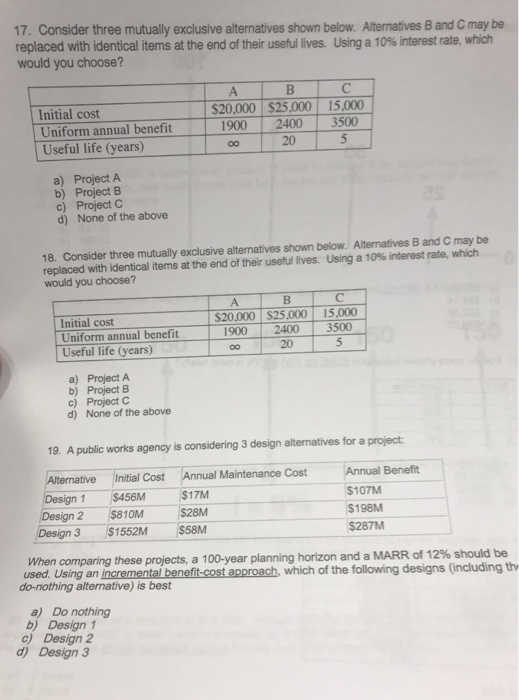

Question: 17. Consider three mutually exclusive alternatives shown below. Alternatives B and C may be replaced with identical items at the end of their useful lives.

17. Consider three mutually exclusive alternatives shown below. Alternatives B and C may be replaced with identical items at the end of their useful lives. Using a 10% interest rate, which would you choose? $20,000 $25,000 Initial cost Uniform annual benefit Useful life (years) 15,000 1900 | 2400 | 3500 0o 20 a) Project A b) Project B c) Project C d) None of the above 18. Consider three mutually exclusive alternatives shown below. Alternatives B and C may be replaced with identical items at the end of their useful lives. Using a 10% interest rate, which would you choose? $20,000 $25,000 15,000 Initial cost Uniform annual benefit 1900 Useful life (years) 2400 3500 20 a) Project A b) Project B c) Project C d) None of the above 19. A public works agency is considering 3 design alternatives for a project Atermative initial Cost Annual Maintenance CostAnnual Beneft Annual Benefit $107M $198M $287M Design 1 S456M-517M Design 2 810M $28M Design 3 $1552M When comparing these used. Using an incremental benefit-cost approach, which of the following designs (including th projects, a 100-year planning horizon and a MARR of 12% should be a) Do nothing b) Design c) Design 2 d) Design 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts