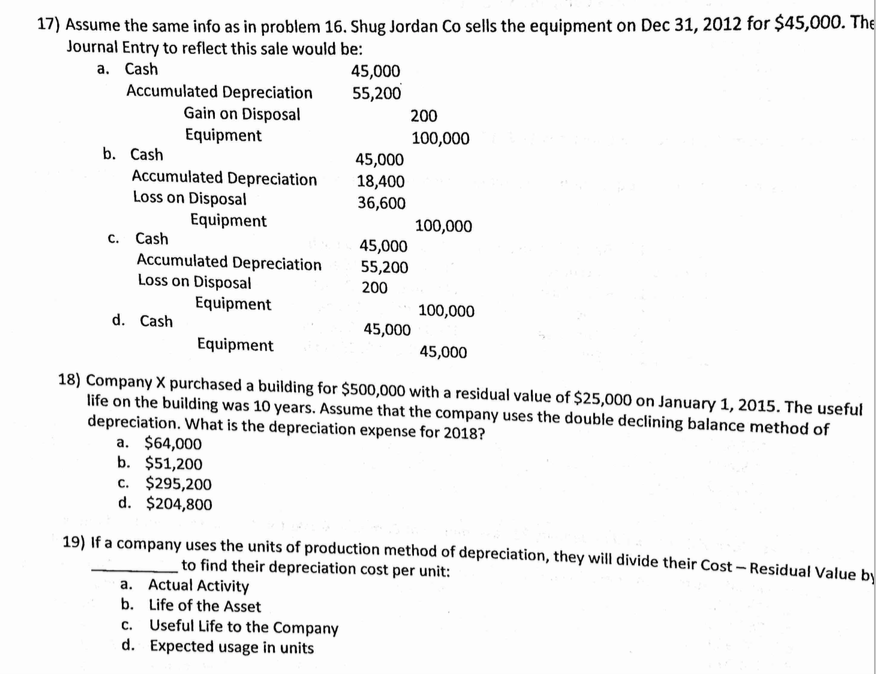

Question: 17) Assume the same info as in problem 16. Shug Jordan Co sells the equipment on Dec 31, 2012 for $45,000. The Journal Entry to

17) Assume the same info as in problem 16. Shug Jordan Co sells the equipment on Dec 31, 2012 for $45,000. The Journal Entry to reflect this sale would be 45,000 Accumulated Depreciation 55,200 a. Cash Gain on Disposal Equipment 200 100,000 45,000 Accumulated Depreciation 18,400 36,600 b. Cash Loss on Disposal Equipment 100,000 c. Cash 45,000 Accumulated Depreciation 55,200 Loss on Disposal 200 Equipment 100,000 d. Cash 45,000 Equipment 45,000 18) Company X purchased a building for $500,000 with a residual value of $25,000 on January 1, 2015. The useful life on the building was 10 years. Assume that the company uses the double declining balance method of depreciation. What is the depreciation expense for 2018? a. $64,000 b. $51,200 c. $295,200 d. $204,800 19) If a company uses the units of production method of depreciation, they will divide their Cost-Residual Value by to find their depreciation cost per unit a. Actual Activity b. Life of the Asset c. Useful Life to the Company d. Expected usage in units

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts