Question: 16. If a net present value analysis for a normal project gives an NPV greater than zero, an internal rate of return calculation on the

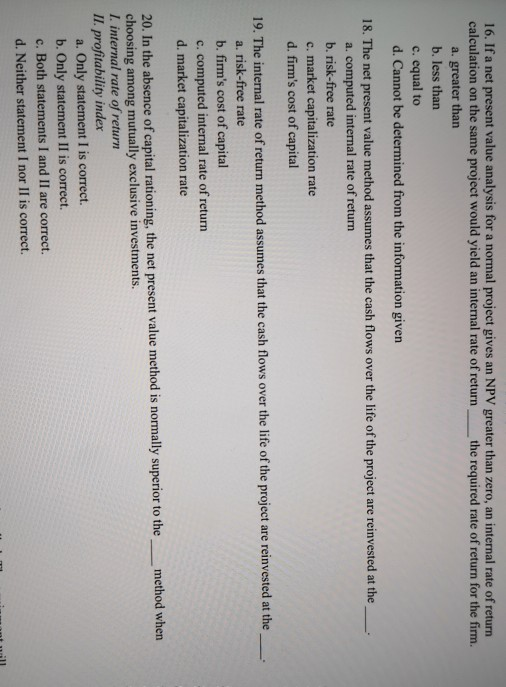

16. If a net present value analysis for a normal project gives an NPV greater than zero, an internal rate of return calculation on the same project would yield an internal rate of return the required rate of return for the firm. a. greater than b. less than c. equal to d. Cannot be determined from the information given 18. The net present value method assumes that the cash flows over the life of the project are reinvested at the a. computed internal rate of return b. risk-free rate c. market capitalization rate d. fim's cost of capital 19. The intermal rate of return method assumes that the cash flows over the life of the project are reinvested at the a. risk-free rate b. firm's cost of capital c. computed internal rate of return d. market capitalization rate 20. In the absence of capital rationing, the net present value method is normally superior to the choosing among mutually exclusive investments. I. internal rate of return II. profitability index a. Only statement I is correct. b. Only statement II is correct. method when c. Both statements I and II are correct. d. Neither statement I nor II is correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts