Question: 17) In this problem, you will apply the CAPM to value the tech stocks of the table below. 1. Compute the covariance matrix. 2. What

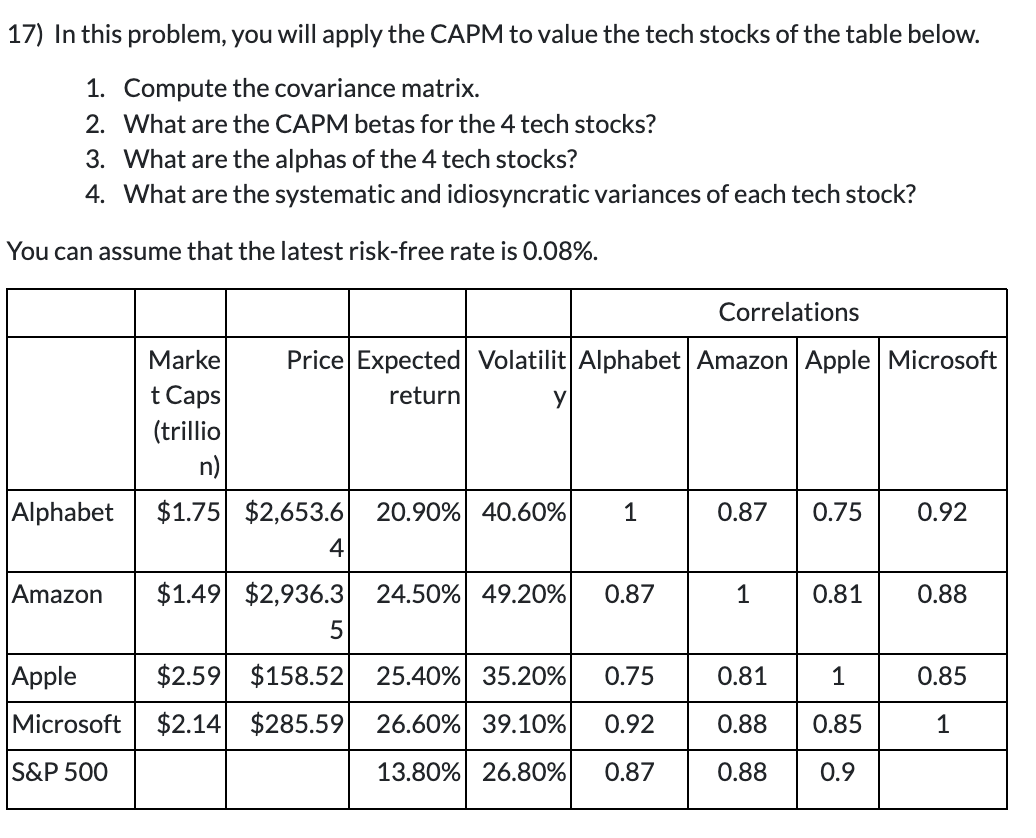

17) In this problem, you will apply the CAPM to value the tech stocks of the table below. 1. Compute the covariance matrix. 2. What are the CAPM betas for the 4 tech stocks? 3. What are the alphas of the 4 tech stocks? 4. What are the systematic and idiosyncratic variances of each tech stock? You can assume that the latest risk-free rate is 0.08%. Correlations Price Expected Volatilit Alphabet Amazon Apple Microsoft return Marke t Caps (trillio n) Alphabet 20.90% 40.60% 1 0.87 0.75 0.92 $1.75 $2,653.6 4. Amazon 24.50% 49.20% 0.87 1 0.81 0.88 $1.49 $2,936.3 5 Apple 25.40% 35.20% 0.75 0.81 1 0.85 $2.59 $158.52 $2.14 $285.59 Microsoft 26.60% 39.10% 0.92 0.88 0.85 1 S&P 500 13.80% 26.80% 0.87 0.88 0.9 17) In this problem, you will apply the CAPM to value the tech stocks of the table below. 1. Compute the covariance matrix. 2. What are the CAPM betas for the 4 tech stocks? 3. What are the alphas of the 4 tech stocks? 4. What are the systematic and idiosyncratic variances of each tech stock? You can assume that the latest risk-free rate is 0.08%. Correlations Price Expected Volatilit Alphabet Amazon Apple Microsoft return Marke t Caps (trillio n) Alphabet 20.90% 40.60% 1 0.87 0.75 0.92 $1.75 $2,653.6 4. Amazon 24.50% 49.20% 0.87 1 0.81 0.88 $1.49 $2,936.3 5 Apple 25.40% 35.20% 0.75 0.81 1 0.85 $2.59 $158.52 $2.14 $285.59 Microsoft 26.60% 39.10% 0.92 0.88 0.85 1 S&P 500 13.80% 26.80% 0.87 0.88 0.9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts