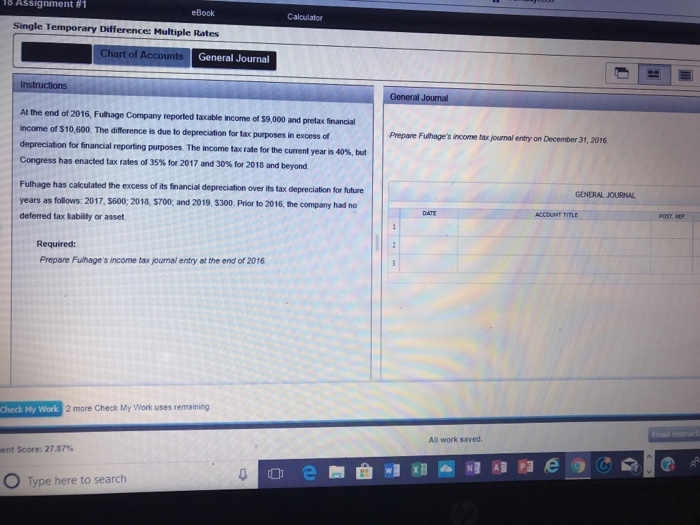

Question: 16 Assignment #1 eBook Calculator Single Temporary Difference: Multiple Rates art Accounts General Journal At the end of 2016, Fulhage Company reported taxable income of

16 Assignment #1 eBook Calculator Single Temporary Difference: Multiple Rates art Accounts General Journal At the end of 2016, Fulhage Company reported taxable income of s9,000 and pretax financial income of $10,600. The diflerence is due to depreciation for tax purposes in excess of depreciation for financial reporting purposes. The income tax rate for the current Congress has Prepare Fulhage's income tax journal entry an December 31, 2016 year is 40%, but enacted tax rates of 35% for 2017 and 30% for 2018 and beyond Fulhage has calculated the excess of its financial depreciation over its tax depreciation for future years as follows: 2017, 5600; 2018, $700, and 2019, 5300. Prior to 2016, the company had no deferred tax liability or asset GENERAL JOURNAL ACCOUNT TITLE POST. REP Required: Prepare Fuithage's income tax joumal entry at the end of 2016 Check My Work 2 more Check My Work uses remaining All work saved. ent Score: 27.87% O Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts