Question: 16 Problem: Module 2 Textbook Problem 16 Learning Objectives: 0.5 points 2-9 Calculate straight-line depreciation and show how it affects financial statements 2-13 Show how

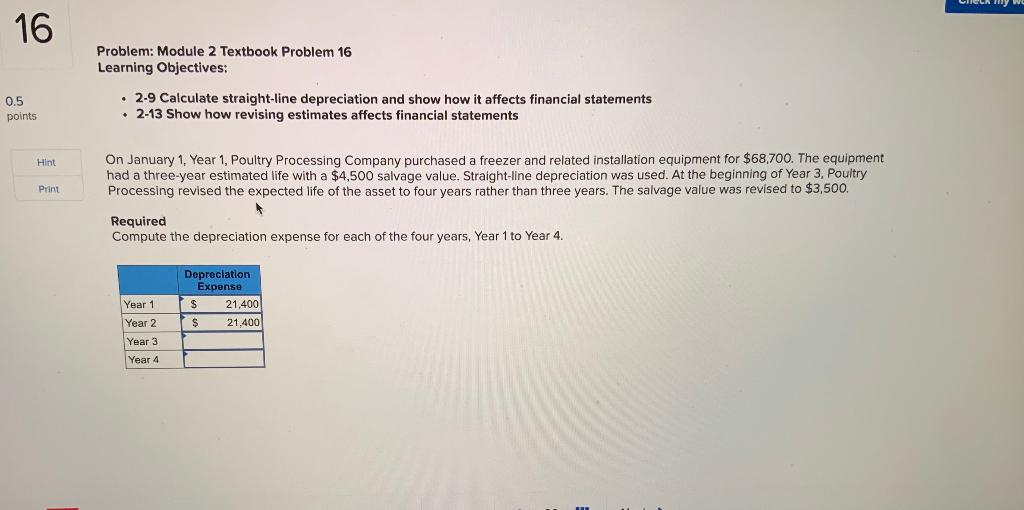

16 Problem: Module 2 Textbook Problem 16 Learning Objectives: 0.5 points 2-9 Calculate straight-line depreciation and show how it affects financial statements 2-13 Show how revising estimates affects financial statements Hint Print On January 1, Year 1, Poultry Processing Company purchased a freezer and related installation equipment for $68,700. The equipment had a three-year estimated life with a $4,500 salvage value. Straight-line depreciation was used. At the beginning of Year 3, Poultry Processing revised the expected life of the asset to four years rather than three years. The salvage value was revised to $3,500. Required Compute the depreciation expense for each of the four years, Year 1 to Year 4. Depreciation Expense $ 21,400 $ 21,400 Year 1 Year 2 Year 3 Year 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts