Question: Attempts: 8. Calculating a beta coefficient for a single stock Suppose that the standard deviation of returns for a single stock A is A =

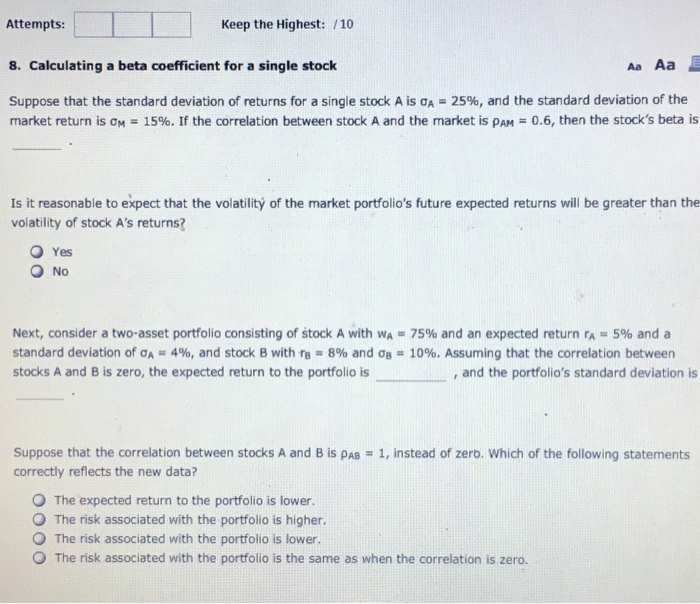

Attempts: 8. Calculating a beta coefficient for a single stock Suppose that the standard deviation of returns for a single stock A is A = 25%, and the standard deviation of the Keep the Highest: 10 Aa Aa market return is 15%. If the correlation between stock A and the market is PAN 0.6, then the stock's beta is Is it reasonable to expect that the volatilit of the market portfolio's future expected returns will be greater than the volatility of stock A's returns? O Yes O No Next, consider a two-asset portfolio consisting of stock A with wA = 75% and an expected return rA = 5% and a standard deviation of ^ = 4%, and stock B with rB = 8% and Og 10%. Assuming that the correlation between stocks A and B is zero, the expected return to the portfolio is and the portfolio's standard deviation is suppose that the correlation between stocks A and B is AB = 1, instead of zero, which of the following statements correctly reflects the new data? O The expected return to the portfolio is lower. O The risk associated with the portfolio is higher. O The risk associated with the portfolio is lower. O The risk associated with the portfolio is the same as when the correlation is zero

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts