Question: 16. Calculating a beta coefficient for a single stock Suppose that the standard deviation of returns for a single stock A is 0A-40%, and the

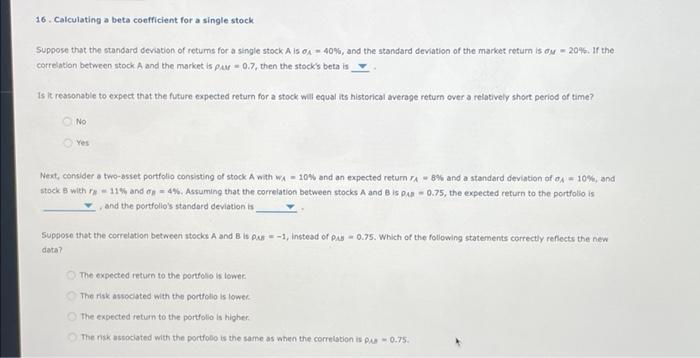

16. Calculating a beta coefficient for a single stock Suppose that the standard deviation of returns for a single stock A is 0A-40%, and the standard deviation of the market return is du 20%. If the correlation between stock A and the market is PAM 0.7, then the stock's beta is . Is it reasonable to expect that the future expected return for a stock will equal its historical average return over a relatively short period of time? No Yes Next, consider a two-asset portfolio consisting of stock A with WA - 10% and an expected return FA 8% and a standard deviation of a 10%, and stock B with ra -11% and 4%. Assuming that the correlation between stocks A and B IS PAR-0.75, the expected return to the portfolio is and the portfollo's standard deviation is Suppose that the correlation between stocks A and B is PAR-1, instead of PAB 0.75. Which of the following statements correctly reflects the new data? The expected return to the portfolio is lower The risk associated with the portfolio is lower The expected return to the portfolio is higher. The risk associated with the portfolio is the same as when the correlation is PAB - 0.75

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts