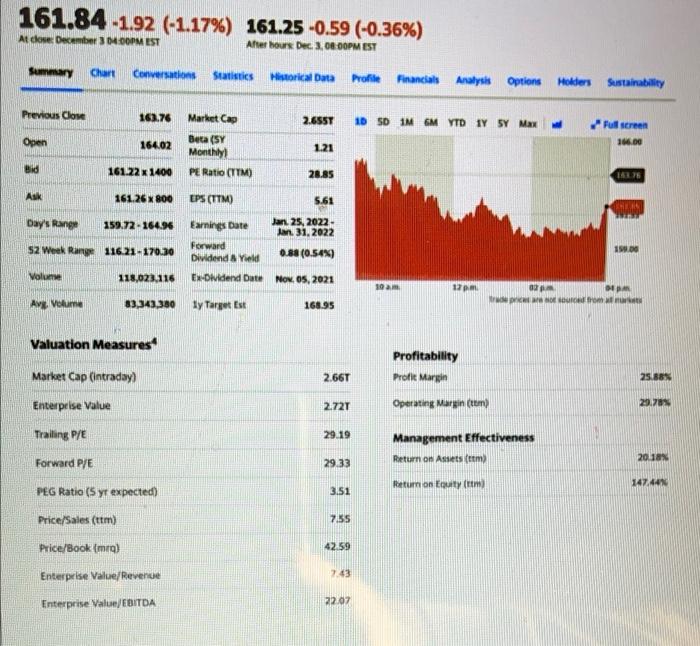

Question: 161.84 -1.92 (-1.17 %) 161.25 -0.59 (-0.36%) At close: December 3 04:00PM EST After hours: Dec. 3, 08:00PM EST Summary Chart Conversations Statistics Historical Data

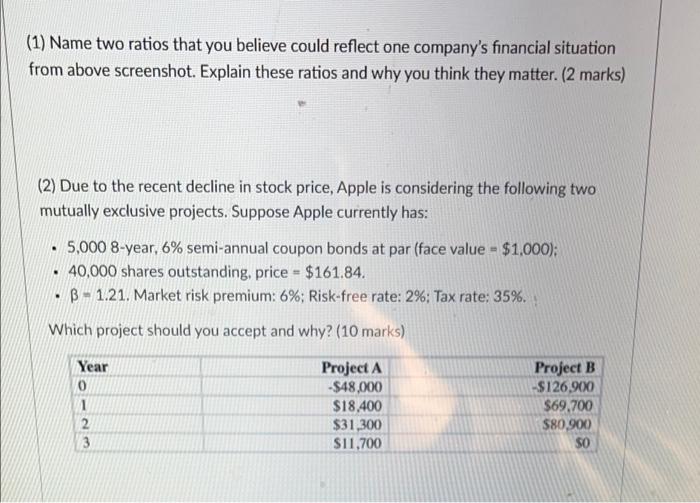

161.84 -1.92 (-1.17 %) 161.25 -0.59 (-0.36%) At close: December 3 04:00PM EST After hours: Dec. 3, 08:00PM EST Summary Chart Conversations Statistics Historical Data Profile Financials Previous Close 163.76 Market Cap 2.655T 1D 5D 1M GM YTD 1Y SY Max W Beta (SY Open 164.02 1.21 Monthly) Bid 161.22 x 1400 PE Ratio (TTM) 28.85 Ask 161.26 x 800 EPS (TTM) 5.61 Day's Range 159.72-164.96 Earnings Date Jan 25, 2022- Jan 31, 2022 52 Week Range 116.21-170.30 Forward Dividend & Yield 0.88 (0.54%) Volume 118,023,116 Ex-Dividend Date Nov. 05, 2021 12pm. 02 pm DE PA trade prices are not sourced from all market Avg. Volume 83,343,380 ly Target Est 168.95 Valuation Measures Market Cap (intraday) Enterprise Value Trailing P/E Forward P/E PEG Ratio (5 yr expected) Price/Sales (ttm) Price/Book (mrg) Enterprise Value/Revenue Enterprise Value/EBITDA 2.66T 2.72T 29.19 29.33 3.51 7.55 42.59 7.43 22.07 10 am Analysis Options Holders Sustainability Full screen 166.00 143.76 ENERN 159.00 Profitability Profit Margin Operating Margin (tm) Management Effectiveness Return on Assets (tem) Return on Equity (tm) 25.88% 29.78% 20.18% 147.44% (1) Name two ratios that you believe could reflect one company's financial situation from above screenshot. Explain these ratios and why you think they matter. (2 marks) (2) Due to the recent decline in stock price, Apple is considering the following two mutually exclusive projects. Suppose Apple currently has: . 5,000 8-year, 6% semi-annual coupon bonds at par (face value $1,000); 40,000 shares outstanding, price = $161.84. . B-1.21. Market risk premium: 6%; Risk-free rate: 2%: Tax rate: 35%. Which project should you accept and why? (10 marks) Year Project A 0 -$48,000 1 $18,400 2 $31,300 3 $11,700 Project B -$126,900 $69,700 $80,900 $0 (3) Net present value and Internal Rate of Return use the same data and the same time value of money theory in their computations. Why then is net present value considered to be a superior measure when making capital budgeting decisions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts