,441 23 Wages (direct) $63,106 $59.670 $61,212 24 Repairs & Maintenance - Machinery $91,503 $85,937 $33,538 25 Total Operating Expenses $284,150 $276,691 $157,181 26 27 CONTRIBUTION MARGIN $375, 813 ($105,164) ($125,862) 28 29 ADMINISTRATION and OVERHEAD EXPENSES 30 Utilities $13,273 $11.431 $14.963 21 Rent SR46 S599 SR1 201 Balance Sheet Income Statement $381,991 $223,288 $114,958 $27 407 $747 644 $240.996 $240,577 $164,351 $38,217 $684,141 $1,258 449 $1,166,975 $82.229 $72,140 $73,374 $49 235 $276.978 $84,101 $85,821 $97,864 $69,225 $317011 $979,471 $849.964 $12,143 $60 304 $15,898 $71 652 IC 2 E = IM IM $ % 60 .00 900 Londitional Formatting Clipboard 5 Font 27 Alignment E Number E PS X B $91,503 $284,150 C $85,937 $276.691 D $33,538 $157,181 E $49,235 $275,978 F $69 225 $317011 $375,813 ($105,164) ($125 962) $979,471 $849,964 A 24 Repairs & Maintenance - Machinery 25 Total Operating Expenses 26 27 CONTRIBUTION MARGIN 28 29 ADMINISTRATION and OVERHEAD EXPENSES 30 Utilities 31 Rent 32 Repairs & Maintenance - Building 33 Insurance 31 Interest & Bank charges 35 Interest on Long Term Debt 36 Office 37 Professional Fees 33 Property Taxes 39 Salaries & Benefits 40 Amortization 41 Total Overhead & Administration Expenses 42 43 NET OPERATING PROFIT 44 45 OTHER REVENUE (EXPENSE) 46 Programs (Government) 47 Rebates 48 Custom work 49 Gain/ (Loss) on capital assets 50 Total Other 51 52 NET INCOME $13,273 $64,659 $26,333 $34,731 $16,677 $91 216 $34,020 $10 468 $23,521 567 212 $99,037 $481,147 $11,431 $56,969 $20.286 $39,195 $19,887 $82,664 $24,577 $7,134 $26,284 $73,299 $91,976 $453,702 $14,953 $61,201 $11.473 $39,532 $28,932 $97,054 $25,530 $7,475 $22,743 $72, 167 $107,625 $488,685 $12,143 $60,304 $28,179 $30,876 $22,554 $88,254 $31,860 $9,050 $11 687 $74, 276 $106,816 $495,999 $15,898 $71,652 $11 230 $30,646 $22,638 $102,084 $21,029 $8,740 $14,998 $73,259 $79,652 $451,826 45 ($105,334) ($558 866) (5614 547) $493 472 $398,138 $231,382 $17,667 $18,326 $13,389 $280,764 $18,988 $16,384 $3255 {$26,512) $12,115 $290,477 $25 226 $11,903 ($14399) $313,208 $291058 $17,194 $13,857 $0 $322, 109 $117,295 $22.437 $17,083 $0 $156,815 $175,430 15546751) ($301 339) $815 581 $554,953 12 Balance Sheet Income Statement