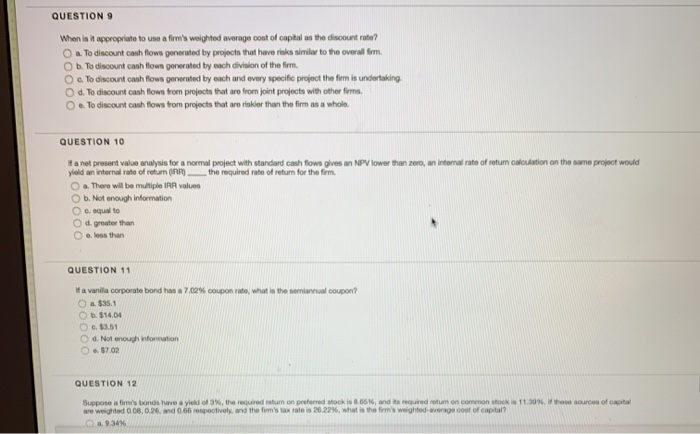

Question: PLEASE ANSWER question 12 too QUESTION 9 When is it appropriate to use a firm's weighted average cost of capital as the discount rate? O

QUESTION 9 When is it appropriate to use a firm's weighted average cost of capital as the discount rate? O a. To discount cash flow generated by projects that have risks similar to the overall fimm O b. To discount cash flows generated by each division of the firm. O o. To discount cash flow generated by each and every specific project the firm is undertaking O d. To discount cash flows from projects that are from joint projects with other firms. To discount cash flows from projects that are riskier than the firm as a whole. QUESTION 10 fa net present value analysis for a normal project with standard cash flows gives an NPV lower than zero, an internal rate of retum calculation on the same project would yield an internal rate of return the required rate of return for the firm, O a. There will be multiple IRR values b. Not enough information c. equal to Od greater than o less than QUESTION 11 la vanila corporate bond has a 7.02% coupon rate, what is the semiannual coupon? a. $35.1 b. $14.04 351 d. Not enough information O.. $7.02 QUESTION 12 11.309, has sources of capital Suppose a firm's bonds have a yield of the returdum on preferred sockis 3.0 , and t oured eum on comenon ho are weighted 08.0.26. and 0.66 respectively, and the fem's tax rate 20.226, what is the firm's weighted-wverage cost of capital? 9 30%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts