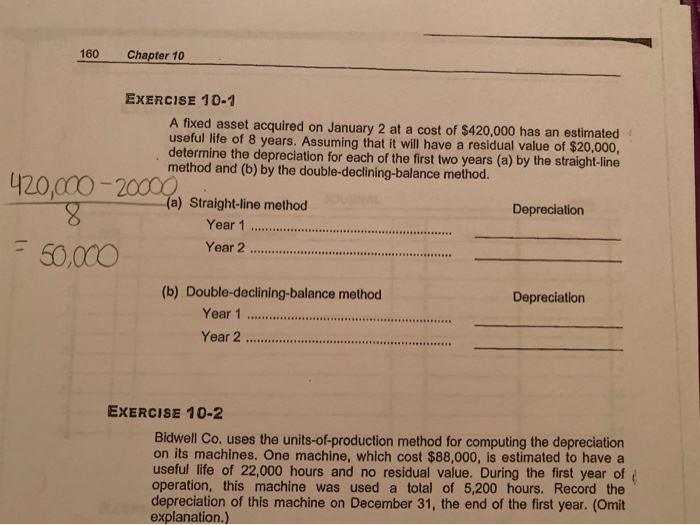

Question: 160 Chapter 10 EXERCISE 10-1 A fixed asset acquired on January 2 at a cost of $420,000 has an estimated useful life of 8 years.

160 Chapter 10 EXERCISE 10-1 A fixed asset acquired on January 2 at a cost of $420,000 has an estimated useful life of 8 years. Assuming that it will have a residual value of $20,000, determine the depreciation for each of the first two years (a) by the straight-line method and (b) by the double-declining-balance method. Depreciation 420,000-20000 8 550,000 (a) Straight-line method Year 1 .. Year 2 ....... Depreciation (b) Double-declining-balance method Year 1 ................... Year 2 .............................. EXERCISE 10-2 Bidwell Co. uses the units-of-production method for computing the depreciation on its machines. One machine, which cost $88,000, is estimated to have a useful life of 22,000 hours and no residual value. During the first year of 2 operation, this machine was used a total of 5,200 hours. Record the depreciation of this machine on December 31, the end of the first year. (Omit explanation.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts